You couldn't have missed the buzz. Front-page newspaper ads of housing projects, text messages on your mobile of soon-to-be-over discounts, advertisements of home loan deals, builders promising freebies would remind you of the frenzied party of Indian real estate that lasted till end-2007.

We are talking of the heady party that saw the soaring of real estate prices, home loan rates and home ownership during 2004-07.

But that was before the global economic squeeze, rising interest rates and fickle job security, among other things, had buyers and investors abandoning the party. Has the party resumed or is it just an illusion?

***

With inputs by Anagh Pal, Tejas Vahalia & Kavya Balaji

Coming back to life: "All the measures that the government took is now having effect cumulatively on the buyers' psyche and the developers' ability to deliver," explains Pranay Vakil, chairman, Knight Frank India, a real estate consultancy firm.

According to a report by Credit Suisse, "Mortgage disbursements in Q4 FY09 were also higher than in Q3 FY09 and were similar to Q4 FY06 levels."

A more sensible pricing of homes, especially via 'affordable housing' projects, hasn't also come in a day early. Says Anshuman Magazine, chief managing director, CB Richard Ellis, South Asia, a real estate consultancy: "The Indian economy was not impacted to the same extent as developed economies by the global credit crunch."

The rebound of the stockmarkets since early April 2009 and far less bad economic news have clearly improved sentiments (See Pickup Evidence: The Volume Rebound and A Case of Tepid Growth). In this backdrop, should you buy real estate now?

If so, where and how? Or, should you wait some more?

Pickup Evidence: The volume rebound

The figures show the number of new dwelling units that came to the market and absorption from them and existing inventory

| Price Range (Rs) | New Launches (In Units) | Total Absorption (In Units) | ||

|

| Jan-Mar 2009 | Apr-Jun 2009 | Jan-Mar 2009 | Apr-Jun 2009 |

| Mumbai | ||||

| < 40 lakh | 9,931 | 464 | 4,295 | 2,961 |

| 40 lakh-75 lakh | 1,884 | 613 | 1,077 | 1,406 |

| 75 lakh-1 cr | 90 | 256 | 336 | 430 |

| > 1 cr | 789 | 450 | 660 | 767 |

| Total | 12,694 | 1,783 | 6,368 | 5,564 |

| Hyderabad | ||||

| < 40 lakh | 1,377 | 250 | 889 | 821 |

| 40 lakh-75 lakh | 529 | 382 | 785 | 962 |

| 75 lakh-1 cr | 77 | 32 | 140 | 83 |

| > 1 cr | 261 | 174 | 231 | 287 |

| Total | 2,244 | 838 | 2,045 | 2,153 |

| Delhi NCR | ||||

| < 40 lakh | 10,655 | 6,421 | 4,350 | 7,066 |

| 40 lakh-75 lakh | 3,372 | 2,816 | 2,471 | 4,764 |

| 75 lakh-1 cr | 123 | - | 346 | 368 |

| > 1 cr | 174 | 12 | 445 | 463 |

| Total | 14,324 | 9,249 | 7,612 | 12,661 |

| Bengaluru | ||||

| < 40 lakh | 2,052 | 1,383 | 1,535 | 1,754 |

| 40 lakh-75 lakh | 355 | 167 | 856 | 968 |

| 75 lakh-1 cr | 79 | 100 | 103 | 140 |

| > 1 cr | 204 | 166 | 122 | 164 |

| Total | 2,690 | 1,816 | 2,616 | 3,026 |

| Chennai | ||||

| < 40 lakh | 3,371 | 1,947 | 1,767 | 1,094 |

| 40 lakh-75 lakh | 177 | 361 | 706 | 585 |

| 75 lakh-1 cr | 119 | 67 | 62 | 74 |

| > 1 cr | 109 | 51 | 64 | 85 |

| Total | 3,776 | 2,426 | 2,599 | 1,838 |

| Kolkata | ||||

| < 40 lakh | 661 | 401 | 693 | 896 |

| 40 lakh-75 lakh | 50 | 206 | 250 | 364 |

| 75 lakh-1 cr | - | - | 66 | 51 |

| > 1 cr | 51 | - | 62 | 53 |

| Total | 762 | 607 | 1,071 | 1,364 |

| Pune | ||||

| < 40 lakh | 1,745 | 4,531 | 2,693 | 5,131 |

| 40 lakh-75 lakh | 347 | 1,630 | 961 | 2,051 |

| 75 lakh-1 cr | 215 | 36 | 72 | 109 |

| > 1 cr | 395 | 150 | 116 | 147 |

| Total | 2,702 | 6,347 | 3,842 | 7,438 |

What Should You Do?

