Gold has had a nice run up from the $1526 region to the $1800 region over the last four months. It closed last week at $1780, continuing a sideways movement at elevated levels. The metal is likely to continue its sideways movement, but below the $1800 for a week or two more before correcting for the substantial rise from $1525 to $1800.

Gold has had a nice run up from the $1526 region to the $1800 region over the last four months. It closed last week at $1780, continuing a sideways movement at elevated levels. The metal is likely to continue its sideways movement, but below the $1800 for a week or two more before correcting for the substantial rise from $1525 to $1800.

Gold has established a firm upward trend and the possibility of a retest of $1525 is now remote. The next correction could at best see the metal in the $1700 region.

Gold bulls should wait for a correction to the $1700 region to reenter the metal. Gold now becomes a buy at dips.

Silver [$SILVER]: Silver has been in a reactive pullback since it hit a low of $26 on June 28 this year. It closed last week at $34.5720. Silver, unlike gold, hasn't been able to establish a firm uptrend as yet.

Silver [$SILVER]: Silver has been in a reactive pullback since it hit a low of $26 on June 28 this year. It closed last week at $34.5720. Silver, unlike gold, hasn't been able to establish a firm uptrend as yet.

Silver too may continue its sideways movement with an upward bias for many weeks to come. Things will get interesting in silver once it breaks atop $37.50. Until then it is safe to assume that silver's main trend is down.

Silver remains a sell at rallies until it breaks atop $37.50 or corrects substantially.

Crude Oil $WTIC]: WTI crude oil closed last week at $89.88. Crude has been correcting since it hit a high of $100.50 on 14th September, and the correction should continue for a few weeks more. Crude's first support lies at $87.50 followed by a deeper support at $83.

Crude Oil $WTIC]: WTI crude oil closed last week at $89.88. Crude has been correcting since it hit a high of $100.50 on 14th September, and the correction should continue for a few weeks more. Crude's first support lies at $87.50 followed by a deeper support at $83.

Oil could test $87.50 before bouncing back for a bit. However, the movement is likely to be one of consolidation above $87.50 but below $94. Long-term I am not bearish on crude. It remains a buy at fall to support.

I would put my stop loss in crude at $82. This fall is a good place to accumulate crude.

US Dollar [$USD]: Had expected the $ to find support and head towards 81 to reclaim its 200 DMA. Instead the $ turned down from its first resistance at 80.50 and is probably going to retest its floor at 78.50.

Unless the floor of 78.50 is decisively taken out the present wave count, which is bullish, holds and the $ is likely to move up again after a retest of 78.50 which could happen this week. $ remains a buy at dips with stop loss just below 78.

Euro$ [$FXE]: Euro$ turned down after hitting a high of 1.3175 and touched a low of 1.28 which was its first support. It has since pulled back and closed the week at 1.3030.

Euro$ [$FXE]: Euro$ turned down after hitting a high of 1.3175 and touched a low of 1.28 which was its first support. It has since pulled back and closed the week at 1.3030.

Euro$ could pullback all the way to 1.3175. However, I do not expect it to go higher than that in terms of my wave counts. After reversing from 1.3175 or below, the Euro$ is likely to seek substantially lower levels. Sell rallies in the Euro$ with a stop just above 1.3200.

$-INR: The $ had a long-term support at 52 which too was violated, albeit marginally, last week. The $ has also breached its 200 DMA. So for all practical purposes, unless the $ swings around dramatically from 52 levels, the long rally in the $ against INR is over.

$-INR: The $ had a long-term support at 52 which too was violated, albeit marginally, last week. The $ has also breached its 200 DMA. So for all practical purposes, unless the $ swings around dramatically from 52 levels, the long rally in the $ against INR is over.

The next major support for the $ lies at INR 49. RBI reluctance to mop up the $ at a certain level is a policy decision. It should have intervened at INR 52 level IMO. RBI and GoI have to realise that job creation in the software services sector is, and will remain, the key driver of all growth in the economy. As such, the RBI's exchange rate policy must focus on attracting jobs into the sector before all else. Without jobs, the strengthening of the Rupee is meaningless.

