The Budget announcements have been made. The finance minister changed the tax slabs giving more money in the hands of the people. However, he also hiked duty on petroleum leading to a fuel price rise.

The Budget announcements have been made. The finance minister changed the tax slabs giving more money in the hands of the people. However, he also hiked duty on petroleum leading to a fuel price rise.

The entire Opposition walked out of the Lok Sabha in protest terming the Budget 'inflationary'.

What effect will the Budget have on food prices? And on prices of other things? Has the FM given with one hand and taken away from the other?

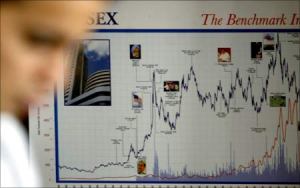

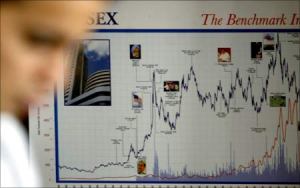

The markets seemed to have taken the Budget proposals in stride. The Sensex regained the 17,000 mark on Wednesday, but on Thursday, it's trading in the negative region.

However, certain analysts feel that it will touch 22,000 by the end of this year.

In a chat on rediff.com on Thursday, market expert Vinay Mahajan offered some valuable tips. Here is the transcript:Vinay Mahajan says, The views and opinions expressed here are the personal views of the writer and in no way reflect the views and opinions of the company they represent or work for

Vinay Mahajan says, Welcome to the session

perqanand asked, my wife draws 25k. looking to invest on resale flat with 12L loan. whts ur opinion? Heard that gradually govt will remove tax benefit from home loan.. is it true?

Vinay Mahajan answers, at 2010-03-04 15:01:03so far it looks that benefit on home loans will continue

kash asked, reality sector how lucrative it is ?

Vinay Mahajan answers, with reference to the budget proposals firms which are in infr construction space are at an adavantage

dec asked, hi vinay is investing in fds in banks good

Vinay Mahajan answers, it depends on cash flow needs and risk perception. alternate is corporate depsoits where yield is 2-4% higher depending on rating etc.

anilvel asked, Hi Vinay, I want to invest a fix sum say Rs. 5000 per month. is it better to buy Index Funds or buy BSE100 shares to get maximum gain.

Vinay Mahajan answers, better to look at diversified large cap mutual funds

m.p.pravin asked, my age is 45 yrs to get 2cr+ at the age of 60 how much should i invest

Vinay Mahajan answers, a little over Rs 500000 a year

budget asked, 20 years from now, sensex will be at 50000

Vinay Mahajan answers, looks possible even much earlier

harish asked, Hi, Is it best time to invest in gold

Vinay Mahajan answers, Gold acts as hedge against inflation, should form 5-10% of your overall portfolio

Som asked, Hello, Is this the right time to invest in MFs?

Vinay Mahajan answers, one can not time the market, if you are long term investor you can invest through mutual fund which provides you investment advisory

samir asked, what is long term target for sensex & what period is actually long term

Vinay Mahajan answers, short, medium and long term varies from individual to individual. it depends on investment objectives and risk. generally period of 5 year+ is considered as long term

bobby asked, I can invest upto 15k in equity every month for upto 20 years. Please suggest how and where to invest to get maximum return. I have term insurance and invest in PPF/NSC for debt.

Vinay Mahajan answers, equity outperforms in long term. you may select mid cap funds(50%) and large cap funds (50%) for better return

BHARAT asked, which are long term infrastructure fund and what is the lock-in period,where one can invest 20k for tax saving purpose in the coming year.

Vinay Mahajan answers, we have o wait for these bonds to come in the market. normally lock-in period is 3 years

looser asked, actually stock trading 90% are looser and 10% gainer

Vinay Mahajan answers, may not be true, it happens if an investor invest like a trader and a trader trade like an investor

desi asked, Hi, I want to invest in ELSS funds for this yrs last minute tax saving. So is investing one time money OK? I dont want to follow the SIP route since i want to save tax for 08-09. Please reply.

Vinay Mahajan answers, one time investment in ELSS is better comapred to SIP route

kare asked, Sir, Gud AN. I hold 100 idea, 200 petronet, Indian bank 100. I bought today only. Is it good for investment for 3 months.

Vinay Mahajan answers, these are good long term stocks. 3 moths may not give you desired returns

sunny asked, For 5 year prospective what should be investment planning

Vinay Mahajan answers, just work on three questions 1. Financial Goal( cash flow requirement) 2. How much to save for tose goals 3. Where to invest for step 1

BABA asked, IS MUTUAL FUND INVESTMENT IS SAFE AND CORRECT?

Vinay Mahajan answers, MFs are today well regulated hence safe.

Farook asked, what are infrastructure bonds?

Vinay Mahajan answers, funds raising instrument used by infrastructure companies or banking companies

mani asked, Is the right tim to enter the market and if yes whether it is advisable to enter the primary and secondary market

Vinay Mahajan answers, if you know equity markets well you may invest through both, if you are new enrant primary market is prefereable

Joel asked, mutual funds are promoted as good invetment options, however after having invested in icici,merryl L,reliance , bajaj alliance & the likes I have not got retuns as expected over the last 5 years. Which mutual funds would you suggest for long term returns.

