India could not have accepted the demand of the South African government for dual listing of shares in the absence of full convertibility of rupee which ultimately led to the collapse of the $23 billion merger deal between Bharti Airtel and MTN, experts say.

India could not have accepted the demand of the South African government for dual listing of shares in the absence of full convertibility of rupee which ultimately led to the collapse of the $23 billion merger deal between Bharti Airtel and MTN, experts say.

"As the Indian rupee is not fully convertible, it is not possible to go in for dual listing of shares which allows people to buy shares in the stock exchanges of one country and sell in the bourses of the other country," said law firm Titus and Co's senior partner Diljeet Titus.

Expressing similar opinion, SMC Capital equity head Jagannadham Thunuguntla said, "There will be flight of capital from one country to another without any control... this cannot be allowed unless we have full currency convertibility".

Partner of global consultancy firm Ernst and Young, Ashwin Parekh too opined against full convertibility and said it could 'lead to flight of capital'.

According to rating agency CRISIL's principal economist, 'proper risk management needs to be in place for full capital account convertibility...suddenly having full convertibility does not make sense amid the global crisis'.

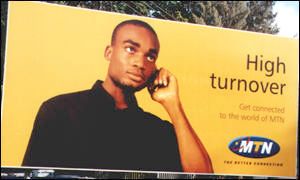

Sunil Mittal-led Bharti called off discussions with telecom giant MTN citing the South African government's rejection of the proposed merger structure, which would have created the world's third largest telecom company with combined revenues of over $20 billion annually and a subscriber base of over 200 million.