| « Back to article | Print this article |

What you did not know about Wipro

After being venerated as an IT czar, Wipro is slowly but surely gaining ground in the FMCG space, its original thrust area.

You will find it hard to find a name more venerated than Wipro in information technology.

It runs 54 development centres across the globe, and is the world's largest independent provider of research & development services.

It was the first information technology services company to use Six Sigma, has over 95,000 people on its rolls, and is the second-largest player in the domestic space. No small achievement.

What is not so well-known, possibly because of the scale and size of its information technology business, is that Wipro is the third-largest Indian-owned fast-moving consumer goods company after Nirma and Dabur -- Wipro Consumer Care and Lighting, the FMCG and lighting products arm of the company, will likely end 2009-10 with sales revenue of Rs 2,500 crore (Rs 25 billion).

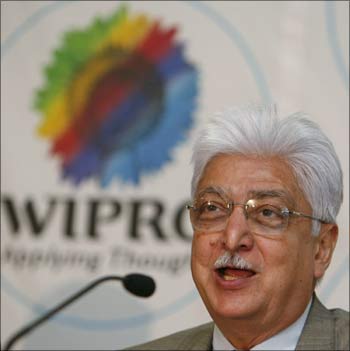

FMCG, to be sure, has been in Wipro's DNA from day one. It began life as Western India Vegetable Products Company in 1945 to make edible oils and soap. Information technology got added to its portfolio only in 1991, a full 23 years after Azim Premji took over the reins of the company.

Its FMCG portfolio comprises personal care and skincare products. It also has a lighting products and furniture business. It has done several acquisitions to grow the business. Wipro owns brands like Santoor, Chandrika, Glucovita and Yardley (in some geographies of the world). Close to nine per cent of its turnover comes from these non-information technology businesses.

Why FMCG?

The question that begs an answer here is, why FMCG? Information technology and FMCG are as different as cheese and chalk -- information technology does not have retail buyers, does not require a long supply chain and advertising support.

Success in the former gives no guarantee for success in the other. And the FMCG market is crowded. There are multinational corporations like Hindustan Unilever, Procter & Gamble, Nestle and Colgate-Palmolive as well as homespun street fighters like Dabur, Marico, Godrej and Emami.

Moreover, the profit margins in FMCG are thinner. For Wipro, the operating margins are 21 per cent in information technology but only 12.5 per cent in consumer care and lighting. (Investment analysts have calculated the return on capital employed for Wipro Consumer Care at 48 per cent.) Click NEXT to read further. . .

What you did not know about Wipro

Sector experts say there could be two reasons. One, FMCG can be a hedge against any downturn in information technology.

For long, Wipro and others have depended on overseas corporations for business.

These customers can slash their information technology budgets at the first sign of nervousness.

That's why all big names in the business have turned to the domestic market in the last one or two years. FMCG, on the other hand, is stable. No matter what, people will never cease to buy soap, skincare products and so on, though they might down-trade in a slowdown and settle for cheaper brands.

There is also evidence that as Indians get richer, and more and more people sail past the poverty line, the demand for FMCG will grow.

According to a recent McKinsey report, the number of households in the deprived segment is likely to drop from 101 million in 2005 to 74 million in 2015.

That means 27 million households will have entered the market in the ten years to 2015 -- the size of many a mid-size country's population.

AC Nielsen too estimates that India is amongst the fastest-growing FMCG markets in the world, with annual growth of 16 per cent in the non-food segment. Naturally, the consumer goods industry is poised for great leaps and Wipro wants a piece of this action.

What you did not know about Wipro

Two, FMCG gives Wipro the space to build assets in the form of brands. Wipro has spent large sums of money to put together a brand portfolio. In 2003, it acquired Glucovita from Hindustan Unilever for about Rs 5 crore (Rs 50 million).

The next year it bought ayurvedic soap brand Chandrika for Rs 31 crore (Rs 310 million). Then, in May 2006, it acquired North West Switches for Rs 102 crore (Rs 1.02 billion).

The big move came in 2007 when Wipro forked out Rs 1,000 crore (Rs 10 billion) for Singapore-based personal care maker Unza Holdings.

And earlier this year, it snapped up Yardley from the UK-based Lornamead Group for Rs 210 crore (Rs 2.1 billion) for Asia, Asia-Pacific and North Africa.

