| « Back to article | Print this article |

Why General Motors went bankrupt

General Motors Corp filed for bankruptcy on Monday, forcing the 100-year-old iconic car major which has been one of the most visible symbols of American capitalism and economic might into uncharted waters of nationalisation or government ownership.

This is the third-largest bankruptcy filing in American history and the largest-ever US bankruptcy in the manufacturing arena.

US Chapter 11 bankruptcy protection gives GM time to restructure its finances while being protected from its creditors.

The bankruptcy is likely to change GM drastically and 20,000 workers are likely to lose their jobs. GM has 92,000 employees in the United States and supports 500,000 retirees under the contract filed with the workers' union.

So why has the world's best known car company gone bankrupt? What led to the fall of the giant and how will the developments unfolding in the US affect GM India? Read on. . .

Text: Rediff Business Desk

Why General Motors went bankrupt

A killer combination

In a nutshell, very high labour costs, rising competition from foreign car makers, a frightening spike in fuel prices, freezing of credit, the collapse of the American economy, drop in sales caused by lack of purchasing power among Americans due to the recession, et cetera have formed a lethal concoction leading to the bankruptcy of the iconic carmaker.

However, General Motors's problems run much deeper. Here's why. . .

Why General Motors went bankrupt

Unmanageable labour costs

Over the years, protesting workers' unions at GM managed to get the company to agree to contracts that provide lifetime benefits to the members. This excessive cost of lifetime benefits pushed labour costs through the roof.

These costs have now reached an unmanageable proportion and the automotive giant just does not have enough money to either make these payments or to keep the company afloat, given the decline in sales and plummetting profits. Expansion, upgrade, new investments were totally out of the question.

Why General Motors went bankrupt

No cash, few receivables and huge expenses

Reports suggest that GM is paying more than $1,500 per car that is built as just benefits to people who are not even working for the auto giant any more. An interesting bit of statistics says that the cost of steel used in a car made by GM is less than what it pays its retired union members in terms of benefits.

Added to this is the huge pay that GM workers draw even for low-level jobs at the company.

The company does not have much cash and even if it adds receivables to this, it accounts payable and accrued expenses are many times higher than that figure. Even adding the company's current assets (inventories, equipment on lease, etc) to this still leaves it way behind it current liabilities.

Why General Motors went bankrupt

Government aid

The United States government, mindful of the impending death of GM, gave it over $19 billion from taxpayer money to keep it alive. It also sacked its legendary chief executive Rick Wagoner and decided to monitor the company's restructuring itself.

However, that has not helped revive the fortunes of the world's second-largest car company, after Toyota.

Once it goes into bankruptcy, the US government will infuse yet another tranche of about $30 billion to refinance and restructure GM.

Why General Motors went bankrupt

The first signs of trouble

The first signs of GM's gargantuan financial troubles began to surface in early 2008. When by mid-2008, the prices of furl touched a historic high, there was a stunning change in consumer behaviour with Americans deciding to keep off big fuel-guzzling cars and SUVs in favour or smaller, fuel-efficient vehicles.

The sudden rise in the price of oil, the deepening recession and the falling sales led to Detroit's Big Three - GM, Chrysler, and Ford Motor Co - almost throwing in the towel.

Why General Motors went bankrupt

Hard-to-get car loans and crazy fuel prices hurt GM

Car loans too were difficult to come by as banks, already reeling under the world's greatest financial crisis, decided to freeze credit. More and more people failed to qualify for loans, leading to a huge drop in car sales. Companies like GM found it almost impossible to raise funds or borrow from the market to keep from going belly up.

A study conducted by the car firms said that the historic spike in fuel prices was the '500-pound gorilla' that almost single-handedly kayoed GM and other carmakers.

By the end of the year, car giants were begging for help and the then George W Bush-led US administration decided to extend carmakers a lifeline and pumped in taxpayer money to keep the companies from collapsing.

Why General Motors went bankrupt

US govt may own 70% in GM

Reports say that the US government may own 70 per cent stake in the restructured General Motors, the ailing auto maker which is battling to avert a possible bankruptcy.

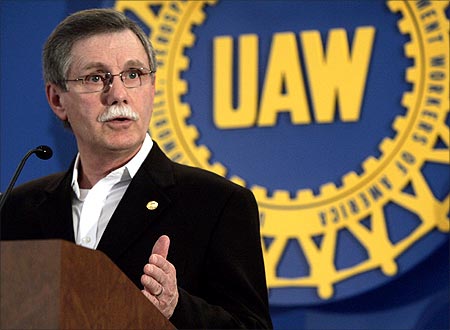

Under the GM restructuring plan, the United Automobile Workers union would hold up to 20 per cent through its retiree health care fund, and bondholders and other parties will get the remaining share. Shareholders would be virtually wiped out.

Why General Motors went bankrupt

Some thorny questions

The prospect of GM being effectively owned by the government raises a number of thorny questions: Countless policy decisions -- on matters such as fuel economy standards, tax incentives to replace aging cars and green technology initiatives -- will present conflicting interests.

President Barack Obama's aides, meanwhile, have consistently said they would be reluctant shareholders, and they plan no operating role in the company. The day-to-day running of the firm would be left to professional managers and the government would not be involved in decisions about closing factories, renegotiating contracts or selecting product lines.

A news report said that the auto maker expected the UAW's health care trust, called Voluntary Employee Beneficiary Association or VEBA would receive 39 per cent of the company, bondholders 9 per cent, shareholders 1 per cent, and the rest going to the Treasury.

The Treasury Department which has lent GM about $18 billion since December, required the company to make deals with the union and bondholders to cut debt and expenses by June 1, the report said.

Why General Motors went bankrupt

GM India not to be impacted

However, there are some questions on whether the new US government aid help revive the company's fortunes. There are a lot of uncertainties involved here too: no one is quite sure when will the US economy start turning around and when will consumer demand for new cars give GM any hope of coming out this mess.

The sales of new cars have plummeted by as much as 40 per cent since early 2009 and even Toyota, the world's biggest car maker, is suffering losses.

Amidst all this turmoil, General Motors India has kept a brave face. The company feel that there is little reason for it to panic as the Indian automobile market, even during this slowdown, is still growing faster than in most other economies.

An Economic Times report, quoting a GM India source, said that the bankruptcy will not have any impact on Indian operations. The bankruptcy proceedings are only for the reinvention of the US operations of GM. In the US, bankruptcy or Chapter 11 is used to make a brand stronger to suit the changing business environment. Therefore, it will only make GM stronger, the newspaper said.