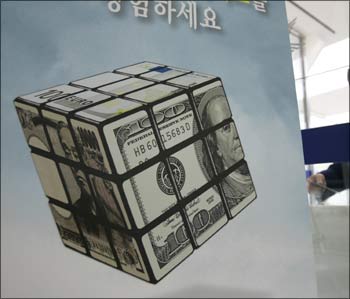

Given their stability, the rupee and the renminbi (Chinese currency) -- when made convertible -- could well emerge as substitute currencies which countries will hold their reserves, stated Raghuram Rajan, Economic Advisor to the Prime Minister and Professor of Finance at the Chicago Graduate School of Business, on Wednesday.

Commenting on a single currency for better returns vis-a-vis the US dollar, Rajan said, "My sense is that the next international currency would be the renminbi, when they allow it to be convertible and down the line. I think the rupee will join the basket of international reserve currencies when we allow full convertibility and so on."

India, China and Russia have at the G8 Summit suggested that the global economy has for too long been too dependent on the dollar and called for changes in how $6.5 trillion in foreign-exchange reserves are managed. At the G-8 Summit in Italy, China asked for a debate on a coming up with a new global reserve currency.

And although this was ignored, the fact remains that with enormous foreign exchange reserves, China India, and Russia do pull a lot of weight in the global economy today. The weakness of the dollar has added to this pressure significantly.

The author of the latest report on financial sector reforms said that India was poised delicately for growth; but the big question was whether or not we regain the same level of growth and consumption.

He said that the Reserve Bank of India should distance itself further from the government to preserve its credibility at a time when the Centre was rapidly borrowing to fund deficit.

Rajan said if the money raised by the government was not spent, it could result in inflationary pressures, pushing up real interest rates. The problem could get aggravated if foreign capital flows rose, said Rajan, who was in Mumbai to deliver a lecture.

He suggested that RBI should be relieved from the role of being the government's debt manager and have a clear focus on inflation.

"The rationale for guiding the government to manage its own debt as opposed to having it lie with RBI is that in that situation RBI is not pressured into buying debt because it is the debt manager. To my mind, this is one of the reasons why it makes sense to separate these two offices," he said.

Maintaining that there was not too much room for further monetary and fiscal policy accommodation, Rajan elaborated on the rationale for RBI to focus on inflation.

He said it would not in any way result in diluting the central bank's mandate of managing interest rates. It would only mean that the focus would automatically ensure low interest rates, which in turn was a necessary ingredient for growth, he said.

"A more formal monetary policy committee structure should be set up with technical experts and former governors of RBI to broadbase the process of determining interest rates," he said.

The former International Monetary Fund Chief Economist also said that banks should float convertible debentures for managing the crisis instead of maintaining buffer capital. While delivering a lecture on 'Financial Sector Regulation in Light of the Crisis', Rajan said buffer capital was often a burden on equity and was also expensive.

"Raising capital in good times and reducing it when times are bad is not easy. Therefore, banks can float contingent capital in the form of convertible debentures which could be converted into equity only when they need capital. Managing debt is cheaper than equity," he said.

In a report on the financial sector, G8 had recommended that banks maintain higher capital in good times to be used during the bad times.

He also said that new markets and instruments should be developed to reduce over-dependence on the banking system. These would also act as shock absorbers for diversifying risks.

Greater foreign and domestic institutional participation in the corporate bond market and securitisation facilities of the receivables of finance companies could go a long way in this regard, Rajan said. "The lesson from the (credit) crisis is not that we should stop having markets. Conservatism is good but at some point in time one should trade off between risks and conservatism for growth or otherwise the policies will be questionable," Rajan said.

Insurance and pension funds were not at all used for the corporate bond market, he said. At the same time, funds were a constraint for infrastructure development, he added.

Rajan pointed out that India Infrastructure Finance Company borrowed from banks and on-lends to banks. Instead, he said, markets should be developed for infrastructure companies to source finance from households.

He reiterated his earlier recommendation that India should create a statutory body called the Financial Sector Oversight Agency comprising chiefs of regulatory bodies that would be answerable to a council headed by the finance minister.