Conversely, KPMG analyst Anand Ramanathan says the high brand recall of Wipro in information technology will have a positive rub-off on its FMCG business.

"A lot of operational synergies can be achieved through the proper use of information technology. This gives Wipro advantages in its supply chain management, which help enhance its margins and improve the cost structure."

At the moment, Wipro seems to be outperforming its FMCG rivals.

"The industry is growing at the rate of 16 to 17 per cent (per annum), while we are growing at almost 30 per cent," says Wipro Consumer Care and Lighting president Vineet Agrawal. At present, almost half the company's top-line comes from Santoor and Chandrika, the two soap brands.

Another Rs 800 crore (Rs 8 billion) comes from Unza, while the rest is brought in by Wipro's lighting and furniture business.

Value for money

So far, Wipro's strategy has focused on the bottom of the pyramid. Santoor has grown at 29 per cent per annum for the last three years. (Chandrika has grown 18 per cent.)

It is the third-largest brand in the Rs 7,500-crore (Rs 75-billion) market after Hindustan Unilever's Lifebuoy and Lux. It leads the pack in the southern market. More than half of its sale volumes come from the rural markets.

What you did not know about Wipro

Wipro, in fact, realised the worth of the rural markets pretty early. As early as the 1990s, it had introduced small 50-gram packs that were priced at Rs 5.

The contours of the soap market began to change in the slowdown that happened some ten years ago. There was a global meltdown as the dotcom bubble went bust and the stock markets tanked.

For the first time perhaps, consumers began to down-trade heavily on FMCG products. Brands that were competitively priced were in great demand. This worked in favour of brands like Santoor.

To this day, Santoor continues to have value packs priced at Rs 6 and Rs 10.

The early-mover advantage has helped Wipro spread its reach across 1.3 million outlets in the country.

Rough estimates suggest there are about 6 million grocery stores in the country. So, Santoor reaches over 20 per cent of the sale points. The gaps are in the north.

Though Santoor lords over 21 per cent of the rural market in the south, it has not really set the northern states on fire.

"We just got better-accepted in the south because we had a better distribution sense there," claims Agarwal. Wipro Vice-President (sales and marketing) Anil Chugh feels that the demand for sub-popular soaps is stronger in the north where Wipro has no product.

Meanwhile, 56 per cent of consumers go for popular soap brands in south India. "Naturally, that makes for a bigger play for us," he says.

Launched in 1984, Santoor was first positioned as the soap with 'natural ingredients' in a market that was already overcrowded with several brands, many of which were positioned along similar lines.

Keen to make its mark, Wipro conducted an extensive study after which it positioned itself as the soap for 'younger-looking skin'.

It has since stuck to that ground. "To beat competition we had to ensure that our communication was effective," says Chugh.

What you did not know about Wipro

Better spread

This is not to say that Wipro has pushed the upper end of the market out of its strategic vision. It has launched variants of Santoor like Santoor White and Santoor Glycerine that cost approximately Rs 20 for 75 grams, and has extended the brand to emerging categories like hand wash and face wash.

And now Wipro hopes to cater to the premium segment with its range of Yardley products including body sprays, soaps, talcum powder and other toiletries.

While Santoor costs approximately Rs 18 for 100 grams, Yardley will be priced at Rs 40 for a similar pack. In talcum powder, Yardley will be priced at Rs 60, while other brands cost approximately Rs 35.

As for distribution, Yardley will be sold across cosmetic counters and modern trade. "Historically, Yardley has been an exclusive brand that has come to consumers through the grey channel. We are going to unlock its latent brand equity in the country," says Agarwal.

This acquisition, he hopes, will help the company do business worth $30 million in the West Asian market where the beauty and wellness industry is booming.

Wipro needs to strengthen Yardley's distribution network. India accounts for only 20 per cent of Yardley's revenues. The plan is to increase its presence from 20,000 stores to over 50,000.

Analysts observe that Yardley will work for Wipro if the former's profit margins are preserved. While Yardley's revenue growth rates hover between 20 and 25 per cent, Agrawal notes that its gross margins are good and won't lessen Wipro's 13 per cent operating margin. Agrawal is confident that maintaining manufacturing efficiencies will safeguard margins.

For now, Wipro will opt for a mix of outsourcing (which Yardley currently does) and manufacturing some products in-house.

