If the corrections underway across most markets hold first support, the probability of another leg to the rally until mid-August is fairly certain, says Sonali Ranade

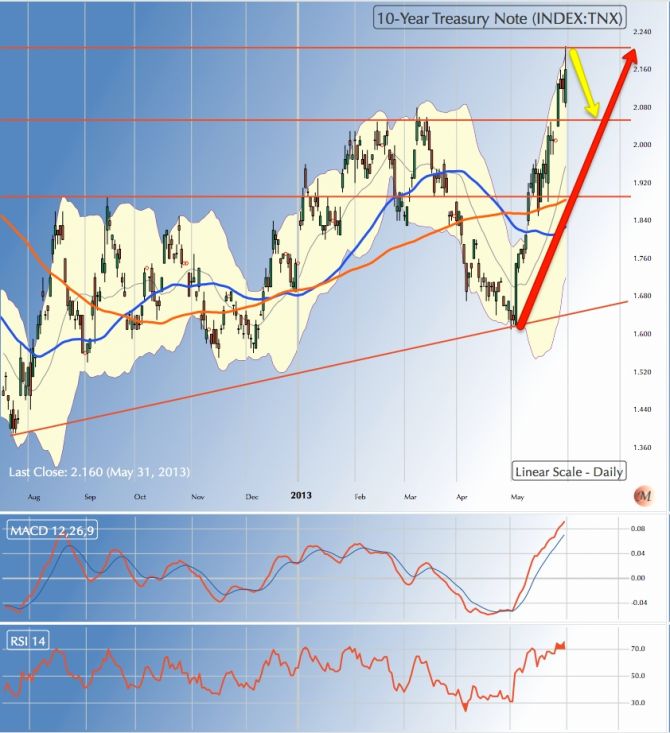

The big game changer under way in the markets is the turn in the interest rate cycle in the US that will have an impact across all markets. I track this through the yield on 10-year treasury notes. All asset classes will adjust to the turn in the interest rate cycle, some early, and others with a lag. Apart from the bond markets, commodities arelikely to feel the impact immediately. Both the markets could see sharp selloffs. On the other hand, speculative markets in commodities are in backwardation, indicating excessive shorts. So yes, expect selloffs but no panic as such.

Will money rotate out of bonds and head for equities? With central banks bent on keeping interest rates low, there are few assets to flee to if you expect a selloff in bond markets. In fact there shouldn’t be a selloff in the first place except in peripheral junk bonds and the like. Nevertheless, the turn in interest rate cycles is real and central bank ability to impose their will on markets limited. Safe to say some money will rotate from fixed income to equities and that might fuel the last leg of the rally in equities.

Equities are in over-stretched and dangerous territory and a selloff is imminent. Wave counts in terms of price and time favour a selloff mid-August but that is just indicative. That said, if the corrections now underway across most markets hold first support, the probability of another leg to the rally until mid-August is fairly certain.

Keep very tight stop losses and look to exit longs in a planned manner. Not worth shorting this market till a top is confirmed. There will be plenty of timefor that.

Happy trading.

Gold: It closed the week at $1393 after making a high of 1421.90. It narrowly missed triggering a key reversal day on Friday. While the long term correction in gold is by no means over, my sense is that it needs to rally a bit more towards the $1460 to $1500 region where its 50 DMA is positioned before making another attempt to retest $1320 floor. Note, gold is in a counter-trend rally that could be rather jagged.

SILVER: It closed the week the week at $22.2430. Maintain my view that we haven’t see a bottom in silver yet and that the floor of $20 is unlikely to hold when the price does collapse.

HG Copper: It closed the week at 3.2925. After rally past its 50 DMAand making a high of 3.418, copper failed to hold above it. My sense is that copper is likely to retest its recent low of 3.0 along with the rest of the commodities.

WTI Crude: It closed the week at $91.97, below both its 50 & 200 DMA. Maintain my view that crude is eventually headed towards the $84 region. Over the next week crude could rally to test its 50 DMA placed at 93.65 as the new overhead resistance before drifting lower.

