If you hold stocks in sectors which have seen stock prices melt, what should your strategy be?

Here's a checklist, says Sarbajeet K Sen.

Deepak Mahrotra, 60, a veteran stock market investor, has been caught in a bind.

He holds both Maruti and Dewan Housing Finance (DHFL) in his portfolio and has been watching both the stocks almost on a free fall for some time.

"I had bought 60 Maruti shares long time back when the price was around Rs 900. I had sold 20 at around Rs 5,500, making a big profit. However, I have held on to the remaining 40 shares and saw the price coming down to the present levels after reaching around Rs 10,000 recently. I had also bought 500 shares of DHFL at an average price of around Rs 350. I sold half of my holding at around Rs 80," says Mahrotra.

And there are many Malhotras in the market currently.

With all the key indices -- large, mid or small cap -- taking a knock daily, many portfolios are in the red.

And going forward, the signs aren't good.

Recently, the country's consumption bellwether, Hindustan Unilever, reported its lowest volume growth in seven quarters.

And auto companies like Maruti Suzuki continue to cut production.

While the economy seems to be doing poorly, scarier is the tumbling out of skeletons in the financial sector.

The crisis caused by Infrastructure Leasing and Financial Services, DHFL and other non-banking financial companies (NBFCs) is surely making it worse for investors.

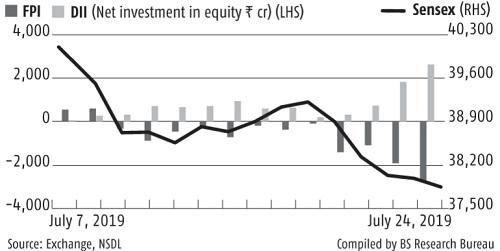

And of course, there is the surcharge on super-rich imposed in Budget 2019-20, which is making foreign portfolio investors run for cover.

These investors have already pulled out over Rs 10,000 crore during the year, and it is only the domestic institutional investors such as mutual funds and insurance companies that are holding the fort.

In such times, retail investors have little choice.

Don't try to be smart

This is not the time to start punting on stocks to make a quick buck.

And there would be many people trying to sell 'value' to you, but a retail investor would do well to avoid these temptations.

Yes, there would be many fund managers who might be betting on future multi-baggers, but they have the benefit of good research and management interactions to back their decisions.

With portfolios of well-known private wealth managers like Porinju Veliyath of Equity Intelligence, who manages Rs 1,000 crore and invests largely in mid- and small-cap stocks taking a serious knock, retail investors are better off staying away from risky investment themes.

In a letter to investors recently, he wrote: "Eighteen months since the sell-off in broader markets began and yet there has been no respite for small-and mid-cap investors like us... The longevity of the ongoing bear market in mid-and small-caps of this magnitude has been astounding to even the most seasoned investors... Unfortunately, the positives of the continuity in government has been lost with the market-unfriendly provisions in the Budget, at least for the near term."

According to him, the broader markets shaved off 50 per cent in January 2018.

Close to 90 per cent of listed stocks are down anywhere between 30 per cent and 90 per cent.

Only the top 10 per cent have not fallen much.

Go for quality names

If you hold stocks in sectors which have seen stock prices melt, what should your strategy be?

"Investors have to hold stocks which are of high quality and have solid management and corporate governance and of course, top-quality balance sheets," says Gautam Duggad, head, institutional research, Motilal Oswal Financial Services.

Rajesh Cheruvu, chief investment officer, Validus Wealth, agrees: "Investors should stick to companies that have a strong track record of demonstrating out-performance in these tough times."

Rahul Agarwal, director, Wealth Discovery/EZ Wealth, also advises sticking to sound companies.

"There are a few bright spots in an overall troubled environment that can withstand the storm," he said.

Maruti figures among his top picks.

He also likes M&M and Ashok Leyland.

Diversify portfolio

In case you are uncertain of the long-term prospect of your auto and NBFC stock holding, you can explore other sectors that could hold greater potential going forward.

"Investors who are looking to restructure their holdings in auto and NBFCs can align their investment thesis with the growth focus areas for the government such as infrastructure, affordable housing, aviation, etc.

"Companies in the infrastructure, real estate, cement, and the engineering sector are expected to deliver exceptional returns.

"Also one can look into select banking names as the negatives for banks, especially PSU banks, have been adequately priced in," says Agarwal.

Cheruvu also suggests switching to good names in sectors like construction materials and home improvement segments, which are likely to benefit from the infrastructure and housing push.

Mutual fund investors

If you have invested through systematic investment plans, don't make the mistake of stopping them.

These are times when your monthly amount will get more units due to lower net asset values.

These units will earn significant returns when the market turns around.

If you want to invest a lumpsum amount, this may not be the right time.

With lack of clarity around the market's performance and economy not looking in good shape, it is better to hold on to cash.

© 2025

© 2025