First home: Buy if affordable. If it is your first home, affordability is the key. You should be able to easily afford your down payment -- typically 15-20 per cent of the property price -- and the home loan EMIs, ideally never more than 40 per cent of your take-home pay.

Waiting makes sense if you expect a fall in real estate prices, true only in some areas where a downward correction is expected post-Diwali. Interest rates, too, are expected to move up in the new future. In this scenario, if you have job security, go home shopping.

Avoid real estate as an investment now: If you are looking forward to investing in residential property, we recommend that you skip this party. Hardening interest rates could add to the interest burden if you take a floating rate-loan.

What's more important is to recognise the fact that the realty market is seeing some activity after a lull of almost 12-18 months. The frenzy of the past is unlikely to get repeated soon and you are unlikely to get quick returns.

Action Plan

If you are looking to buy your first home, here are some must-dos.

Go for ready-to-move-in homes: Says Vineet K. Singh, business head at realty portal 99acres.com: "Most projects launched in 2008 are delayed." Advises Aditya Verma, business head and vice-president, Makaan.com: "In this scenario, it makes sense to be sure than sorry." This will spare you of the pain of project delays.

Check the developer's project track record: In case of new projects, stick to punctual players and those slated to deliver in the next 6-12 months. Says Samarjit Singh, managing director at realty company Agni Group: "Most developers have details of their track record listed on their websites."

Buy from realty investors: Says Pankaj Kapoor of realty research firm Liases Foras: "During 2006-07, many people who invested in residential properties were investors. Those projects would either be complete or nearing completion." Go for them.

Look for FDI funded projects: Says Samir Jasuja, founder and CEO, real estate research and services firm PropEquity: "If the project is FDI funded, it ensures that the financial closure of the project will happen on time."

With these general guidelines, you can scour the real estate market for deals that suit you. Here is the the low down on seven major cities in the country. . .

DELHI NCR

This region was one of the most affected from the slowdown in the residential property market. However, since the beginning of 2009, many projects have been launched under the 'affordable housing' tag.

New and existing projects: Most of the activity is happening 30-35 km from the central business district. This includes Sectors 37 C and D, and Sectors 56 and beyond in Gurgaon. Other places in Haryana include areas around NH-8, Manesar, Bhiwadi, Dharuhera, Kundli and Rohtak Road, and Sectors 70-88 in Faridabad. Greater Noida Expressway and Sectors 93 A/B, 119 and 151 and beyond are seeing the highest level of activity in Greater Noida.

In Ghaziabad, Mohan Nagar, Vasundhara, Vaishali, Indirapuram, Raj Nagar, and NH-24 and NH-58 have been at the centre of action.

What to buy & where Delhi NCR

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 16,000-21,000 | 19,000-24,000 | 28,000-30,000 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 17,74,000-23,38,000 | 20,90,000-26,84,000 | 30,88,000-33,00,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 3,13,000-4,12,000 | 3,69,000-4,74,000 | 5,45,000-5,83,000 |

| Affordable house property value (Rs) | 20,87,000-27,50,000 | 24,60,000-3 1,58,000 | 36,33,000-38,84,000 |

