It's been a remarkable reign at the top.

For nine years in a row, Star Plus has held on to the number one slot in the Hindi general entertainment channel space, with at least 50 of its shows almost always in the top 100.

Now Colors from the Viacom18 stables is threatening to usurp that position: During the week April 5-11, Colors notched up weekly gross rating points of 292, which was ahead of Star Plus' score of 267.

With just 35 of the top 100 shows currently, Star Plus has lost some of the rapport it had built with its viewers. Before Colors came into the picture last July, it commanded a channel share of close to 10.7 per cent in the total TV space. That share has now dropped to 8.6 per cent -- the same as Colors'.

To be fair, Colors has earned many of its GRPs from weekend programmes including films screened without commercial breaks, rather than weekday shows.

Still, Star Plus admits there's a challenge ahead. And Star TV India CEO Uday Shankar has worked out a game plan to deal with it.

"Our programming has taken a little longer to evolve than it probably should have with the result that some amount of viewer fatigue and disenchantment has set in," he says. "But there's too much competition out there right now; so all of us will be forced to experiment."

Text: Shobhana Subramanian

Shankar believes family values are here to stay in the Indian society.

He says young Indians today are less rebellious and more conservative possibly because of the high stress they face in an increasingly competitive environment. As a result, they're clinging to their families and traditional beliefs.

The import for Star Plus is clear -- it won't change the accent on family and traditional Indian values. Shankar is convinced that the treatment of soap operas on the channel has to be conservative and conformist.

"Some of the themes that our competitors have chosen may be socially relevant but the treatment has been extreme rather than mellow. The public may have liked it and the shows have been successful, but it's arguably regressive," says he.

At the same time, he concedes that some of the serials that Star Plus aired in the later years too had become very negative and regressive. Shankar refuses to give names but experts say he could be referring to a couple of Balaji Telefilms serials.

"We're trying to move away from stories of mistrust and negativity to those that reflect success at the end of a struggle, stories that portray a spirit to succeed," he says.

So, while soap operas will continue to rule at Star Plus because that's what the core audience -- mainly housewives -- is looking for, happiness will be the leitmotif.

Young is in

Another change being ushered in is that the protagonist in the stories will be a young person and will remain young throughout. "The data shows that we have the largest share of young viewers. With audiences becoming younger, we need to cater for youngsters," says Shankar.

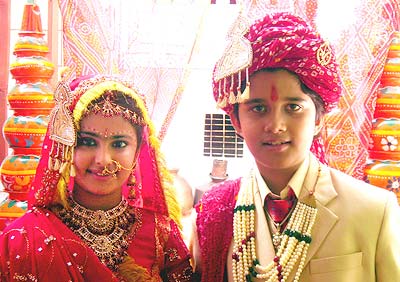

What this means is that the saas-bahu (a woman's tryst with her mother-in-law) theme will be discarded and instead stories will revolve around a young woman, with the accent on her role not as a daughter-in-law but as a young person or a wife.

Yeh Rishta Kya Kehlata Hai, which went on air in January, explores the theme of love after an arranged marriage and husband-wife relationships. Shankar explains that women, even in small towns, now want more and are looking for new experiences.

Since housewives comprise the biggest chunk of its audience, Star Plus has little option but to keep their latest fads, fancies and aspirations in mind.

At the same time, more households from socio-economic categories C and D are entering the cable and satellite universe and since they can no longer be ignored because of their increasing purchasing power, Star Plus needs to keep their sensibilities in mind too. And there lies the problem.

According to Star TV India Executive Vice-president (marketing) Anupam Vasudev, these viewers are conservative and want much the same fare as those from more affluent backgrounds. So, Star Plus has to walk the tightrope with care.

Won't get too real

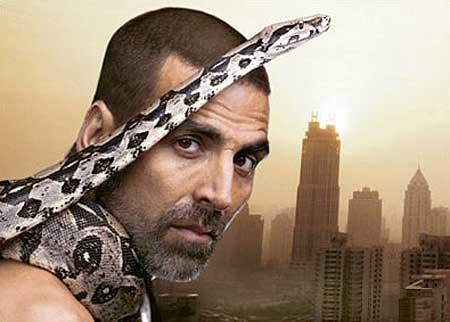

That is also the reason why Star Plus is uncomfortable with reality shows such as Big Boss (modeled on the hugely successful Big Brother). In fact, Shankar believes the show, aired by Colors last year, can't be watched by a family together.

He points out that for Colors it was not the reality shows -- Khatron Ke Khiladi or Big Boss -- that fetched it the GRPs but serials like Balika Vadhu and the mythological Jai Shri Krishna.

"The reality shows brought in the buzz and let them market the channel which they needed to do. But even for NDTV Imagine, it's Ramayan that's most popular," says Shankar.

"For reality shows, Star Plus will stay with tried and trusted formulas like Nach Baliye or Voice of India, which mirror the aspirations of people rather than aberrant extreme behaviour. Youngsters are daring to dream and what we'll capture is the latent desire of ordinary people for acknowledgement."

Doesn't Star Plus run a similar show called Aap Ki Kacheri anchored by ex-cop Kiran Bedi? Shankar believes that this show works because "a certain amount of assertiveness has crept into society and people are no longer afraid to express their views."

Apparently, although the show didn't feature people from affluent backgrounds, it got response from socio-economic categories A and A-plus. "We do think it's important to take a position on something that Star Plus will do," says Shankar adding that the changes in programming will happen slowly and subtly so as to grow on the viewer.

Ad revenues in trouble

Industry watchers believe that Star Plus needs to spend more on programming to win back audiences, or else it will lose out on advertising revenues.

