RBI Governor D Subbarao made a strong case on Friday for a rollback of the expansionary monetary policy being pursued to combat the impact of the global financial meltdown, saying it could result in another bout of inflationary pressure.

RBI Governor D Subbarao made a strong case on Friday for a rollback of the expansionary monetary policy being pursued to combat the impact of the global financial meltdown, saying it could result in another bout of inflationary pressure.

"Creation of high power money in the face of large fiscal deficit. . .is not costless; it can sow the seeds of the next inflationary cycle," Subbaro said, delivering the JRD Tata Memorial lecture organised by the industry body Assocham in New Delhi.

RBI had made available a potential liquidity of Rs 5.60 lakh crore (Rs 5.6 trillion), nearly 9 per cent of gross domestic product, to help the country tide over the liquidity crisis following the global financial meltdown triggered by the collapse of America's iconic investment banker Lehman Brothers in mid-September.

Noting that RBI would continue to pursue an accommodative monetary policy until the economic conditions improve, he said, 'reversing the expansionary policies is definitely on the agenda (of the central bank).

"The current monetary and fiscal stance is, however, not the steady state. The Reserve Bank needs to roll back the special monetary accommodation", he stressed.

The RBI, Subbarao said, will roll back the easy monetary policy after the government shows credible commitment to fiscal responsibility and the economy manifests more definite signs of recovery.

The challenge for the central bank is to simultaneously maintain a comfortable liquidity situation and anchor inflationary expectations, he said.

Inflation, which has been in the negative zone since June, fell to (-)1.54 per cent for the week ended July 18 even as prices of essential food items like cereals, pulses, fruit and vegetables rose.

The Governor said the RBI's objective is to simultaneously maintain price stability, financial stability and growth but it cannot do much to tame a supply driven inflation except as a line of defence in extreme situation.

Noting that the government borrowing programme has increased substantially, the Governor said it militates against the low interest regime.

"Government borrowing had resulted in firming up of yields, notwithstanding the substantial excess liquidty, militating against the low interest rate regime that we want," Subbaro said.

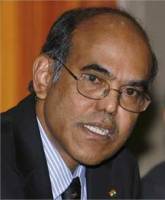

Image: Reserve Bank of India Governor Duvvuri Subbarao. | Photograph: Punit Paranjpe/Reuters