Garment makers and retailers, who have been demanding rollback of 10 per cent excise imposed on branded apparels, were left disappointed on Tuesday by a partial tax concession given by Finance Minister Pranab Mukherjee.

Garment makers and retailers, who have been demanding rollback of 10 per cent excise imposed on branded apparels, were left disappointed on Tuesday by a partial tax concession given by Finance Minister Pranab Mukherjee.

"Very disappointing," Clothing Manufacturers Association of India president Rahul Mehta told PTI, while reacting to the announcement made by the finance minister to reduce excise duty on readymade garments and other textiles articles from 60 per cent of the retail price to 45 per cent.

CMAI, which had gone on strike earlier this month against the proposals made in Budget 2011-12, especially demanding the rollback of 10 per cent excise duty on branded apparels, said Mukherjee's move failed to address the bigger issues.

"Since it has only tinkered with the rates and not addressed our major concerns particularly that of spiralling costs of raw materials and futility of introducing a new tax one year before GST rolls out," Mehta said.

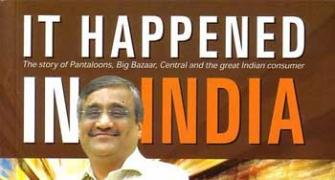

Echoing similar sentiments, Future Group director and chief executive officer (retail) Rakesh Biyani said:

Biyani said the incidence of tax that will have to be passed on to consumers, will continue to be high, even after the concession offered.

To protest the imposition of 10 per cent excise duty on branded apparels, about 10,000 retail stores, including Shoppers Stop, Pantaloons, Westside, Lifestyle, Madura Garments and Arvind Brands had also observed one day of 'shutter down' on March 7.

"The finance ministry should re-consider the appeal of the garment industry to continue with the optional scheme of zero excise duty when no Cenvat Credit is claimed alternately garments should be considered as 'products' in transition & a nominal excise duty of one per cent should be charged," Biyani added.