Exports have been falling month after month. The software services sector is losing jobs. Mere portfolio investment inflows via FIIs should not be used as a pretext to allow an appreciation in the Rupee. Portfolio inflows are a financing device for Current Account Deficit, not income like trade flows are. RBI must not repeat its strategic blunder of the past.

That said, the $ having violated 52, should head towards a disastrous 49 level barring a swift reversal. Don't rule out a corrective bounce in the $ next week. INR 52 is a good place to bounce from.

NASDAQ Composite [$COMPAQ]: The NASDAQ Comp closed last week at 3136, above its immediate support at 3130. That's pretty bullish.

NASDAQ Composite [$COMPAQ]: The NASDAQ Comp closed last week at 3136, above its immediate support at 3130. That's pretty bullish.

The NASDAQ Comp could continue a sideways correction this week to retest the 3100 region. On a successful retest, the index could move up substantially to new highs.

The NASDAQ Comp remains the strongest of the US indices. So it should be tracked carefully for any sign of weakness or internal cracks. So far there are none of note.

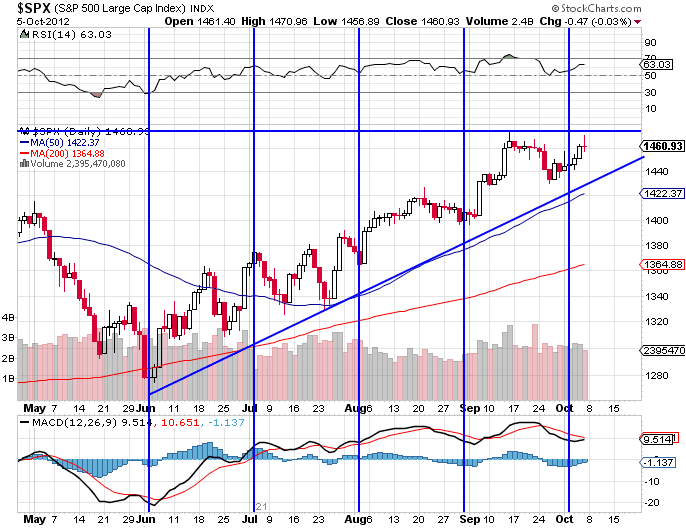

S&P 500 [SPX]: The SPX close last week 1460.93 just short of its previous high 1474. Like NASDAQ, SPX too has demonstrated considerable strength where one would expect a correction. That indicates the index could go higher and may have another leg up.

S&P 500 [SPX]: The SPX close last week 1460.93 just short of its previous high 1474. Like NASDAQ, SPX too has demonstrated considerable strength where one would expect a correction. That indicates the index could go higher and may have another leg up.

SPX could correct early next week in a sideways move before moving up. There is little downside to the index unless 1440 is threatened, which per present wave count looks unlikely.

A reminder though. This bull move has traversed a long way over nearly 4 years. So we are pretty close to the top. So keep very tight, stop losses at preset levels. That said, SPX has demonstrated strength in this correction, not weakness.

S&P CNX Nifty [$CNXN]: Nifty's first support lies at 5630 and then again just above the gap at 5525. Whatever be the reason for the crash on last Friday, Nifty has to correct and test its support at the above two levels failing which it will drift down to 5450. This is not to say Nifty is bearish. It simply means the market will try to drift there. The rest depends on who was trapped in the gap between 5450 and 5530.

S&P CNX Nifty [$CNXN]: Nifty's first support lies at 5630 and then again just above the gap at 5525. Whatever be the reason for the crash on last Friday, Nifty has to correct and test its support at the above two levels failing which it will drift down to 5450. This is not to say Nifty is bearish. It simply means the market will try to drift there. The rest depends on who was trapped in the gap between 5450 and 5530.

That said, the crash marks a very important date which can be construed to be the end of the major correction to the market's steep bull run from 918 in 2003 to 6340 in January 2008. That's too important a date to miss and its significance should not be lost on the market.

Should the next three weeks prove the above reading to be correct, we have started a major new bull run on the Nifty that will last many years. How will we know if this interpretation of the charts is correct? Watch this space for confirmation before the end of November.

So a short-term correction or sideways move may be on the cards till end November. But don't count on major dips. Wait for confirmation of a bull run on broad markets. Meanwhile, buy the blue chips on your buy list but at your prices.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

Sonali Ranade is a trader in the international markets