| « Back to article | Print this article |

FMCG industry buries recession in fairness cream

As the global economic crisis consumed nearly every sphere of business, one industry held out against recession through 2009 by promising to help Indians look fairer, younger and their teeth whiter, kids stronger and taller, and toilets cleaner.

Looks-conscious consumers propped up sales of FMCG (fast moving consumer goods) companies, which in turn rewarded loyalty by not raising prices of fairness, anti-ageing creams, bathing bars and their likes, although input costs rose in an economy ravaged by drought and then floods. Instead, they downsized the packaging to balance costs and margins.

"The sector has coped well with recent challenges and grew by 15 per cent over the last year," says FICCI (Federation of Indian Chambers of Commerce and Industry). The FMCG market in the country is worth $25 billion (Rs 1,20,000 crore or Rs 1,200 billion).

Year 2009 also saw modern retail format stores and aggressive marketing helping home-grown FMCG firms wrest market share from leader Hindustan Unilever Ltd (HUL), according to market research firm AC Nielsen.

HUL's share in the estimated Rs 8,000 crore (Rs 80 billion) personal care market fell to 44.5 per cent from about half last year, as others like ITC, Godrej and Wipro fought for space in markets like Uttar Pradesh, Bihar and Gujarat with a rural push, says AC Nielsen.

FMCG industry buries recession in fairness cream

Mergers and acquisitions were few and far during the year, and Wipro's Rs 210 crore (Rs 2.10 billion) acquisition of UK-based Yardley's overseas operations was a highlight.

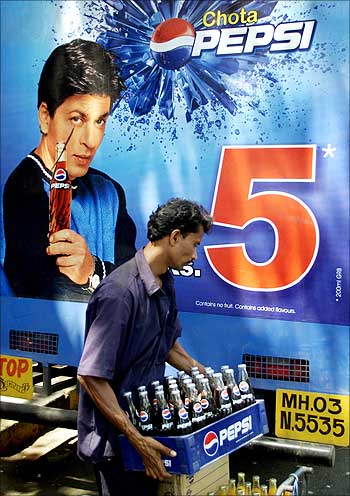

As for foods and beverages, the Indian market proved to be the growth driver for world's biggest players like Coca-Cola and PepsiCo, even as their US parents grappled with falling sales.

PepsiCo's optimism in the Indian market was reflected when the global major held its board meeting in the country for the first time this year. The company has stepped up investments by another $100 million, from the $500 million announced last year for the next three years.

Meanwhile, surging input costs remained a pain area this year for the foods and beverages segment, mainly on account of soaring sugar prices which doubled to almost Rs 40 a kg in the national capital in a year.

Companies like PepsiCo, Britannia, ITC and Parle seriously mulled increasing prices of products to mitigate the rising costs, but held back.

FMCG industry buries recession in fairness cream

Elsewhere, Dabur and Emami completed consolidation and restructuring post their respective acquisitions last year of Fem Care and Zandu Pharmaceuticals.

While Wipro went premium with Yardley, FMCG firms went in for big push in rural areas, upbeat on the government's thrust on agriculture and increase in allocation for rural jobs.

HUL was also seen experimenting new measures to retain leadership position. It blocked whole-day TV air-time on Star and Zee, besides relaunching its skin cleansing portfolio that included products like Lux, Liril and Breeze. It also pulled down price points to attract the mass market.

Overall, the prospects of the FMCG sector remain good.

According to FICCI, the sector has grown consistently during the last three to four years and is expected to grow at 12-15 per cent over the next three to four years.