'If all goes well, we may well hit or even surpass the forecast growth rate.'

"But a lot of things can go wrong, and the MPC should in my view keep a careful watch on this," Jayanth Varma, external member of the Monetary Policy Committee, tells Manojit SahaBusiness Standard in an e-mail interview.

You started saying, 'The outlook on inflation and growth has changed only marginally between the April meeting and this meeting.' Do you still think growth is fragile? Is that 6.5 per cent projection for FY24 optimistic?

If all goes well, we may well hit or even surpass the forecast growth rate. But a lot of things can go wrong, and the MPC should in my view keep a careful watch on this.

So, yes, I still think growth is fragile.

The biggest concern is, of course, the unfavourable global economic and geopolitical environment.

We are an open economy and these global factors constitute a major headwind for economic growth.

The second issue is that the government has quite rightly embarked on a programme of fiscal consolidation which withdraws fiscal stimulus to the tune of about 0.5 per cdent of GDP.

Third, the rate hikes over the last year or so are working their way through the economy, and this is suppressing domestic demand.

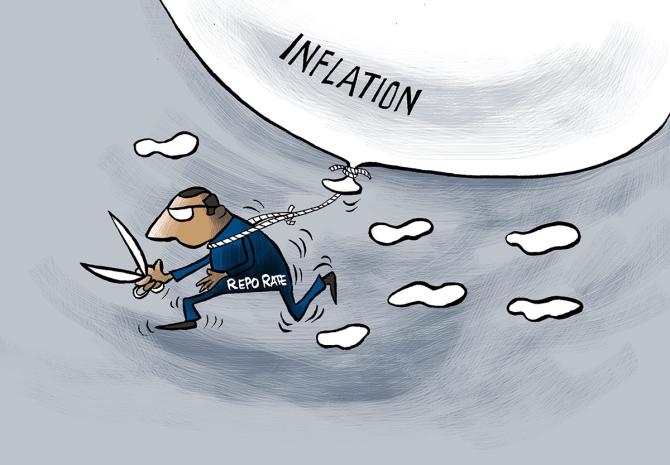

Why do you think that MPC declared winning the inflation battle prematurely?

The self-serving bias of taking credit for positive events or outcomes, but blaming outside factors for negative events is nearly universal.

The MPC did not describe an inflation print of above 7% as being the consequence of its monetary policy, but seems happy to make that attribution for a favourable reading.

I think it is necessary to consciously guard against the self-serving bias, and so I thought it necessary to point this out in my statement and dissociate myself from this attribution.

IMAGE: Jayanth R Varma, member, Monetary Policy Committee.

Photograph: Kind courtesy jrvarma.in

Is it absolutely a must that inflation falls to around 4 per cent, consistently, before the repo rate can be cut? Even if the real rate stays above 1 per cent.

Your question hits the nail on the head. Monetary policy should focus on the real repo rate and not the nominal repo rate which would have to be set mechanically at the level consistent with the desired real rate.

I think the real repo rate should be kept between 1 per cent and 1.5 per cent until projected inflation drops close to 4 per cent.

Even if there are monsoon related uncertainties, do you believe the interest rate cycle has peaked?

The real world has the habit of throwing nasty surprises at us when we are least expecting them.

In the past three years, monetary policy has had to cope with the pandemic, supply chain disruptions, and the Ukraine war.

So I would not like to make any statement that ignore all uncertainties.

Having said that, the current real repo rate will in my opinion keep inflation within the tolerance band and gradually align it to the 4 per cent target.

But this process will take time, and as I wrote in my statement, we should not declare victory too early.

'Monetary policy is now dangerously close to levels at which it can inflict significant damage to the economy' -- why do you say so? Is it because of the high real rate? What should be the real rate in an economy like India, according to you?

I have already stated that I think the real repo rate should be kept between 1% and 1.5% under current conditions.

Under what circumstances, do you think the repo rate can start to come down?

I expect the real repo rate to remain elevated for an extended period of time. The nominal repo rate should then track projected inflation as it trends downward.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025