| « Back to article | Print this article |

In response to a news item -- titled 'Infosys faces evasion charges' -- that appeared in Financial Express on March 13, Infosys Technologies CEO S 'Kris' Gopalakrishnan said on Monday that the company "has never evaded any taxes nor will it ever evade any taxes in the future."

In response to a news item -- titled 'Infosys faces evasion charges' -- that appeared in Financial Express on March 13, Infosys Technologies CEO S 'Kris' Gopalakrishnan said on Monday that the company "has never evaded any taxes nor will it ever evade any taxes in the future."

"First of all, as one of the most respected and ethical Indian companies, Infosys has never in the past intended to evade taxes and never in the future will intend to evade taxes and duties. In fact, Infosys chairman -- N R Narayana Murthy -- has been the only business leader who has argued publicly for abolition of all tax exemptions to software and BPO companies," Gopalakrishnan said in a media statement.

Financial Express had reported on March 13 that Infosys, India's second largest IT company, could 'potentially face a tax liability of Rs 100 crore (Rs 1 billion) for alleged violations of special economic zones rules at its Chandigarh SEZ'.

Earlier, a Press Trust of India report had said that the SEZ in Chandigarh being developed by Infosys was under the scanner of the revenue department for allegedly breaking certain norms.

The Infosys statement said that the company "was the first software company to be invited by the Chandigarh administration to start a development centre at Rajiv Gandhi Chandigarh Technology Park (being created as a Special Economic Zone or SEZ) for creation of employment for the young men and women of Chandigarh. Infosys accepted the offer and signed a memorandum of understanding with the Chandigarh administration on November 15, 2002."

"As per this MoU, Infosys was allotted 20 acres of land on June 11, 2004. The remaining 10 acres were allotted on November 10, 2005. No sale deed was signed for both the allotments," the statement said.

"As a company focussed on speed, Infosys submitted the development centre building plans and documents for sanction with the Chandigarh administration on July 7 and on July 19, 2004. Land excavation permission was given on July 20, 2004," Gopalakrishnan said in the statement.

"As the developer of the SEZ, the Chandigarh administration made an application on November 30, 2004 to the ministry of commerce to notify 111 acres of the Rajiv Gandhi Chandigarh Technology Park as SEZ," the statement added.

"The Chandigarh administration disclosed in the application the fact that Infosys was proposing to start the construction of the building on the land applied to be declared as SEZ. The actual construction of Infosys development center was started on December 27, 2004," Gopalakrishnan added.

"This is as per the 3.1.1 guidelines of SEZ -- issued by the ministry of commerce on January 21, 2002. The government of India gave the formal approval for the RGCTP to operate as a SEZ on June 6, 2005. This approval was under the old SEZ scheme. New Act and Rules came in to force from February 10, 2006," Gopalakrishnan further stated.

"As the RGCTP SEZ did not start functioning before the new SEZ Act and rule set came in to force on February 10, 2006, the Board of Approval of the government of India (GOI), after consideration of all the facts put forward by the Chandigarh administration, accorded the approval of RGCTP SEZ on May 19, 2006. The issue of vacant land at the time of submitting the SEZ application by the Chandigarh administration was considered by the BOA and the notification was issued only after the site inspection by the Development Commissioner of GOI at Noida," the Infosys statement said.

"Infosys submitted an application to the Development Commissioner Noida on May 24, 2006 for setting up an IT SEZ unit in RGCTP. Infosys received the approval for setting up an IT SEZ unit in RGCTP from the Government of India on June 16, 2006," the statement further said.

"Infosys did not avail any customs / excise duty / tax exemption on the construction activities till it got the Letter of Approval from the ministry of commerce on June 16, 2006. Infosys started the operation of its development center at RGCTP from September 4, 2006," the Infosys CEO said in the statement.

Gopalakrishnan said, "No land has been sold to us by the Chandigarh administration on freehold basis. Infosys signed the land lease agreement as per the provisions of SEZ Rules on April 3, 2009. The company has not carried out, as alleged by FE, a series of complex buying and lease deals with the Chandigarh Administration in order to buttress the legality of its SEZ status."

"Land was vacant at the time of filing the application by the Chandigarh administration. The subsequent construction activities have been fully disclosed and the government has also confirmed the same in its inspection report and this fact has been considered by the government before the issuance of the SEZ notification," he added.

"Infosys did not claim any tax or duty benefit till its SEZ Unit got approved by the ministry of commerce on June 16, 2006 and signing of the customs bond on July 10, 2006. Therefore there is no question of evasion of taxes and duties (direct and indirect) as reported in the press," he said.

"Infosys started the operation in the RGCTP only after it obtained the Letter of Approval from the commerce ministry. Infosys continues to invest in its facility in Chandigarh," the statement added.

Gopalakrishnan said that the "cumulative investment by Infosys in this facility as on December 31, 2009 is Rs 286.85 crore (Rs 2.868 billion). Since the start of operations of our Chandigarh Development Centre on September 4, 2006 till December 31, 2009, we have had exports of over Rs 750.40 crore (Rs 7.504 billion). The exports for the last 12 months ending December 31, 2009 were Rs 374.64 crore (Rs 3.746 billion). As of December 31, 2009 we had 2,676 employees at our Chandigarh Development Center. The only activity taken up in this development center is for export purposes."

"We are among the top tax payers in the software and BPO industry. For fiscal year 2010 our total advance tax payment is Rs 1,180 crore (Rs 11.80 billion)," Gopalakrishnan concluded.

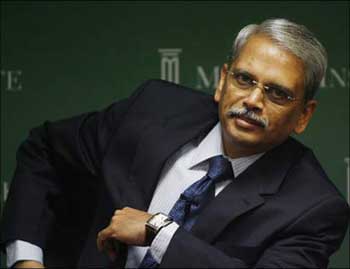

Image: Infosys Technologies CEO S 'Kris' Gopalakrishnan. Photograph: Reuters