| Preferred size (sq. ft) | 700-800 | 750-800 | 900-1,000 |

| Price (Rs/sq. ft) | 2,900-3,650 | 3,250-3,750 | 3,800-4,000 |

| Locations available considering preferred size and few residential areas | Delhi: Rohini/Pitampura; Gurgaon: Sushant Lok I, II, III, Golf Course Road, Sectors 52/56/58/61, Extd Golf Course Road, Sohna Road, NH-8; Ghaziabad: Mohan Nagar, Raj Nagar, Kavi Nagar, Indirapuram, Vaishali/Vasundhara, NH-24; Noida: Sectors 93 A and B, Sectors 119, 137, 151; Faridabad: Suraj Kund, Sectors 70-88, NH-2; Greater Noida | Delhi: Rohini/Pitampura; Gurgaon: Sushant Lok I, II, III, Golf Course Road, Sectors 52/56/58/61, Extd Golf Course Road, Sohna Road, NH-8; Ghaziabad: Mohan Nagar, Raj Nagar, Kavi Nagar, Indirapuram, Vaishali/Vasundhara, NH-24; Noida: Sectors 93 A and B, Sectors 119, 137, 151; Faridabad: Suraj Kund, Sectors 70-88, NH-2; Greater Noida | Delhi: Rohini/Pitampura; Gurgaon: Sushant Lok I, II, III, Golf Course Road, Sectors 52/56/58/61, Extd Golf Course Road, Sohna Road, NH-8; Ghaziabad: Mohan Nagar, Raj Nagar, Kavi Nagar, Indirapuram, Vaishali/Vasundhara, NH-24; Noida: Sectors 50, 61, 62, 63, 119, 137, 151, 93 A and B; Faridabad: Suraj Kund, Sectors 70-88, NH-2; Greater Noida |

Among the major projects launched are DLF Capital Greens, Tulip Orange by Tulip Infratech, The Residences by Unitech and Vatika Bellevue and IRIS-Emilia-Primrose by Vatika Group.

Over the last quarter, capital values across various micro markets have stabilised for both high- and mid-range projects. Central locations saw the maximum correction over the last six months (-11 per cent) as their high prices were unsustainable during the economic downturn.

In the mid-segment, Gurgaon and Noida saw noticeable correction over the year due to competitive prices offered by new developments. But capital values witnessed no change over the quarter due to positive buyer sentiment. Prices in Gurgaon and Noida are currently around Rs 3,000-4,500 per sq. ft.

What to do: Prices have remained largely stable across locations and micro-markets in the region. Even in the short term, prices are expected to remain stable in most micro-markets. So, it may be a good time to buy your first house.

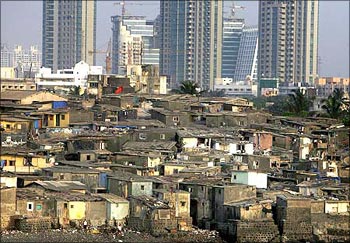

MUMBAI

Mumbai emerged as the most promising city in a study done by PropEquity titled Top 10 Cities in the Indian Real Estate Market in terms of having the highest absorption, price correction and new real estate project launches with a lower share of project delays.

Demand for residential units increased in 2009. Capital values in most locations declined in the past one year across major locations in the city. For instance, prices in South Mumbai corrected by 6 per cent and are currently around Rs 40,000-55,000 per sq. ft.

What to buy & where Mumbai

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 13,000-17,000 | 19,000-22,000 | 25,000-29,000 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 14,57,000-18,67,000 | 21,15,000-24,66,000 | 28,07,000-32,45,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 2,57,000-3,30,000 | 3,73,000-4,35,000 | 4,95,000-5,73,000 |

| Affordable house property value (Rs) | 17,15,000-21,97,000 | 24,89,000-29,02,000 | 33,02,000-38,18,000 |

| Preferred size (sq. ft) | 800-900 | 750-800 | 800-950 |

| Price (Rs/sq. ft) | 2,000-2,400 | 3,400-3,800 | 4,000-4,100 |

| Locations available considering preferred size and few residential areas | Extended Suburbs: Naigaon, Vasai, Virar; Navi Mumbai: Kharghar | Western Suburbs: Mira Road; Extended Suburbs: Naigaon, Vasai, Virar; Navi Mumbai: Vashi, Nerul, Airoli, Kharghar; Central Suburbs: Thane | Western Suburbs: Mira Road, Goregaon, Malad, Kandivali, Borivali; Extended Suburbs: Naigaon, Vasai, Virar; Navi Mumbai: Vashi, Nerul, Airoli, Kharghar; Central Suburbs: Powai, Chembur, Ghatkopar, Thane |

New projects: Apart from the change in buyer sentiment and economic conditions, increased focus on affordable housing saw the launch of several projects in the second quarter of 2009, mostly in peripheral locations of Mumbai.

Hiranandani Developers, Rustomjee, Lodha Developers, Nirmal Lifestyle are some major developers to have launched such projects since January. Says Niranjan Hiranandani, managing director, Hiranandani Group of Companies: "We have launched projects in Mumbai at more than five locations." The group also plans similar launches in Pune, Ahmedabad and Nasik. Similarly, Rustomjee has launched projects in Virar (W) and Thane (W).

The new projects that are priced lower than prevailing rates have got better response.

