When you invest in equities, either directly in stocks or via equity mutual funds, tell yourself this: 'I am fine with volatility if in the long term there is a good chance of earning higher returns', suggests Ankur Choudhary.

Illustration: Dominic Xavier/Rediff.com

The past week has been akin to a rollercoaster ride for the Indian stock markets as the US-Iran standoff raised temperatures in West Asia and sparked fears of an all-out war.

The year gone by was no less turbulent, as fears of an economic slowdown in India took a toll on stock prices.

According to industry experts, equity markets are likely to remain volatile even in 2020, owing to factors such as weak earnings, elections in key state such as Delhi and Bihar, the US-China trade war, and the announcement of a new Brexit deal.

While the large-cap indices have managed to show decent returns over the past year, mid and small-cap stocks are still struggling to make a comeback.

Which brings us to the question often posed by investors: How to navigate volatility? The answer: Understand, plan and ignore.

Volatility is a feature, not a bug

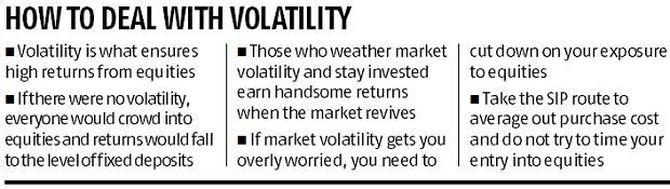

The first thing investors need to understand is that volatility creates risk, which is what gives rise to higher returns from equity investing.

In other words, it's a feature and not a bug.

Timid investors jettison their investments during volatile phases in the market while the steady ones keep investing and hence earn higher returns when the market recovers eventually.

Take one extreme example.

After the Lehman crisis in 2008, the Sensex fell by around 60 per cent within a year.

But since then it has given 400 per cent return in the following 10 years (even more if one takes into account dividends).

If there was no volatility, demand for stocks would shoot up and future returns from equity markets would get pushed down to the level of fixed deposits (FDs).

When you invest in equities, either directly in stocks or via equity mutual funds, tell yourself this: "I am fine with volatility if in the long term there is a good chance of earning higher returns."

In other words, returns are not guaranteed but volatility is.

Invest according to a plan

The first step in investment planning is to know your risk profile.

What degree of losses are you willing to tolerate before you start getting worried? Is it 0, 10, 20 or 40 per cent? The lower this number, the lower should be your allocation to equity mutual funds and higher to debt mutual funds and FDs.

If the number is close to 0 per cent, ie, any loss will make you panicky, don't invest in stocks or equity mutual funds.

That's quite okay. You will still do better than the person who invests in stocks without actually having the risk tolerance for them, and then bails out at a loss.

Get an idea of your risk profile by answering risk-related questionnaires available online, including on our website.

The second step is to know your goals.

Most people invest without any planning or purpose.

The outcome is that they redeem their investments at the first sign of trouble.

Having definite goals keeps the investor anchored.

If you are investing for your retirement, it doesn't matter if your investments are down 20 per cent today.

So, figure out your short-, medium- and long-term financial goals and build appropriate portfolios for each of them.

Systematic investment plans (SIPs) are a good way to invest for most people who earn a monthly salary.

Save monthly and invest monthly. SIPs also help average out the cost of purchase and make market fluctuations work in your favour.

If you have a lump sum to invest, put all of it in a liquid fund and then do a systematic transfer into equity funds over 6-12 months.

This will protect you from getting unlucky with the entry price.

Again, the idea is to average out and not pick the best entry price. No one can time their entry to perfection.

Ignore volatility

Once you have invested according to your risk profile and goals, there is nothing else left to do.

You can't predict when the markets will go up or down.

No one can -- not consistently anyway. Investing according to your risk profile will help you stay put when the markets go down, which they inevitably will.

Investing according to goals will give you the peace of mind that you are not investing in an ad-hoc way but are actually making progress towards your financial goals.

If market volatility worries you, that means you have invested in equities beyond your risk appetite.

Accept that you have a lower risk profile than you originally thought and reduce your equity allocation to the point where you are able to sleep soundly.

When the markets go up, do not make the mistake of increasing your equity allocation beyond the level you originally decided upon.

In fact, during market rallies, you should book profits regularly to bring the allocation back to the original level.

If you do not do so, you will find yourself in deep trouble when the markets go down, as will inevitably happen.

Should you try to profit from volatility?

What if you are the news-tracking, Buffett-worshipping, confident types? Should you invest more during times of volatility? Not beyond your usual SIPs.

First, you should not have any left-over money to invest more (than your usual ongoing SIPs).

All your money should have been allocated towards achieving your goals rather than trying to time the market.

It may work out once or twice. But as a strategy, not being invested fully in order to time the market is not a very reliable one.

You may in fact lose out on returns if you stay out.

Second, even if you manage to, you will most probably invest too soon.

Most investors who maintain some dry powder to invest more end up investing it within a 5-10 per cent fall of their favourite stock or the market.

So, the advantage you will ultimately get will be quite limited. The time, energy and opportunity cost of keeping that money aside and analysing the right moment to invest is not going to be worth the trouble.

Ideally, volatility should be seen as neither a threat nor as an opportunity.

It should just be ignored. Invest according to your plan and then stay the course until you reach your goal.

Ankur Choudhary is co-founder and chief investment officer, Goalwise.com

© 2025

© 2025