| « Back to article | Print this article |

Bangalore's loss, Buffalo's gain?

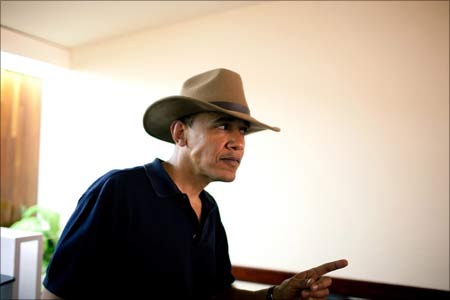

US president Barack Obama's promise to modify tax laws that currently allow US companies to pay less tax if they create a job in Bangalore, India, rather then in Buffalo, New York, has elicited diverse reactions in India.

While some have slammed it as a protectionist measure that will hurt the US more than it will harm India, others feel that it will not have any effect on the Indian outsourcing industry even as a handful have accepted that it is a matter of concern.

A couple of points need mention here. Bangalore is just a brand identity for outsourcing; the statement is not meant specifically for Bangalore or India. Also, the statement needs to be approved by the US Congress before it becomes a law and is supposed to come into effect only from 2011.

Bangalore's loss, Buffalo's gain?

What it means

As of now, when a US company incurs any business expense outside the US, it is eligible for deduction under corporate income tax laws.

Under the proposed structure, this deduction will be deferred till the profits earned outside of the US, say, in India, are repatriated to the US.

For example, if a US company incurs an expense of Rs 90 in India and also generates a profit of Rs 10 in India, the Rs 90 would be deductible only when the profit of Rs 10 is repatriated to the US.

Bangalore's loss, Buffalo's gain?

The implications

Uday Ved, Head-Tax, KPMG India, says the impact would be more on US companies that have subsidiaries in India and generate an income here. US companies that outsource their work to a third party in India, for example, a bank outsourcing part of its IT operations to a software firm in, say, Bangalore, will not be impacted as they are not generating any income in India and, thus, the question of deferred deduction does not arise.

Nasscom, the premier association representing the IT-BPO industry in India, also says the new laws will not affect the Indian outsourcing industry.

Bangalore's loss, Buffalo's gain?

Meanwhile, the Associated Chambers of Commerce and Industry of India (Assocham) sees this move as protectionism. The trade body has urged the Obama administration to review its decision as "taking resort to protectionism tendencies will kill the spirit of competition and dilute spirits of World Trade Organisation".

Ramesh Ramani, founder and CEO, Expertus, a learning outsourcing organisation, however, feels that Obama's proposals are legitimate. "The new tax laws would mean that US companies will restructure their business models based on market dynamics and not just on tax implications," he says.

Bangalore's loss, Buffalo's gain?

One of the main reasons for US companies to set up subsidiaries in India is to tap the Indian and Asia Pacific markets. Some companies, however, have been expanding their Indian subsidiaries and shifting jobs from the US to India solely for the resulting tax benefits. The new law wants to discourage this trend.

Yes/No/Maybe

1. If the law comes into force, US firms will get a tax deduction on their expenses incurred in India only when their profits in India are repatriated to the United States. This could affect Indian subsidiaries of US firms that generate profits in India.

2. US companies that outsource to a third party in India will not be affected as they do not generate any profit in India. So the impact on the Indian outsourcing industry will be limited.

3. The move would encourage US companies to set up subsidiaries in India based on market dynamics and not tax benefits.