What to do: Mumbai may see restricted supply in the short term due to a slowdown in construction activity and a phase-wise development by most developers. Even though prices have corrected in South and North Mumbai in the past three months, if you are planning to buy a house, now is a good time since prices are expected to remain stable across most locations.

A notable development has been that the Maharashtra government has amended the Mumbai Stamp Duty Act, 1958, allowing refund of stamp duty to buyers who want to cancel their purchase agreements with their builders.

BENGALURU

The IT City was one of the worst hit from the changing fortunes of the residential property market. To give an idea, real estate major DLF had reduced prices in its Westend Heights project by 10.71 per cent to 18.75 per cent in early 2009. However, things have started to look up.

Says Sushil Mantri, chairman and managing director of Bengaluru-based Mantri Developers: "We have already started seeing a positive attitude among customers."

New and existing properties: Recently, DLF launched its new residential project called Westend Heights New Town. Century Group, another prominent developer, has launched 2-3 projects in the city, with an affordable housing project in Rajarajeshwari Nagar. Ozone Group, a Bengaluru-based developer, has launched its project on Sarjapur Road.

Says Sudarshan KS, CEO, Ozone Group, "First-time homebuyers are the first to move in, and are showing committed buying." Other notable new launches in the city are Sobha Sunscape, Aquila Heights, Mantri Astra, Purva Vebezia and Salarpuria Symphony.

What to buy & where Bengaluru

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 14,000-18,500 | 18,500-22,000 | 25,500-28,000 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 15,85,000-20,48,000 | 20,32,000-24,19,000 | 28,30,000-31,23,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 2,80,000-3,61,000 | 3,59,000-4,27,000 | 5,00,000-5,51,000 |

| Affordable house property value (Rs) | 18,65,000-24,09,000 | 23,90,000-28,45,000 | 33,29,000-36,75,000 |

| Preferred size (sq. ft) | 900-1,000 | 850-1,050 | 950-1,050 |

| Price (Rs/sq. ft) | 2,050-2,600 | 2,700-2,850 | 3,450-3,600 |

| Locations available considering preferred size and few residential areas | Whitefield, Banerghatta Road, Hebbal | Whitefield, Banerghatta Road, Hebbal | Banswadi, BTM, Old Airport Road, Jayanagar, Old Madras Road, J.P. Nagar, Whitefield, Banerghatta Road, Hebbal |

According to research by Colliers International, a realty consulting firm, overall housing demand in most markets has remained low except in Yelahanka in north Bengaluru.

For example, capital values in the northern part of the city (Hebbal, Bellary Road, Yelahanka, Dodballapur Road), prices are in the Rs 2,500-3,000 per sq. ft range, while in the south-east (Sarjapur Road, Outer Ring Road, HSR Layout), they are hovering at Rs 2,500-3,500 per sq. ft. In fact, in locations like Sarjapur Road, Outer Ring Road and HSR Layout, prices have corrected by 25 per cent in the past one year.

Other locations that saw similar price corrections are Marathalli, Whitefield and Airport Road (27 per cent) and Brunton Road, Artillery Road, Ali Askar Road and Cunningham Road (17 per cent).

Considerable activity has also taken place in the secondary market, with end-users willing to take advantage of reduced prices and lower home loan interest rates.

The state government has reduced the stamp duty on first-sale transactions of apartments from 7.5 per cent to 6 per cent, which should act as a boost for potential homebuyers.

What to do: The short-term outlook for capital values in most locations across the city is negative and there could be further price correction. So, take an informed decision if you are able to locate a property you want to buy.

CHENNAI

Prices remained stable in most locations although some areas saw corrections.

For example, prices in Perungudi fell by 12 per cent and are now around Rs 2,500-3,000 per sq. ft. Velachery and Nungambakkam saw 3 per cent and 9 per cent correction, respectively. Capital values in Velachery are around Rs 3,500-4,000 per sq. ft now. According to Colliers International Research, even after two quarters, buyers are still postponing a purchase.

Job insecurity and expectations of a further fall are bringing down demand.

New projects: Considering the fact that demand has been muted, demand for ready-to-move-in properties is expected to pick up over the short-term as consumers are still wary of projects that are under construction.

