| « Back to article | Print this article |

Why markets are conversations

The Market is a good that's become a God, and that's the problem. ---- David Jenkins, former Bishop of Durham

After going walkabout on Wall Street I plunged back in time to the cradles of civilization, before the earliest forms of buying and selling. This helped me to distinguish bazaars from the market.

In some form or other bazaars have been with us for at least 5,000 years -- as gathering places for many different kinds of communication and exchange where value is expressed in multiple languages.

By contrast the market is a relatively recent human construct that has sometimes been compared to a computer -- a self--regulating machine that can itself ensure the equilibrium of economic activities.

This assumption may not have been vaporized by the financial meltdown of 2008 but it is more discredited than ever before. Public clamour for closer, more sophisticated regulation has a new sharpness.

**********

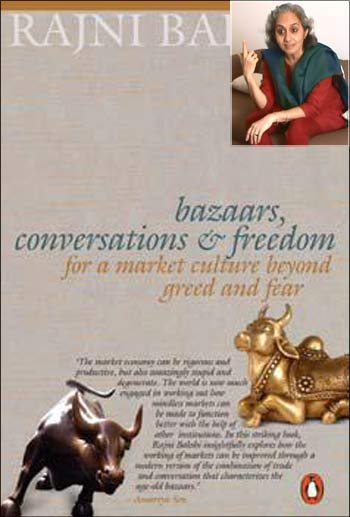

Excerpted with the permission of Penguin Books India from Bazaars, Conversations and Freedom: For a Market Culture Beyond Greed and Fear by Rajni Bakshi, Penguin, Rs 450.

Why markets are conversations

But the real story of our times is taking shape in the innards of what can be visualized as the global agora. This is a vast, interlinked realm of businesspeople, activists, crafts--persons, software backers and academics fostering bazaar spaces where exchange of goods and services comes second to the need to gather.

For exchange of values, reflections about purpose and that most basic question of all: how should one live?

Sometime in 2003 a retired American admiral, John Poindexter of the Iran-Contra scandal fame, masterminded a futures market in terrorism. This was to be a mechanism through which a wide range of experts could bid on a prediction, for example, that bomb blasts would occur at a particular location. Individual trades were to be kept down to about $100.

When word of this scheme reached Capitol Hill there was outrage across party lines. The idea of a betting parlour on atrocities and terrorism was variously denounced by Senators as 'ridiculous', 'stupid', 'grotesque' and 'sick'.

For the promoters of the scheme, at the Pentagon's Defense Advanced Research Projects Agency, it was simply an efficient way to aggregate intelligence information. The scheme was called Futures Markets Applied to Prediction.

Why markets are conversations

'What's wrong with a trading floor for ideas which makes it possible to capture people's collective wisdom in a given area, even if it is terrorism' asked one of its designers? 'Using such a mechanism will work,' argued another Pentagon expert, 'because markets bring together people with information in a way that blue--ribbon panels of experts just cannot.'

None of these justifications sounded convincing to the Senators and Congressmen. The plan for terrorism futures was killed within days of it becoming public.

Why? Firstly, as one Senator said, because it would be like trading in death. It's a gross misapplication of the market mechanism. What if traders start investing in a way that might actually bring about a particular terrorist strike?

Secondly, markets can go horribly wrong in aggregating information and are known to foster delusions.

At that time, a report in Wired illustrated this point by reminding people that the idea of terrorism futures was particularly odd after the lessons of the dot--com bust in which many flimsy firms had boasted 'muscle--bound stock prices'.

And yet all this reasoning was merely a thin layer on the surface of public life. The Pentagon's scheme seemed to stir a still darker doubt. Has faith in the market gone too gar, become somewhat messianic?

Why markets are conversations

The historian Steve Fraser saw the whole episode as a classic example of what he called 'the Wall Streeting of the American mind.'

From this perspective, the market was seen not merely as the most efficient processor of information but as the supreme conveyer of truth and thus the most reliable basis for organizing not only economic but also social life.

In the 1990s this view became not only the dominant view of reality but an orthodoxy which held societies across the world in thrall. However, disquiet continued to simmer just below the surface. That outrage on Capitol Hill was a rather weak signal of unrest.

Far more creative and robust challenges were being incubated beyond the reach of either state power or money power. For instance, cyber--age iconoclasts pointed out that the Internet would certainly end business as usual -- but not in ways that dot--com boomers imagined.

Doc Searls, the editor of the Linux Journal, liked to explain why by telling this story about a European tourist at a traditional village bazaar in West Africa.

