The world press seems to be suffering withdrawal symptoms due to the recent absence / paucity of strong negative financial news. What else would explain the panicky histrionics following Dubai's announcement that it is seeking to restructure payment on $59 billion in debt?

If markets and market commentators are to be believed, the end of the world is near!

"Let's bring a little perspective to the situation here," said an economist attached to a fund management company domiciled in the Dubai International Financial Centre, or DIFC, which aims to become the Arabian Gulf's and the Middle East's financial hub.

Click on NEXT to read further. . .

"How can seeking a standstill agreement be construed as default? (Government-owned conglomerate) Dubai World has not intimated that it is going to default on paying back the $59 billion; it just wants a six-month window to restructure the entire debt package, during which it is requesting that its lenders hold off on demanding the interest payments due, which are less than $1 billion."

Most pundits at the DIFC are derisive of the market's reaction to the Dubai World announcement. The conglomerate, which has interests spanning the global ports and property sectors as well as investments in hospitality and retail worldwide, owes lenders $59 billion, compared to Lehman Brothers' exposure of more than $1 trillion when it collapsed.

When US mortgage lenders Fannie Mae and Freddie Mac were rescued, they were guaranteeing over $5 trillion in mortgages. When insurer American International Group was rescued, it had over $200 billion in credit default swap, or CDS, exposure.

Citigroup and Bank of America Corp too had hundreds of billions of dollars in potential exposure. The bailouts by the US government, funded primarily by the taxpayer, ran into trillions of dollars added to the national debt.

These were, however, privately owned entities. The fear generated by Dubai's announcement is that it could become the first in a new wave of defaults -- this time from the sovereign sector. This argument too seems to be invalid, because Iceland has already started that particular ball rolling, and the global markets have risen above that.

Besides, Dubai is not, per se, a sovereign state. It is part of a federation, and, at the federal level, economic growth continues from record oil income.

The other fear is that a potential default by Dubai government-owned companies would put a dent in the balance sheets of its Western lenders. Goldman Sachs squashed that one when it released a report on Thursday (November 26, 2009) in which it estimated potential credit losses to HSBC and Standard Chartered at $611 million and $177 million, respectively, or 4.6 and 3.9 per cent of estimated 2010 net profit after tax and 0.5 and 0.6 of estimated 2010 equity. No more than a drop in the Arabian Gulf.

So widespread was the panic that the chairman of the Dubai Government's Supreme Fiscal Committee, Sheikh Ahmed bin Saeed Al Maktoum, a member of the ruling family who also heads the airline Emirates, was forced to issue a statement saying: "Like most global cities, Dubai has experienced its share of economic and social challenges in this global downturn. No market is immune from economic issues."

Referring to Dubai World's request for a standstill on debt repayment until May 30, 2010, Sheikh Ahmed said: "This is a sensible business decision."

Not all roses

This does not imply that Dubai's cash-flow problems do not exist, or are not significant. The emirate's finances were thrown into disarray when the economic crisis -- which had its roots in the credit crunch that came from a mortgage meltdown in the United States -- finally caught up with its ambitious plans and threw its property and construction sectors into a maelstrom.

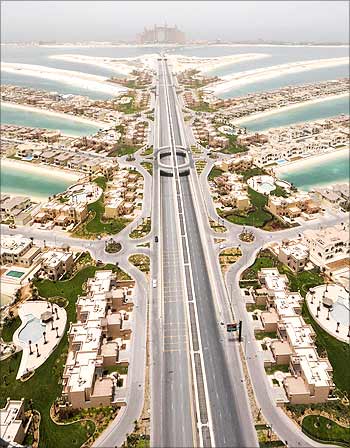

Using high levels of leverage, Dubai-based companies such as Emaar Properties, DP World and Leisurecorp expanded across the world at breathtaking speed. Global lenders were falling over themselves to finance this expansion spree, until the economic crisis hit the revenues of every single corporation in the world.

Dubai's real estate prices have dropped by more than 60 per cent across the board in the city that once boasted the presence of 23 per cent of the world's construction cranes.

Today, most projects that were announced two to four years ago have been either put on hold or cancelled. The income from these projects has been lost to the Dubai gross domestic product, or GDP, which has seen growth shrink from 16 per cent in 2006 to about 12 per cent in 2007. In a country where official data is difficult to obtain, the numbers for 2008 and 2009 are unavailable.

However, Standard Chartered said in September that it expects the United Arab Emirates economy to grow 0.5 per cent this year. UAE Economy Minister Sultan bin Saeed Al Mansouri said key indicators show that economic growth will be back on track by the last quarter of 2009 and start of 2010.

The International Monetary Fund forecast in May that full-year economic growth in the Middle East would halve in 2009 and that the UAE's economy would contract by 0.6 per cent. But HSBC and Standard Chartered both predict the nation's economy to end the year showing positive growth.

The UAE economy expanded by 7.4 per cent last year as record oil prices helped boost government income, and the outlook for 2010 is positive. Dubai has been hard hit during the ongoing global credit crisis as the property market underwent a correction and oil prices fell from their $147 a barrel peak.

But there are signs of an economic recovery as reflected by a rise in bond prices, said Shayne Nelson, Standard Chartered's chief executive for the Middle East and Africa.

The British lender remains positive about the medium-term economic outlook for the emirate and believes the risk appetite for the Gulf region's bond market improving. "We remain pretty optimistic about the medium term, albeit there is some short-term pain the emirate has to go through," Nelson said.

All eyes are now on the UAE federal government, which is expected to come to the aid of the ailing Dubai economy, again. The UAE Central Bank has already subscribed to $10 billion of a 4 per cent $20 billion bond issue earlier this year.

Last week, Abu Dhabi-based banks took up another $5 billion of the same issue. Another $5 billion is yet to be placed. Abu Dhabi, the capital city of the UAE, has the fifth-largest proven crude reserves in the oil-exporting Arabian Gulf region.

Dubai World needs to make a payment of about $5 billion in early December, which may be covered by last week's placement of the five-year bond tranche. Another $5 billion payment comes due within a month.