DAX: It closed the week at 8348.84. The index could have a few days more of consolidation before heading up for the last leg of this rally that could end in a fairly sharp collapse in prices. We are in dangerous territory but until the market confirms a top, hazardous to call one. Longs should make exit plans across all equity markets. That said, the last leg could yet deliver significant gains. A confirmation of the support at 8100 should give the bulls a leg up.

EURUSD: It closed the week at1.2995, just above its 50 DMA at 1.2980 but below its 200 DMA at 1.3025. EURUSD is correcting from its recent top at1.37 and is presently in a counter-trend rally that could reach up for 1.32. However, having done that over the next two weeks, the pair is likely to head for a retest of 1.27.

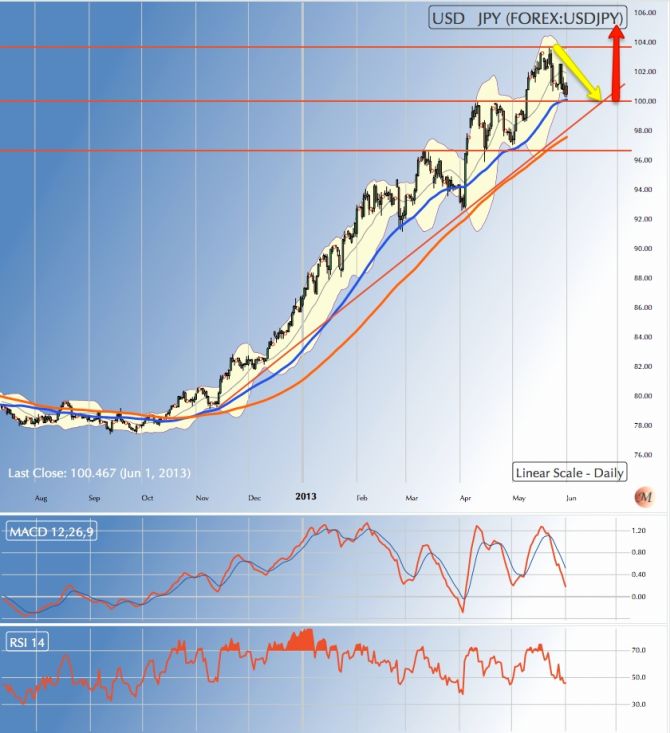

USDJPY: It closed the week at 100.46. The correction in the pair from the top of 103.65 is not yet over and the consolidation and base building over 100 yen is likely to continue for a few days more. The dollar appears headed much higher than 103.65 against the yen eventually.

USDINR: It closed the week at INR 56.57 after making a high of 56.76. Clearly the dollar is overbought and needs to work it off. On the other hand, there is nothing to prevent it from rallying all the way to 57.30 before consolidating. Either way, expect the dollar to consolidate above 55 and below 57 over the next few weeks before it decides which way to turn eventually. I don’t think 57.3 wil lbe taken out quickly or easily.

Yield on 10 year US Treasury Notes: In some dramatic moves the yield on 10-year USTs made a new high of 2.207 before settling down to 2.13%. Next overhead resistance for the yield lies at 2.30% and we could see that materialise in the next few weeks. Note the yield is now well over its 50 and 200 DMAs. The interest rate cycle has clearly turned up after a near 30-year bull market in treasuries. Its impact will take time to manifest itself in equities. But expect fairly sharp corrections in commodity and bond markets over the next few weeks.

US Dollar Index [DXY]: It closed the week at 83.40. DXY still needs to consolidate a bit more above 83, which is now its 50 DMA. My sense is that DXY will resume its attempt at making new highs towards the end of the ensuing week. Next overhead resistance for DXY lies at 85.50 and we could be there over the next two to three weeks.

