Two factors play a predominant role in fetching good returns -- stock selection and allocation, suggests Sanjay Kumar Singh.

With several categories of active funds underperforming their benchmarks in recent years, fund managers have a few options to improve their performance: Take more concentrated bets, curtail expense ratio, and reduce churn in their portfolios.

Focused funds, by their mandate, allow fund managers to follow the first of these strategies.

According to the Securities and Exchange Board of India's (Sebi's) definition, focused funds cannot hold more than 30 stocks in their portfolios.

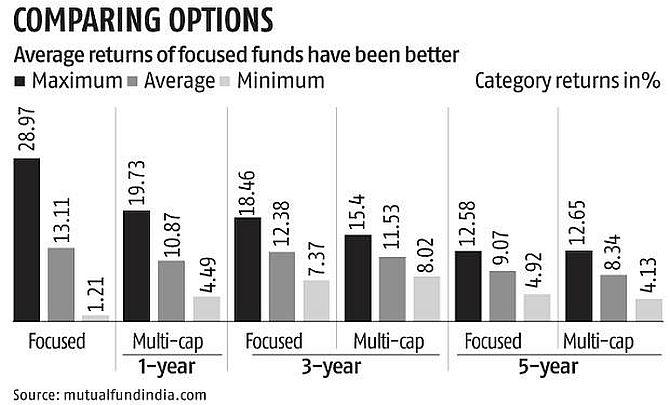

As the table shows, the focused category has performed better than the multicap funds.

Focused funds are run mostly as multi-cap strategies and hence, are most closely comparable with this category among diversified peers.

Two factors play a predominant role in fetching good returns -- stock selection and allocation.

"Having a meaningful allocation to your high-conviction ideas is important. A focused strategy allows you to do that," says Rupesh Patel, senior fund manager, Tata Mutual Fund, whose new fund offer for Tata Focused Equity Fund is on currently.

Patel adds that even if a fund manager picks a multibagger, it will not improve his portfolio's performance much if he has only a small allocation to it.

Thus, these funds can potentially fetch superior returns for investors if the fund manager gets his stock selections right.

Analysts at Tata MF carried out an exercise wherein they built a portfolio resembling the Nifty50.

What they found was that more than 90% of the returns over the three and the five-year period come from the top 20 stocks in the portfolio.

Says Patel: "My experience has been that the stocks sitting in the tail of the portfolio, to which the fund manager has a minimal allocation because he does not have much conviction in them, contribute the most to negative returns."

Focused funds cull such low-conviction bets from the portfolio.

Beta, a measure of volatility, is higher in the portfolios of focused funds than in their diversified counterparts.

The primary risk in these funds is that if the fund manager gets a few stock picks wrong, the fund's performance could take a significant hit.

Focused funds are better suited to investors with higher risk appetite.

"Investors looking for high-risk, high-return bets may opt for them," says Jinesh Gopani, head of equity, Axis MF.

Axis Focused 25, managed by Gopani, is the largest fund within this category with assets under management (AUM) of Rs 8,799.58 crore (total category AUM stands at Rs 44,741.35 crore).

Gopani adds that investors with high risk appetite, who were earlier investing in stocks directly but could not get their stock picks right, may also opt for these funds.

Those with moderate risk appetite may stick to diversified funds in their core portfolios, and take some exposure to these funds, if they want to, in their satellite portfolios.

For most investors, allocation to these funds should not exceed 15-20 per cent of the equity portfolio.

As the fund manager's stock selection ability is of paramount importance in these funds, investors should opt for schemes where the fund manager has been running this strategy for a considerable time and has a good track record.

According to Avinash Luthria, a Sebi-registered investment adviser and founder, Fiduciaries, besides looking up the fund manager and the fund house's track record, if an investor opts for this category, he should go with a fund that has a low expense ratio.

Sanjay Kumar Singh covers personal finance for the Business Standard newspaper.

© 2025

© 2025