What to buy & where Chennai

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 14,500-21,000 | 21,000-24,500 | 27,500-34,500 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 16,32,000-23,09,000 | 23,57,000-27,16,000 | 30,17,000-38,34,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 2,88,000-4,07,000 | 4,16,000-4,80,000 | 5,30,000-6,77,000 |

| Affordable house property value (Rs) | 19,20,000-27,16,000 | 27,73,000-31,96,000 | 35,49,000-45,10,000 |

| Preferred size (sq. ft) | 800-850 | 900-1,000 | 1,050-1,200 |

| Price (Rs/sq. ft) | 2,200-3,400 | 3,000-3,200 | 3,400-3,800 |

| Locations available considering preferred size and few residential areas | Velachery, Rajiv Gandhi Salai, Tambaram, Chitlapakkam | Velachery, Rajiv Gandhi Salai, Tambaram, Chitlapakkam | Moggapair, Guindy, Vadapalani, Velachery, Rajiv Gandhi Salai, Tambaram, Chitlapakkam |

Many affordable housing projects were launched in the second quarter of 2009. Some of the prominent ones include Infinity, Metro Golden Nest, Copper County by Vijay Shanti True Value Homes and Hallmark Infrastructure. MARG Group has also launched one project in Chennai and one in Tirupathi.

"The results are encouraging," says S. Ramakrishnan, CEO (real estate), MARG Group. Apart from these affordable housing projects, Olympia Group has launched its premium project named Olympia Opaline Sky Villas in Siruseri.

A noticeable feature about the new launches was that the ones by national players such as DLF and Unitech, among others, in peripheral locations were offered at discounted prices to establish a presence.

For instance, in Chennai too, DLF had reduced prices in its Garden City (OMR) project by 3.63 per cent in early 2009. But, regionally established developers such as Appaswamy, Arihant, Ceebros, Chaitanya, Vijayashanthi, were able to use their strong brand recognition and established track records to launch projects within city limits at prices close to prevailing rates.

What to do: If you are planning to buy a house in Chennai, now is perhaps a good time. In most locations, there has been no price correction in the past three months and prices are expected to remain stable. However, prices are expected to correct in select micro-locations in Velachery and Poes Garden.

KOLKATA

Like other major markets, October 2008 was a nightmare for the city's residential property market.

Says Pradeep Sureka, president, Confederation of Real Estate Developer's Associations of India (Credai) Bengal and managing director, Sureka Group: "Volumes had dropped by 50 per cent. Since then, especially from April-May this year, there has been a 30-35 per cent pick-up in volumes."

This rise in demand has been across the board, but residential units priced at Rs 25 lakh-30 lakh have been at the centre of action.

What to buy & where Kolkata

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 15,000-20,000 | 19,000-24,500 | 26,500-30,500 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 16,56,000-22,60,000 | 21,42,000-27,24,000 | 29,50,000-34,02,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 2,92,000-3,98,000 | 3,78,000-4,80,000 | 5,20,000-6,00,000 |

| Affordable house property value (Rs) | 19,48,000-26,57,000 | 25,20,000-32,04,000 | 34,70,000-40,02,000 |

| Preferred size (sq. ft) | 750-800 | 750-900 | 900-1,000 |

| Price (Rs/sq. ft) | 2,600-3,400 | 3,400-3,700 | 3,900-4,000 |

| Locations available considering preferred size and few residential areas | Jadavpaur, EM Bypass, Santoshpur, Tollygunge, Rajarhat, Salt Lake, Gariahat, Jessore Road, Behala, Garia | Salt Lake, Jadavpaur, EM Bypass, Santoshpur, Tollygunge, Rajarhat, Gariahat, Jessore Road, Behala, Garia | Salt Lake, Jadavpaur, EM Bypass, Santoshpur, Tollygunge, Rajarhat, Gariahat, Jessore Road, Behala, Garia |

New projects: However, a number of projects have been announced recently. Ambuja Realty has launched Ujass in Lake Town and Upohar Phase II in Chak Garia. It has also launched projects in Siliguri and Amritsar.

United Credit Belani Group has launched two projects. One of its projects in Batanagar, Calcutta Riverside, was relaunched in January 2009. Further, South City Projects have recently launched four projects in the city.

What to do: Harshvardhan Neotia, chairman, Ambuja Realty, says: "In Kolkata, prices have bottomed out. They will rise steadily from here. In such a situation, investors will be shy of moving into the market. It will be a market of genuine homebuyers. If there is no huge catastrophic event, this steady uptrend will continue."