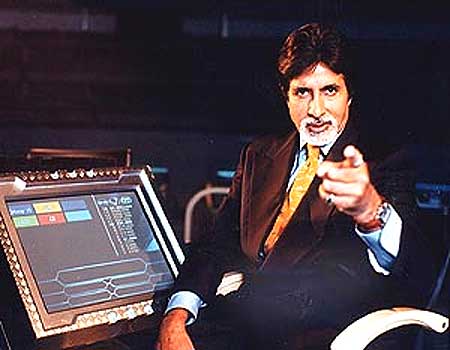

Says Chirag Negandhi, who tracks the media and entertainment sector at Enam Securities: "The channel needs to do something to push up its ratings quickly because it's being challenged by Colors much like how it was challenged by Zee in 2006. It needs another Kaun Banega Crorepati (the popular show hosted first by Amitabh Bachchan and later by Shah Rukh Khan has now been bought by Sony) to make its platform stronger because the gap between the first and second players is narrow -- just around 25-30 GRPs."

Adds a senior executive from one of the country's biggest media buying agencies, "It's clear that a significant amount of money will move to Colors and it is possible that Star Plus will lose some of the premium that it commands on advertising rates. Star Plus needs another soap opera that will give it daily GRPs of 3 or 4, so that its reach improves."

Punitha Arumugam, group CEO of media buying firm Madison, too believes that with more competition in the Hindi GEC genre, advertisers can negotiate better. "Customers have an option and will opt for whichever programme delivers higher TRPs," she says.

Shankar dismisses any proposal for a big budget show like Kaun Banega Crorepati but adds that the team could consider a good idea.

"Last year, we saw good potential in Paanchvi Pass but it didn't do as well as we expected. We don't need to spend just because of Colors. We have a P&L (profit and loss) to protect and we need to be disciplined. Upsides and downsides are part of the normal business cycle and there's no need to get desperate."

Shankar's also clear Star Plus won't play the price card and says discounting can also take its toll on the brand. So, he would rather leave the inventory unused.

"The premium doesn't come from market share alone; of course, you have to ensure basic reach and delivery, otherwise it doesn't work for the advertiser. But the power, perception and positioning of the brand and the historical comfort that advertisers have with it also make a difference," he says.

"So, even if market shares have fluctuated, the premiums do not shift in the same proportion. We have a disproportionately high share of the Hindi GEC ad pie and we'll protect that."

Industry watchers estimate that Star Plus' share of the Hindi GEC pie of Rs 2,200 crore (Rs 22 billion) would be around 45-50 per cent. Media buyers say the channel commands a premium of 25-30 per cent.

Clearly, there is still some comfort left for the channel.

However, Nikhil Vora, the managing director of IDFC SSKI, believes that the impact on ad rates is a reality. "Media buyers now have an option, so rates will fall. While Star Plus has done a great job to be where it is, perhaps it does need to look at some kind of differentiated content."

Of course, Star won't cut corners on expenses such as carriage fees; in any case, it pays a disproportionately low share and, moreover, is also the biggest beneficiary of subscription revenues.

The buzz gets louder

While it may not be upping its programming budget just yet, Star Plus is certainly not cutting back on its marketing spend.

This year's spends on promotion will be up by at least 100 basis points as a share of sales, says Vasudev (According to industry norms, about 5 per cent of a show's budget goes into advertising and marketing).

That's needed because Star Plus itself is rolling out more shows these days -- from one a month a year ago, it's now up to two or more a month. And it's no longer enough to simply promote shows on the Star channels.

"Traditionally, our marketing has always been focused on retaining the viewer but now that approach needs to change because we're reaching out to new viewers too. So it will be more acquisition driven," Vasudev explains.

Also, Star Plus is no longer indulgent with programmes -- if a serial doesn't manage to pick up a 10 per cent share of TRPs in a certain slot everyday within 12 weeks, it's yanked off the air.

"Without a 10 per cent share, it's not worth airing the show; it's too expensive," points out Vasudev.

With far more clutter across the industry that needs to be cut through and less time to do it in, Vasudev's looking at more innovation. So, apart from doing the routine out-of-home stuff, Star Plus has started pushing its shows more through events on the ground.

It has visual strips of its serials in newspapers like Dainik Jagran which recap the previous day's episode, the idea being to both remind the viewers and fill them in if they've missed an episode.

Vasudev believes it works better than simply inserting an advertisement.

To engage with younger viewers, it has started to organise events around its shows.

For instance, it teamed up with McDonald's to promote Shaurya Aur Suhani -- a Robin Hood kind of romance -- complete with Shaurya meals and contests. For its show Laadli, which revolves round the girl child, it partnered the NGO Nanhi Kali to create awareness, roping in film stars. It also got a greeting cards company to create special girl child cards.

"In the past, we've tended to be somewhat regional with our events but now with Laadli, we're giving it a pan-India feeling and scale," points out Vasudev.

Again, for Mummy Ke Superstars, a new singing-based reality show, Star Plus has started branding it in outlets where Amul products are sold and even on some Amul product packs.

Not only does the buzz need to be created well before a new programme is launched, noise levels need to remain high to create entry points for people who might have switched off at some time.

"Marketing is becoming very important for us because now we're a very fast moving consumer good," says Vasudev. That's true.

Spoilt for choice, the audience is more fickle than ever. And that is why Shankar is circumspect about the future: "We would like to win back our number one slot and we do have a strategy in place but it's a very tough market. Why Colors, even Zee has the ability to challenge us like it did in 2006. Of course, we won that round."

This time around though, without Kaun Banega Crorepati, the fight could be a tough one.