Are you happy with the Union Budget 2009 or disappointed like the stockmarket, which didn't see any of the things it wanted - be it lesser government borrowings and corporate taxes, or a PSU divestment programme - and tanked?

Are you happy with the increase in tax exemption of Rs 10,000 provided to women and non-senior citizens and Rs 15,000 for senior citizens? Will the clarification on the tax treatment of pensions under the New Pension System give new direction to your retirement investing? Are you thrilled that you will pay less for LCD TVs, big cars and branded jewellery, thanks to tinkering in excise and customs rates?

Much depends on what you were expecting would come out of finance minister Pranab Mukherjee's briefcase on the day the Budget was announced. If you wanted more growth steroids as the market did, you would have got into a depression. But if you weren't expecting too much or even nothing at all, the immediate aftermath of Budget 2009 will not be too bad a time to be in.

English playwright George Bernard Shaw had once said, "A government with the policy to rob Peter to pay Paul can be assured of the support of Paul." But what happens if the government wants not only the support of Paul, but also that of Peter, Patrick, Phillip, Pam and just about anybody? You get an economic policy package like Budget 2009 presented by the FM that tries to give something to everybody. Now, one can argue that one can't give enough to please everyone, but try telling that to an astute politician like Mukherjee, who tried to manage the contradictions in a way only a seasoned politician can.

Since the UPA government's recent electoral success was based on the "please all" mantra of "give, give and give still more", the Budget is clearly all about sticking to a winning formula.

In the end, Budget 2009 is really a 'something-of-everything' Budget. With a huge hole in the finances as indicated by the fiscal deficit of 6.8 per cent of the GDP (in other words, the government's earnings falling short of expenses by a worryingly large amount), Mukherjee could have only given 'some things' if he wanted to please all.

To be honest, he has done that rather well. Modest tax exemptions for individuals, ridding the bugbear of the fringe benefit tax for corporates, extending educational loan tax breaks to more number of courses and so on, are things that the FM could have done for you, in the least.

However, in trying to achieve the impossible, Budget 2009 also becomes a bag of contradictions sometimes bordering on the comic. New tax regulations that empower tax-assessing officers to give you a hard time (an opportunity they are unlikely to desist) go hand-in-hand with the announcement of a deadline for the new direct tax code and simplification of tax administration in which arbitrary powers to assessing officers is an anathema.

The removal of 10 per cent tax surcharge on income over Rs 10 lakh, clearly an income level of the affluent, doesn't go hand-in-hand with the image of the Budget being one for the common man or 'aam admi'. The long list of contradictions can go on.

Whether large or small, changes in economic policies, especially those relating to taxation, require analysis so that you can fine-tune your approaches to your decision-making related to spending, saving, borrowing or investing. In the next few pages, we provide an analysis and impact of Budget 2009 proposals on your finances even as some experts provide you with insights on the Budget and your money.

Less taxing

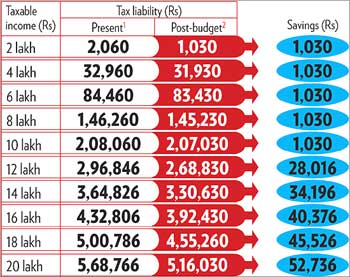

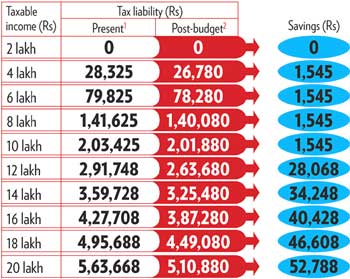

The new tax proposals would definitely help you save marginally more. However, the total savings for the middle-income group is between Rs 1,000-1,500 per year. On the other hand, the higher the salary, the higher the savings.

Proposals and impact

Though the Budget announcement wouldn't effect major changes, your finances could get affected by some of the proposals the FM has made.