Vinay Mahajan answers, returns vary from scheme to scheme. before investing look at the benchmark and objective of the scheme. for long term you may opt for mid cap funds also

bobby asked, Is Birlasunlife frontline equity a good diversified fund to start SIP

Vinay Mahajan answers, yes it is good fund, be consistent and invest for long term

Aruna asked, Hi! I would like to know if the size of the fund would affect its performance over the years? eg - HDFC Top 200, Reliance Growth. Thanks!

Vinay Mahajan answers, this is the topic of academic interest as well, however to me there are no eveidances to suggest that it affects the funds performance

sonu asked, Do u think that power stocks will perform in coming years ? If yes, when & Why, with comparision of previous years in which such stocks are not outperformed?

Vinay Mahajan answers, to me this is a sector which has great potential and and looking at the power consumption in India vis a vis other developed nations, the sector has to grow.

vbn asked, Does SIP gives guaranteed 15% - 20% returns on the investment.

Vinay Mahajan answers, there is no guarantee of return, however over a long term you may expect returns in this range

Sanjay asked, which retierment fund house is good .i want to invest 3000 Rs. every month for 20 years

Vinay Mahajan answers, you may create your own retirement corpus through systematic investing in diversified large cap mutual fund. Alternate is to buy a pension plan which are offered by insurance companies or a few mutual fund houses

Sanjay asked, which retierment fund house is good .i want to invest 3000 Rs. every month for 20 years

Vinay Mahajan answers, you may create your own retirement corpus through systematic investing in diversified large cap mutual fund. Alternate is to buy a pension plan which are offered by insurance companies or a few mutual fund houses

Rohan asked, can u advice me which sector in mutual fund shoud i focus on ??

Vinay Mahajan answers, infrastructure & Banking

Joel asked, Hi, what would be the best investment option for long term returns. I have invested in Reliance infra & icic prudential mutual funds 2 years back but they have given me very poor returns, even lower than a bank FD. I am planning toinvest in LIC since I would get a bonus and tax free returns. Which would be ther best LIC scheme to go for.

Vinay Mahajan answers, returns were low because we had markets in a bad shape, continue with your investments. With regard to LIC you need to check the investment component in it.

ANKulkarni asked, Equity or MF SIP which will b be best option? 2 yrs back i have taken 3 LIC policies but without Term Insurance,shall close that one start new with term.

Vinay Mahajan answers, investment should be in sync with cash inflows hence SIP or lumpsum mode of investment. before closing the policies look at your insurance requirements and surrender value available to you

neelesh asked, im 29 yr old. wants to invest some amount and save some as well. My monthly income is 30,000. how should i do it ?

Vinay Mahajan answers, Liquidity : one should keep 3-4 months monthly expenses in cash / bank Savings: 25-40% of monthly income Investment: MF, Fixed Deposits, Gold match it with your cash inflow and outflows

Som asked, Hi there, shall I invest in MFs now? If yes, then please guide me to select a few - equity growth funds. How about IDFC ?

Vinay Mahajan answers, Select funds based on your investment objectives, IDFC is a good fund house.

Purushottam asked, sir,my son is 3 years old and my daughter is 10 yrs old,pls adv where to invest,as they have got higger studdies in the later part,kindly adv the investment schedule

Vinay Mahajan answers, 1. Decide the fund requirement for studies ( present cost adjusted for inflation) 2. Decide the cash flow pattern e.g. it may be say Rs 2 lakhs every year for 4 years 3. Decide the accululation phase ( for your son it could be say 15 years ) 4. Decide the amount per year required to saved 5. Finally decide the investment instrumet keep the asset allocation moving to meet cash requirements

veena asked, I have heard that taking loans will cut off some tax from your income? what percent of tax can be deducted from the income in case of home loans.

Vinay Mahajan answers, interest 1.5 lakhs and repayment up to Rs 1lakh

motilal asked, i m 28 years unmarried person ,joined automobile company 3 years back after completion of MTECH.Now my permonth saving amount goes up t0 20000-25000 after all expenses.Till date i have invested 60000 in mutual and taken one insurance policy of lic and paid two premium.give me some tips how to invest to get 50 lakh in 10 years as of now.

Vinay Mahajan answers, you need to save and invest about 2.5 lakhs a year to get the desired number

Vinay Mahajan says, thanks for your participation. due to time constraint i may not be able to take more questions. you may please mail your questions to vinaymahajan@rathi.com do wirte with your loaction and contact number. bye.. all the best..

The Budget announcements have been made. The finance minister changed the tax slabs giving more money in the hands of the people. However, he also hiked duty on petroleum leading to a fuel price rise.

The Budget announcements have been made. The finance minister changed the tax slabs giving more money in the hands of the people. However, he also hiked duty on petroleum leading to a fuel price rise.