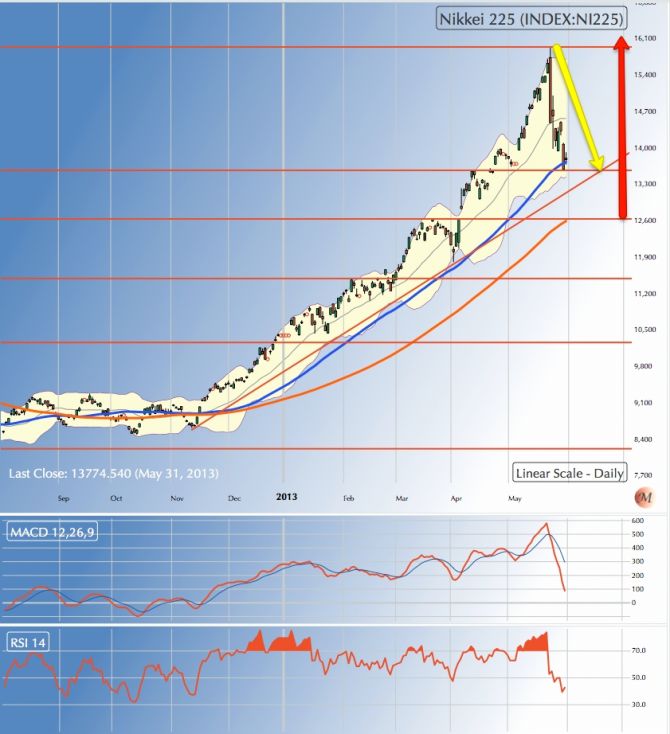

Nikkei: It closed the week 13774, a bit above its 50 DMA 13600. The longer term bull run in Nikkei is far from over but the spectacular run from 8500 to15700 needs some consolidation and a 50% retracement of the run up to 12000 will not be out of order. The consolidation isn’t likely to be one way and we could see sharp rallies in the index as it builds a new base above 13000 for the next leg of the rally. Much of the correction may already be done in terms of price though not time.

Shanghai Composite: The Index closed the week at 2300.59 while its 200 and 50 DMAs are in the 2250 region. On the wave counts I favour for the index, it needs to turn down and retest support at 2150 if the index intends to rally further. In fact the index could retrace all the way down to 1950 over the next few months. The market’s reaction to the prices in 2250 region will tell us which way things will go. In the immediate short-term the Index could rally further towards 2450 but is unlikely to take out that overhead resistance.

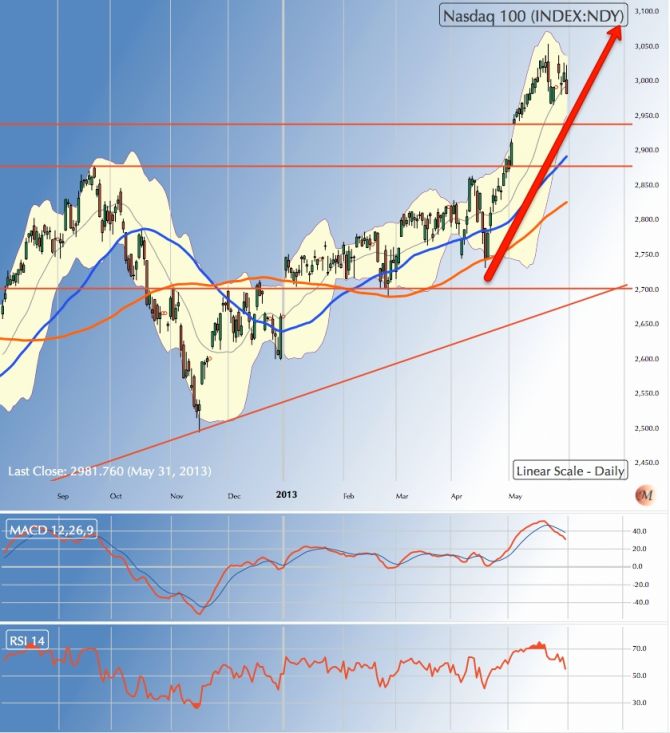

NASDAQ 100: The tech-heavy Index islikely headed into the last leg of its rally that could terminate mid-August. The Index closed the week at 2981.76 and has the gap at 2937 as immediate support. Its 50 DMA is at 2884.38. The current correction has a few days more to go. If the index doesn’t violate its 50 DMA over the next week, expect a fairly ferocious last rally up.