Why markets are conversations

Wandering through the jumble of stalls the tourist was struck by a particular carpet. With the help of his local friend, an Irish missionary, the visitor asked the merchant for the price of the carpet. Hearing the price, the would-be buyer said, 'That's too much', and walked away.

'You've just offended that merchant,' the missionary gently informed his friend. Immediately, the apologetic tourist turned back and offered to buy the rug at the stated price.

'Wrong again,' said the missionary, 'offering to pay full price is as insulting as refusing to discuss the value of the rug. Why don't you say what you think the rug is worth?'

The tourist made an offer. Finally, here was the conversation that the merchant expected as an essential prerequisite for any sale.

The ensuing exchange of ideas and information left the visitor better informed about the rug and threw up a price that both buyer and seller agreed was fair.

Why markets are conversations

Searls enjoys telling this story because it illustrates two elementary truths.

One, that markets are conversations, not merely devices for aggregating information. And, two, that value is not the same as price. All value is discovered inside a conversation and price is just one aspect of 'what's it worth to you'.

A conversation happens when neither side has the power to dictate a price and walk away. It also has more scope for drawing in questions about purpose and meaning -- stuff that is beyond the immediate and momentary transaction.

For almost four millennia bazaars were the seat of such conversation where open exchange of ideas came first, followed closely by exchange of goods and services.

How did these multi-dimensional marketplaces, bazaars, morph into 'the market' -- an idea and a set of assumptions which now rules our lives and has rendered much of society into a veritable auction block?

Perhaps the problem began with the birth of mass production and mass markets, about two centuries ago. As direct face--to--face exchange became rare businesses began to act as though markets are made up of demographic sectors not human beings.

Why markets are conversations

This is the premise around which Searls and his buddies crafted their rebellious Cluetrain Manifesto in the late 1990s. The ninety--five point Manifesto, which started as a web--based conversation, argued that the twenty--first century's agora, the Internet, can bring the human voice back into markets.

The World Wide Web is the latest form of an ancient phenomenon -- the need to gather. From the Americas to Mesopotamia, Africa to the far corners of Asia, people first came together by a stream or under a sacred tree not to buy and sell but just to be together.

They assembled to celebrate, gossip, play games and also to settle disputes dissolving tensions triggered by anger, fear, suspicion or greed. It was around these community gatherings -- somewhat like that summertime hub that Henry Hudson stumbled upon at Menatay -- that the earliest buying and selling took place around 5,000 years ago.

In India the choupal, survives as a traditional forum of the village community. Often located at a chouraha, an intersection at which paths from the four directions converge, the choupal has been both a physical and mental space for gossip and politics, even though everyone may not get an equal say.

A few centuries before the birth of Christ, the Athenians developed the agora as a place for palaver, long parley or conversation, which doubled as a location for exchanging goods and services. With some variations this pattern repeated itself across the ancient world.

Why markets are conversations

From Persia to India, marketplaces came to be known as 'bazaar', derived from the Pahlavi term vicar or baha--char, meaning 'the place of prices'. And yet, the bazaar was as much a place for social connectedness as for striking a deal and determining the 'price'. 'Since no man is an island in the market,' said a Medieval European proverb, 'one must not only think of oneself but of other people too.'

On the Internet, chatting and grouping -- for the sake of knowledge, reflection, political mobilization or plain gossip -- are once again ahead of exchanging goods and services. This does not mean that buying and selling are lowly or that commerce is less important. 'Don't worry, you can still make money,' the Cluetrain team assured old--style companies, 'as long as it's not the only thing on your mind.'

That's not merely because more and more people can now talk to each other directly and have limitless access to information with a few clicks. The core trait of the Internet is that it grows our hunger for democratic bazaar spaces which, like the World Wide Web itself, are not owned by anyone, open to everyone and can be improved by all.

Isn't that just what a free market does? Yes and no. Freedom of movement and exchange in marketplaces which are the true commons might do that.

But the idea and practice of the market, over the last two hundred years, has been about much more than just this simple freedom of exchange. It is loaded with a heavy baggage of assumptions about human nature and market dynamics which masquerade as laws.

Why markets are conversations

For most of the twentieth century a free market could easily be equated with freedom because its opposite was the state--dominated economy of the communist kind.

That dichotomy, always a false one, has now faded into history. Details of that process, one of the most well--documented stories of our times, would be out of place here. And yet we need to map the historical context, the backdrop of ideas for the onward journey.

The defining moment for our purposes is not, as you might expect, the pulling down of the Berlin Wall but a juncture in the 1940s.

**********

Excerpted with the permission of Penguin Books India from Bazaars, Conversations and Freedom: For a Market Culture Beyond Greed and Fear by Rajni Bakshi, Penguin, Rs 450.