With Unza, Wipro has gained instant access to China and markets in southeast Asia such as Indonesia, Vietnam and Malaysia. Unza is southeast Asia's largest maker of personal care products.

Wipro forked out 1.5 times the revenues to buy Unza. The gamble seems to have paid off. It has seen volume growth of 13 per cent this year. "The acquisition gives Wipro access to target segments that are richer, and also access to related extensions beyond the soap category," says KPMG's Ramanathan.

On the flip side, Unza brands such as Enchanteur and Romano have seen limited success in India.

"We had launched it in modern trade but at that time there was a churn and our plans were derailed. But now that modern trade is back on track, we expect things to look up," says Agarwal. Accordingly, Yardley and the Unza range will be restricted to the top 100 towns to begin with.

Rivals say building Unza brands from scratch will be an uphill task for Agarwal and his team. So, Unza may give Wipro limited leverage in the Indian market.

But Unza will come in handy in another way. It will promote Wipro's consumer products globally, with special thrust on Santoor.

It will use Unza's expertise in selling through big retail chains like Carrefour and Walmart. In acquiring Unza, Wipro outbid large companies like Dabur, Emami, Godrej, Unilever, Colgate Palmolive and Sara Lee. It will thus make every effort to maximise its advantage from the purchase.

Some rivals are still to be convinced of the Wipro strategy -- products at different price points, brand acquisitions and global spread.

The product categories it has chosen, they say, are those in which multinational corporations have a strong presence. They are doubtful if Wipro can match their firepower.

(The norm in FMCG is to spend 13 to 14 per cent of a brand's turnover in advertising.) Indian FMCG players like Marico, Dabur and Bajaj Consumer Products have focused their energies in categories like hair oil, digestive candies and so on, in which multinational corporations do not have much interest.

These are uniquely Indian categories which do not fit into their global strategies. Wipro, in contrast, has waded into the territory where multinational corporations rule the roost. Success, if it comes to Wipro, will be hard-earned.

What you did not know about Wipro

Beyond FMCG

Apart from FMCG, Wipro has taken strides in niche segments. Take, for example, its foray into the furniture business, which the company feels fits in well with its institutional lighting business set up in 1992.

According to Wipro Vice-President Parag Kulkarni, who heads Wipro Furniture, the business started after conversations with architects and designers, which indicated that the company could sell furniture to the same customers.

Since then, the company has come out with an entire range comprising popular, premium and super-premium furniture that targets companies in the information technology and information technology-enabled services space.

Of late, the impetus has been on the premium end which is largely serviced by international furniture makers.

Wipro has teamed up with top international designers including London-based Tim Wallace, New York's Eric Chan and Toronto-based Conrad Marini to bring world-class premium furniture to the country.

At the time of its launch in 2004, the modular furniture market was worth about Rs 550 crore. But it has grown 20 per cent per annum since then to get close to Rs 1,500 crore (Rs 15 billion) now.

"We're ahead of the pack, growing at 50 per cent," says Kulkarni. Wipro faces stiff competition from Godrej's furniture, which claims to have a 22 per cent market share.

"Godrej Interio products are targeted at medium to premium price points, and in the last six months we have launched 11 products," says Godrej Interio Chief Operating Officer Anil S Mathur. Wipro also claims its market share is in double digits and is among the top three companies in this space.

In 2006, the company entered switches -- another niche category that is growing at about 25 per cent -- when it acquired North West.

And now it has forayed into security products like close-circuit TVs, intrusion panels, intrusion alarms, access control, video door phones and gas & fire detectors.

While Agarwal's team has not chalked out any strategy yet, he feels Wipro is poised to do well in the segment because of its experience in the lighting and furniture market.

Wipro is keen on tapping niches in the health and wellness space too. Thus, it acquired glucose supplement Glucovita from Hindustan Lever in 2003 where it claims to have beaten industry growth rates.

The company followed that up two years later with the launch of Sanjeevani Honey to compete in the Rs 125-crore (Rs 1.25-billion) category.

Recently, it entered the artificial sweetener market with Wipro Sweet and Healthy. The rationale has been the growing health consciousness in the country. India has more than 50 million diabetics -- the highest number in the world. That's already a significant consumer base to start with.

The sweetener which was test-marketed in Andhra Pradesh has managed to gain 25 per cent market share in the region. Wipro now wants to launch it in other markets.