Salaried individuals may not need to file revised returns as they have only one source of income and there are lesser chances of erring while filing returns

Income tax payers are allowed to file revised Income Tax (I-T) returns to amend the original I-T returns in order to provide a more accurate assessment of their income and the consequent tax liability.

Usually, salaried individuals may not need to file revised returns as they have only one source of income and there are lesser chances of erring while filing returns.

However, there may be genuine mistakes by income tax payers who have various sources of income. We discuss five important points that you should keep in kind while filing revised I-T returns.

Remember that you have to use the same mode of filing revised I-T returns as you did for the original returns. If you have filed the original I-T returns online, then you have to file the revised I-T returns online as well.

Keep the date in mind

The most important thing is to keep the deadline of filing revised I-T returns in mind. The last date of filing I-T returns is July 31, unless extended or changed by the authorities.

In case of revised filings, the date is the end of the next financial year.

For example, the last date of filing I-T returns for the financial year 2016-2017 is July 31, 2017, while the last date of the filing revised returns for the same financial year is the end of the next financial year, March 31, 2018.

There is no limit on how many times you can file revised returns as long as you do it within the timeframe, i.e. before March 31 of the following calendar year.

Submit the original returns along with the revised returns

You should give all the information of original I-T returns that you filed. Mention the date of original I-T returns filing along with the acknowledgement number provided to you.

This is mandatory because you cannot file revised I-T returns unless you have filed the original I-T returns.

Remember that this is the revised I-T returns for the financial year in question. Hence, you are essentially revising or amending the returns that you filed earlier.

This is different from late I-T returns where you could not file the original I-T on time. Moreover, revised I-T return is not allowed for taxpayers who have filed their original returns late.

Revision is allowed only when the mistake is unintentional

You are filing revised I-T returns because presumably there were discrepancies in the original I-T filing.

These discrepancies must be unintentional. Any discrepancies arising out of fraud or concealment of income will result in penalty or strictures.

The penalty can be anywhere between 100 per cent and 300 per cent of the tax liability. For example, if the revised I-T returns with higher income is filed after the tax officer assesses the income, you will have to cough up a huge penalty.

Revised I-T returns may result into more scrutiny

As mentioned earlier, the purpose of revised I-T returns is to allow the taxpayers to rectify any mistake committed unintentionally.

However, if the assessment officer prima facie feels that the revised I-T returns contain suspicious items resembling concealment of income, it will invite further scrutiny by the I-T officials.

It is advisable not to hide any income in the original I-T returns under the misplaced assumption that filing a revised I-T return later will take care of the omission.

Have a sound reason to file the revised I-T returns

Even though the I-T department has provided the option to file revised I-T, you must be ready to explain why.

For example, if the revised I-T return show more income than the original returns, you should be able to explain why it wasn’t filed in the original I-T returns. Being prepared with a genuine reason will pre-empt unnecessary hassles in future.

Finally, do not have any fear of filing revised I-T returns.

If you have genuine reasons for doing so, there is no cause for worry whatsoever - go ahead and amend the original I-T returns with the revised version.

The smart approach to filing taxes is to not let any inadvertent mistake linger unaddressed.

Adhil Shetty is CEO, BankBazaar.com

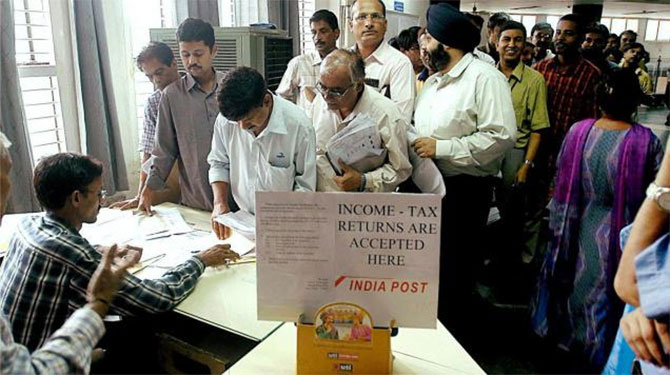

Photograph: PTI Photo

BankBazaar.com is a marketplace where you can compare and apply online for loans to meet all your personal loan, home loan, car loan and credit card needs from India's leading banks and NBFCs.

© 2025

© 2025