As regulators try to contain one of India's most spectacular investment scandals, dozens of smaller but similar schemes continue to mushroom, employing tactics similar to the ones that enriched the Sahara group and later brought it to its knees.

As regulators try to contain one of India's most spectacular investment scandals, dozens of smaller but similar schemes continue to mushroom, employing tactics similar to the ones that enriched the Sahara group and later brought it to its knees.

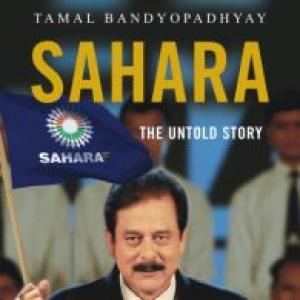

Sahara began as a scheme for small depositors, but it grew over decades with investment plans that critics say were designed to avoid regulatory scrutiny.

At its height, it was one of India's biggest business empires, stretching from Formula One motor racing to New York's Plaza Hotel.

Now its boss is in jail for more than a year and some staff say much of its business is threatening to stall, after it raised billions of dollars from investors by selling bonds that were ruled to be illegal. Patchy oversight in India means countless illegal investment schemes continue to emerge, however, often in the villages.

So far this year, the Securities and Exchange Board of India (SEBI) has barred more than 70 firms that raised funds through debentures or collective investment schemes, promising returns from cash put in land, cattle and even holiday homes.

In most cases, it cited the court order against Sahara in support of its action.

That is cold comfort for retired Indian army officer KL Sharma. Hoping to raise money for his daughter's wedding, he placed a third of his savings into an investment scheme run by property developer PACL in 2007.

The investment matured last year, but there is no trace of the 270,000 rupees ($4,339) he put in, never mind the promised returns that were supposed to double his money.

"It was hard-earned money that I invested because agents for PACL in my village convinced me I would get good returns.

Now I am stuck," said Sharma, speaking from Rajasthan, western India.

As late as November, months after PACL was put under investigation and barred by regulators, local media reported that SEBI told the Corporate Affairs Ministry it was still raising funds from depositors.

SEBI officials say that despite increased monitoring and financial education programmes since the Sahara case and a spate of other scandals, they are still overwhelmed by a backlog of cases, as a financially illiterate adult population, less than half of whom have access to formal banking, continues to put its trust in local agents for such schemes.

One official said many schemes had operated for decades without oversight, until legal changes last year gave SEBI broader powers.

"A collective investment scheme in itself is not unlawful, but the way these schemes have been run, by and large as assured-return guarantee schemes, that's not allowed," he said.

"The law is clear; it requires them to come and register with us.

But they don't, because they have operated without any oversight for years. Why will they want any supervision now?"

A SEBI spokesman had no immediate comment.

REGULATORY GAPS

Collective investment schemes, often known locally as chit funds, operated in the regulatory gaps for years by getting licences from state authorities that were ill equipped to monitor them.

Last year, SEBI was mandated to oversee any investment vehicle that raises more than 1 billion rupees from the public.

Firms issuing any form of security to more than 49 investors are supposed to register with SEBI, but many flout the rules, and activists say even when caught and barred, companies can simply change their names and get back in the market.

"The regulator is trying to do its best, given the capability and resources they have, but is it enough to meet the scale of the challenge? Maybe not," said Shriram Subramanian, managing director of corporate governance advisory firm InGovern.

For most investors, including those in PACL and Sahara, efforts to reclaim their investments are tangled in a legal process that could take years.

The unlicensed companies often vanish, and others banned from the market can challenge the order in court for years. Sahara says it has paid 95 percent of the dues to the bondholders, but the markets regulator disputes that. In West Bengal, factory worker Makhan Midya saved Rs 500 from his salary of Rs 6,000 a month until eight months ago, investing in Rose Valley Real Estate and Constructions Ltd.

A SEBI probe showed Rose Valley raised billions of rupees without the required licence, and in June it asked the company to wind up its business and refund investors within three months of the order.

Midya has yet to get a refund.

Tapan Biswas, Rose Valley operations manager in the state capital Kolkata, blamed SEBI, arguing the decision to freeze its bank accounts had hit business and its ability to repay.The regulator in August last year gave unlisted PACL three months to refund $8.1 billion to investors, after ruling that the company's investment schemes had not been registered.

PACL, which did not respond to requests for comment, has appealed against the decision. (Additional reporting by Himank Sharma in MUMBAI and Sujoy Dhar in KOLKATA;