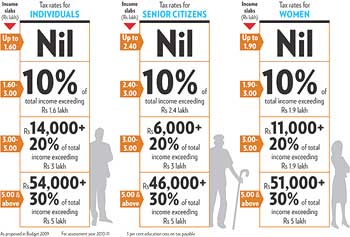

I. Raising of exemption limit

The Budget proposes to increase the personal income tax exemption limit of senior citizens by Rs 15,000 - from Rs 2.25 lakh (Rs 225,000) to Rs 2.40 lakh (Rs 240,000). Similarly, for women and individual taxpayers, the bar has been raised by Rs 10,000 - from Rs 1.80 lakh (Rs 180,000) to Rs 1.90 lakh (Rs 190,000) for women and from Rs 1.50 lakh (Rs 150,000) to Rs.1.60 lakh (Rs 160,000) for the rest.

However, there is not much reason for cheer for those earning below Rs 10 lakh (Rs 1 million) on this count as the changes in the limit will effectively mean a saving of just Rs 1,545 per year for senior citizens and Rs 1,030 per year for others.

Although there is no change in deductions, we give an example how senior citizens can make use of the marginal increase in the exemption limit. Let's assume a senior citizen gets an annual income of Rs 3.6 lakh (Rs 360,000) and saves Rs 1 lakh (Rs 100,000) under Section 80C.

The Senior Citizens Savings Scheme or a notified bank fixed deposit would be the ideal instruments to do so. On top of this, if he buys a health insurance policy worth Rs 20,000, deductible under Section 80D, for himself, his total investment qualifying for deduction will amount to Rs 1.2 lakh (Rs 120,000).

Given the exemption limit of Rs 2.4 lakh (Rs 240,000), his remaining income would remain outside the tax purview. This means that a senior citizen can invest up to Rs 40 lakh (from which he will get an income of Rs 3.6 lakh) and earn a fixed and assured tax-free income of around 9 per cent in times when a non-senior citizen is struggling hard to even find avenues of investments that can give him such returns.

II. Removal of surcharge

Individuals in the higher income bracket have a reason to rejoice. The surcharge of 10 per cent on taxable income exceeding Rs 10 lakh (Rs 1 million) has been removed. This will effectively mean a saving of at least Rs 20,000 per year for them. This will give an opportunity to them to appropriately use the surplus cash.

III. Removal of Fringe Benefit Tax

FBT was applicable to companies and partnerships in respect of expenditure incurred under certain heads of expenditure. In some cases, employers were passing the tax liability to their employees. Now, since FBT is repealed, both the employers and the employees stand to gain.

After its removal, the expenses incurred by employers on such fringe benefits would be claimed only as business expenses.

However, the expenses incurred by employers for the benefit of specific employees would continue to be treated as perquisites and would be taxable in the hands of the individual.

The liability to pay taxes on employee stock options remains with employees. Earlier, the employer was supposed to pay tax on the difference between the fair market value of shares and the exercise price, which it recovered from the employee.

Now, with FBT no longer in picture, the employer has no tax liability, but the employees still have to pay tax on the difference of the share prices.

IV. Scope of educational loans extended

Students would be able to avail relief for interest paid on education loans for any field of study, including vocational studies pursued after school. The scope of Section 80E of the Income Tax Act, which provides deduction on interest on loans taken for pursuing higher education in specified fields of study, has been extended to cover all fields of study.

Remember that any deduction (under Section 80E) on the interest of an education loan is not the sole privilege of the student in whose name the loan is taken, and can also be availed by the parents. What's more, deduction is allowed even if you take a loan to educate your spouse.

Unlike home loans, there is no ceiling on the deduction on the interest portion of an education loan and the principal repayment gets no tax advantage. The tax benefit on interest through deduction is allowed for a maximum period of eight years, or till the interest is paid in full.

V. Tax break for self-employed under NPS

Contributions made to NPS will now enjoy tax deduction under Section 80CCD of the Income Tax Act even for the self-employed, within an overall limit of Rs 1 lakh (Rs 100,000) under Section 80C.

At the time of maturity, 40 per cent of the corpus, which needs to be compulsorily deployed for purchasing annuity, will remain tax-exempt in the hands of the recipient. The remaining 60 per cent, if deployed during the same financial year to purchase annuity, will also be exempt from income tax. However, the pension that you receive every year, thereafter, will be taxable.

The NPS Trust has also been exempted from income tax, securities transaction tax and dividend distribution tax.

