The Budget has changed the rules for Indian citizens and persons of Indian origin visiting India.

Instead of 182 days, the number of days has been reduced to 120.

You will be treated as a resident of India for tax purposes if you stay in the country for more than 120 days in a financial year and 365 days in the past four years.

One consequence of the change will be that people of Indian origin who reside outside India will be able to spend a smaller number of days in the country if they wish to keep their non-resident status intact, points out Sanjay Kumar Singh.

In Budget 2020, the residency rules that determine how a person's income is taxed, were changed.

Experts say that it has become very crucial for a person who spends a limited amount of time in India to keep track of how many days he has been residing in the country.

If he fails to do so, and does not comply with the tax-filing provisions, he could fall foul of the income tax authorities.

Change in the 182-day rule

Residency rules determine how a person is taxed.

And residency depends on the number of days that a person is physically present in India.

Those who are non-residents, and those who are resident-not-ordinarily-resident (RNOR) are liable for taxation only on their India-sourced income (or income that arises in India).

On the other hand, once a person becomes resident-ordinarily-resident (ROR), he becomes liable for taxation on his global income as well.

A person is considered to be a resident of India if he stays in the country for 182 days or more, or if he stays in India for 60 days in one year and cumulatively for 365 days in the past four years.

If a person fulfils either of these two conditions, he is considered a resident of India.

And if he does not fulfil both these conditions, he is considered a non-resident.

In the case of Indian citizens who leave India for the purpose of employment, only the 182-day condition applies.

They are not tested on the 60-cum-365-day criterion.

The same holds true for Indian citizens and persons of Indian origin settled outside India when they visit the country.

They, too, are tested only on the 182-day condition.

The Budget changed the rules for Indian citizens and persons of Indian origin visiting India.

Instead of 182 days, the number of days has been reduced to 120.

You will be treated as a resident of India for tax purposes if you stay in the country for more than 120 days in a financial year and 365 days in the past four years.

One consequence of the change will be that people of Indian origin who reside outside India will be able to spend a smaller number of days in the country if they wish to keep their non-resident status intact.

Experts say the change was made because the government felt that people were misusing the 182-day provision to manage their residency.

In last year's income-tax forms, the tax authorities had introduced a column.

Persons of Indian origin, who are non-resident, have to mention their number of days in India.

The immigration department also captures this information.

"The details that you file in your income tax form about your stay in India could be validated against the information available with the Immigration authorities, hence make sure that you make the correct disclosure," says Kuldip Kumar, partner and leader, personal tax, PwC India.

The 730-day clause removed

Based on the above mentioned two conditions, a person could be deemed a resident of India.

He is deemed to be RNOR if he fulfils either of two criteria: During the past seven financial years, he should have stayed in India for less than 730 days, or he should have been a non-resident in nine out of the past 10 years.

Now, the 730-day criterion has been removed altogether.

A person will now become RNOR if he has been non-resident in India in seven out of the past 10 years.

This change will have an impact on expatriates who come to work in India.

Earlier, they used to become resident ordinarily resident (ROR) in the third or fourth year.

Now they will become ROR only in the fifth year, which means that they will get an extra year before their global income is taxed in India.

"The government has relaxed the rules for expatriates," says Rupali Singhania, Partner, Areete Consultants LLP.

Concept of deemed residency introduced

For the first time, the Indian government has introduced the concept of deemed residency.

If a person is not liable to pay tax in any overseas jurisdiction by virtue of his domicile or residence, then he will be considered a deemed resident of India.

Suppose that a person goes to work in the UAE.

He has stayed in India for less than 182 days that year.

He becomes a non-resident in India and a resident in UAE.

But UAE does not levy personal income tax on residents.

By virtue of the deeming provision, such a person will be considered a resident of India.

A large number of families from India go to work in UAE.

They would have become liable to pay tax in India on their global income.

After there was a hue and cry, the government issued the clarification that it does not intend to tax such people on their overseas income.

The details of how the new deeming provision will work have not yet been provided.

The impact

Many people who run businesses that span multiple geographies tend to spend a lot of time outside the country.

They could become non-resident because of the change of rule from 182 days to 120.

Persons going out of the country on work assignments will need to plan their schedules better to deal with this change of criterion.

Many NRIs, especially older ones, who live in parts of Europe or America that tend to have very harsh winters, spend almost half the year in India.

Such people will have to reduce the amount of time they spend in the country if they wish to retain their non-resident status for tax purposes.

When a person's status changes from non-resident to resident, then besides the change in the way he is taxed, he also has to make changes to his finances.

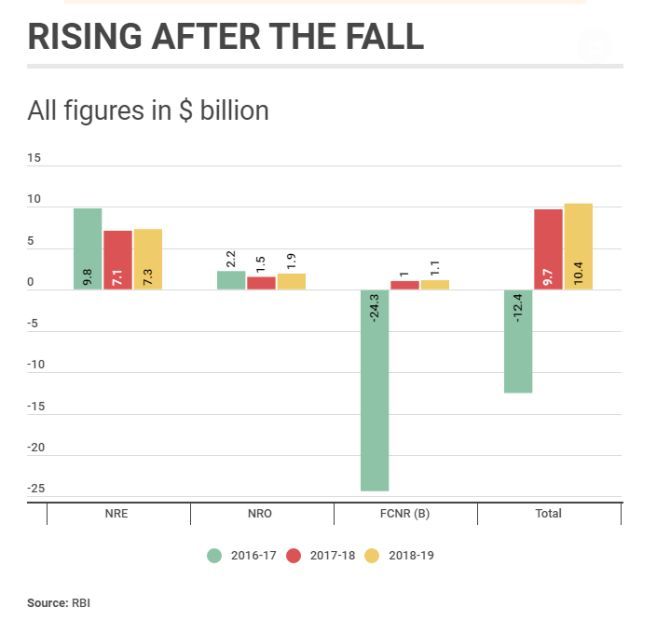

"Interest income on NRE (non-resident external) and FCNR (foreign currency non-resident) accounts, which are tax free when you are a non-resident, will become taxable once your status changes to resident," says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

You also have to convert these accounts into resident accounts.

Some financial products, which are not accessible to non-residents, become available, such as the 7.75 per cent Savings (Taxable) Bonds from the Reserve Bank of India.

In case of Public Provident Fund (PPF), persons who become non-resident can continue to hold their accounts for 15 years, but they cannot extend them.

They will be able to do so once they become residents.

The income-tax rate applicable could work either to a person's advantage or disadvantage, depending on the country that he lived in as a non-resident.

"In the Middle East, there is no taxation, so tax rates in India will be higher for such a person. On the other hand, certain countries in Europe have even higher tax rates than in India, so the rates prevailing in India will appear more attractive to such a person," says Dhawan.

- Non-residents are taxed in India only on their India-sourced income, not on their global income

- For those coming to India, RNOR is a midway stage between being non-resident and resident

- In this stage, RNORs are taxed on their India-sourced income but not on their global income

- Once you become ordinarily resident, you are taxed on both your India-sourced income and global income

- Resident Indians also have to report their foreign assets, like bank accounts and properties, when filing their income-tax return

© 2025

© 2025