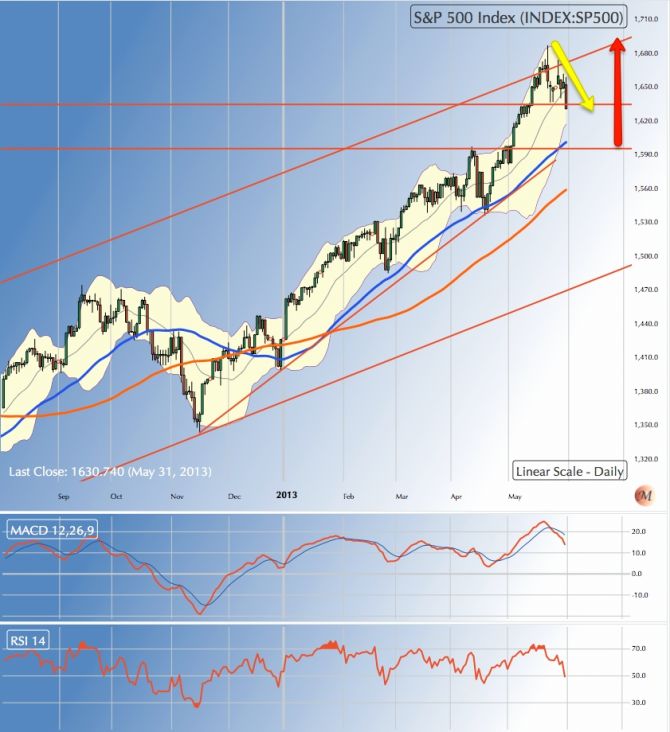

SPX: It closed the week at 1630.74. The index is correcting from the top of 1686.94 and first support lies at 1598. The 50 DMA for the index is also at 1598. Upon the index holding the said level as support over the next few days, expect a fairly sharp last rally towards the previous top or even higher. Keep exit plans handy and tighten stop losses just below 1600. Dangerous territory lies ahead.

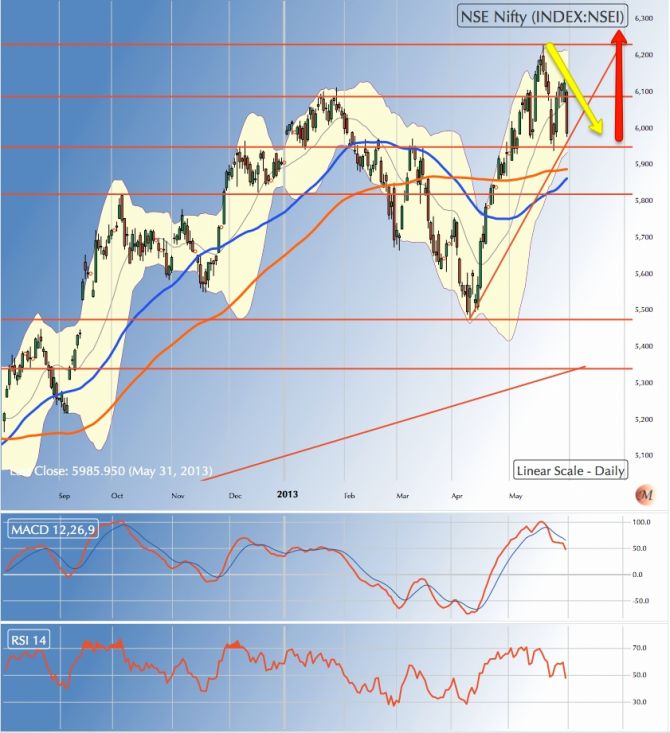

NSE NIFTY: It closed the week at 5985.95. I had expected the Nifty to correct down to 5850 from the top of 6240 and it appears to be heading that way. 50, 200 DMAs and first major support all coincide in the 5800 to 5850 region that is unlikely to be taken out just as yet. Upon 5850 holding, we can expect afairly sharp rally towards 6300.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

Sonali Ranade is a trader in the international markets

© 2025

© 2025