Says D Swarup, chairman, Pension Fund Regulatory and Development Authority: "The Budget has had some positive news for the NPS. Exemption from DDT and STT makes NPS better than a mutual fund for long-term growth. The government has also agreed to give us fiscal support, which will help us step up gas on our awareness campaigns.

"We have also asked the government to bear the cost of investment for individuals (who are non-government employees) just like (it does for) government employees. However, we still seek parity with long-term investment products. NPS has been given exemption from tax only if the maturity corpus is annuitised (which is not the case with other instruments)."

Other experts in the pension industry agree. Says H Sadhak, chief executive officer, Life Insurance Corporation Pension Fund: "Exempting pension funds from STT and DDT will only mean more value for your investment, making NPS an excellent tool for retirement planning."

However, NPS is still at a disadvantage compared to other retirement products. Though it gives a boost to your savings at the time of contribution through tax exemption and its low cost structure, it hits your savings at the time of withdrawal by making 60 per cent of your corpus taxable in case it is not annuitised.

And this tax liability at the time of withdrawal adds up to a sizeable amount. This is in contrast with other long-term products like insurance-cum-investment policies, Public Provident Fund and Employees' Provident Fund, which enjoy tax-free status at the time of contribution as well as withdrawal. NPS needs the same status to become a rock solid retirement solution.

Says Puneet Nanda, executive vice-president, ICICI Prudential Life Insurance: "It is very early days for NPS. Things are looking better with the Budget announcement although the benefit is marginal. Even as NPS hasn't been made tax-free on maturity like other long-term products, we are not entirely disappointed. In the long term, it has the potential to become more favourable for customers. But we are willing to be patient."

Tax liablity

You can work out your actual tax liability depending on your exact annual income and tax slab

VI. Medical treatment limit increased (Section 80DD)

In respect of maintenance, including medical treatment, of a dependent who has a severe disability, the deduction limit under Section 80DD will be increased to Rs 1 lakh from the present limit of Rs 75, 000. The limit for normal disability (up to 40 per cent) remains the same at Rs 50,000. It is only for severe disabilities (at least 80 per cent) that an individual can avail additional benefit.

VII. Zero-coupon bonds from scheduled banks, too

Scheduled banks have been allowed to issue zero-coupon bonds. At present, only infrastructure capital companies, infrastructure capital funds and public sector companies are allowed to issue such bonds.

VIII. Other proposals

Document Identification Number (DIN). A computer-based system will be introduced to allot and quote a Document Identification Number (DIN) in each correspondence sent or received by the income tax department to enable tracking of documents. Any communication from the department without a DIN will be treated as invalid. It will be assumed that it was never issued.

SARAL-II forms. The income tax department has been asked to work on SARAL-II forms. This will make income tax returns simpler and user-friendly.

TDS rates. TDS rates on rental payments by entities other than individuals for using any land or building have been reduced from 20 per cent to 10 per cent.

Advance tax. The threshold limit for payment of advance tax has been raised from the present Rs 5,000 to Rs 10,000. The threshold limit for payment of wealth tax has been raised from Rs 15 lakh (Rs 1.5 million) to Rs 30 lakh (Rs 3 million). Any amount exceeding Rs 30 lakh will be taxed at 1 per cent.

Donations. Donations to electoral trusts will qualify for 100 per cent deduction from the total income.

Tax checks. The assessing officer can reassess income and give reasons to investigate on any matter that was not included in the notice issued by the income tax department.

What's in it for you?

Budget 2009 is a dampener as far as individual taxation is concerned. Since no major changes were proposed, your approach towards your savings, particularly in tax-saving instruments, should largely remain the same as before.

It seems the Budget will not make much of a difference as far as the finances of middle-class individuals are concerned. It will, however, benefit individuals in the higher salary bracket. The measly increase in savings for those earning below Rs 10 lakh (Rs 1 million) will not make any difference to their lifestyle or savings.

Those earning above Rs 10 lakh, who will benefit due to the removal of surcharge, would have, in all likelihood, exhausted their Section 80C limit of Rs 1 lakh. For them, it would make sense to utilise the excess cash.

However, the Budget has paved the way for rolling out tax reforms with the finance minister proposing "to pursue structural changes in direct taxes by releasing the new Direct Taxes Code within the next 45 days".

This makes August 21, a much-awaited date.