Reuters CRB Index: The Reuters/Jeffreies CRB Index includes all commodities including grains, metal, oil and ores. As  such, agricultural commodities are only a part of the overall commodities market. Nevertheless, it is helpful to be able to put agricultural commodities in the context of the general commodities market.

such, agricultural commodities are only a part of the overall commodities market. Nevertheless, it is helpful to be able to put agricultural commodities in the context of the general commodities market.

The weekly chart here, puts the recent rally in commodity prices in the context of the correction in commodities that began in April 2011 from a level of 370. The index closed the last week at 307, about 63 points below its 2011 peak or about 17 per cent below the previous peak prices.

Prices in the current rally have moved up from a low of 270 to 307 or approximately 14 pc. Has the rally peaked out? From the chart above, one could surmise that we are very close to the peak and may well be in for another leg to the correction that commenced in May 2011.

In short, this is not the time to be chasing commodities with the bulls.

Corn [$CORN]: While the pattern of price correction in corn more or less matches the pattern in the general commodities index, it not as bearish as the former. Corn peaked at just under 800 in May 2011 but has made a new high of 809 in the current rally indicating underlying buoyancy in prices.

Corn could correct along with other commodities from current levels. Corn is overbought on the weekly chart and the next correction could well take it back to $600 or so. It is time to book profits in corn along with other commodities.

Soybean [$SOYB]: Soybean illustrates the bullish bias to agricultural commodities in clear contrast to the bearish bias in the general commodity markets. Soybeans were $1475 in May 2011 but have topped $1731 in the current rally.

Nevertheless, it may be time to take profits off the table in soybeans as well. It is highly unlikely that soybeans alone will defy a market wide correction in the commodity markets. SOYB could drop 1475 in the ensuing correction. If so that would be very bullish for the long-term in the commodity.

Wheat [$WHEAT]: The weekly wheat chart again illustrates the bullish bias to agricultural commodity prices in contrast to the general commodity prices. Wheat peaked at $888 in February 2011 and made a new high of $940 in August this year. While a correction in wheat prices is not ruled out, the correction may be relatively shallow. Look to take profits in wheat as well.

Wheat [$WHEAT]: The weekly wheat chart again illustrates the bullish bias to agricultural commodity prices in contrast to the general commodity prices. Wheat peaked at $888 in February 2011 and made a new high of $940 in August this year. While a correction in wheat prices is not ruled out, the correction may be relatively shallow. Look to take profits in wheat as well.

Sugar [$SUGAR]: Sugar is in a long-term downtrend. From a level of 0.34 $SUGAR has declined to 0.20 and the bottom doesn't appear to be in just as yet.

It would be premature to anticipate a bottom in $SUGAR. But one would expect a bottom to be in by end of the year.

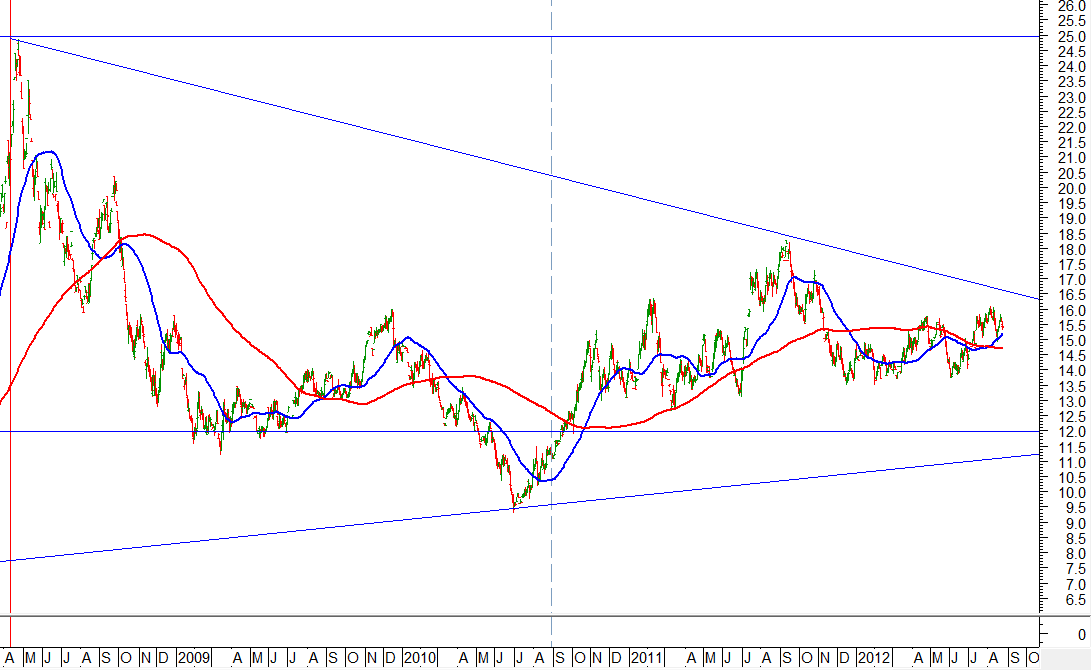

Rough Rice [CBT]: Rice is one of the major food crops that has been in major down-trend April 2008 and probably hasn't bottomed out. From a level of $25 at the peak, the price now stands at $15.5.

The correction in rice may continue. Long-term trends indicate a bottom by the year and about $12.

COTTON 2: Cotton is the big surprise in the agricultural commodity markets. Clearly Cotton has bottomed out at $68 and looks all set for a new long-term bull run.

COTTON 2: Cotton is the big surprise in the agricultural commodity markets. Clearly Cotton has bottomed out at $68 and looks all set for a new long-term bull run.

The confirmation of a major tradable bull run will come on cotton rising above $85 and successfully challenging its 200 DMA which is currently in the $90 region. The logical target for the rally would be the previous of $225 minimum.

Cotton appears well worth tracking for a bullish play. Hope Indian farmers take note of the development.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

Sonali Ranade is a trader in the international markets