Although prices have corrected in most locations over the past one year, in the past three months there have been minor price corrections in some micro markets (Ballygunge, Queens Park, Rainy Park, Gurusaday Road, EM Bypass, Alipore Park Road, Ashoka Road, Belvedere Road) in the range of 2-3 per cent.

In other locations, prices have remained largely stable in the past three months. If you want to buy a house in Kolkata, this is a good time as prices are expected to remain stable in most locations across the city in the coming months.

PUNE

In PropEquity's study, Top 10 Cities in the Indian Real Estate Market, Mumbai, Pune and Thane were the top three cities.

With the IT boom and the city's proximity to Mumbai, most locations in Pune that saw hectic real estate activity in the past, saw capital values decline in the past one year due to weak market sentiment and subdued demand in various micro-markets.

For instance, capital values in Koregoan Park, Bund Garden Road, Kharadi declined by 12 per cent and 6-8 per cent in just the past three months. Prices in Wakad fell by 24 per cent in the past one year and by around 10 per cent in the past three months.

What to buy & where Pune

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 15,300-22,700 | 21,000-23,500 | 27,000-30,300 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 17,04,000-25,22,000 | 23,33,000-26,10,000 | 30,04,000-33,63,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 3,00,000-4,45,000 | 4,12,000-4,60,000 | 5,30,000-5,93,000 |

| Affordable house property value (Rs) | 20,05,000-29,67,000 | 35,34,000-39,56,000 | 27,45,000-30,70,000 |

| Preferred size (sq. ft) | 650-700 | 700-750 | 700-800 |

| Price (Rs/sq. ft) | 2,900-4,200 | 3,800-4,300 | 4,400-5,900 |

| Locations available considering preferred size and few residential areas | Aundh, Kothrud, Baner, Magarpatta, Bavdhan, Vishrantwadi, Pashan, Vadgaon Sheri, Hinjewadi, Viman Nagar, Kharadi, Kondhwa-Undri, Pimpri-Chinchwad, Wakad, Manjri | Aundh, Kothrud, Baner, Magarpatta, Bavdhan, Vishrantwadi, Pashan, Vadgaon Sheri, Hinjewadi, Viman Nagar, Kharadi, Kondhwa-Undri, Pimpri-Chinchwad, Wakad, Manjri | Koregaon Park, Deccan, Bhosale Nagar, Aundh, Kothrud, Baner, Magarpatta, Bavdhan, Vishrantwadi, Pashan, Vadgaon Sheri, Hinjewadi, Viman Nagar, Kharadi, Kondhwa-Undri, Pimpri-Chinchwad, Wakad, Manjri |

Capital values in Wanowrie are now in the region of Rs 2,500-3,000 per sq. ft, around Rs 2,000-2,400 per sq. ft in Wakad and Rs 2,600-3,000 per sq. ft in Baner. In the more upmarket locations of Koregoan Park, Bund Garden Road and Kharadi, capital values are in the region of Rs 4,000-4,500 per sq. ft.

New projects: Growing demand for smaller-sized, budget-friendly homes has, however, resulted in the launch of some affordable residential projects. Nisarg Pushp, Rainbow by RK Lunkad Group, Akruti Countrywoods by Akruti City, Umang Homes by Kolte Patil and Park View by Gera are some projects launched in the second quarter.

Says Kumar Gera, chairman and managing director, Gera Developments: "The flats are mostly of 2-3 bedrooms and are priced at Rs 1,000-1,500 per sq. ft. The maximum pick up in volumes is happening in the Rs 30 lakh-35 lakh bracket." The group will be launching more projects in the next two quarters. DS Kulkarni Developers, too, will have three projects in the city within 2009.

With demand for affordable housing gaining impetus, developers are focusing on redesigning their ongoing projects and launching other low-cost housing projects, which are likely to be concentrated primarily in the peripheral locations of Pune.

What to do: If you are planning to buy a house in Pune, it is advisable to wait for some time before finalising a deal. Even though prices are expected to remain stable in the short term, in most places, locations such as Wakad could see more price falls.

HYDERABAD

The residential property market in Hyderabad has undergone considerable change since 2004-05, largely due to the impetus provided by the state government and spread of IT, pharmaceutical and biotech companies. Some of the major real estate players in the city are DLF, Lodha Group and Purvankara.

Even though there has been renewed interest, most locations in the city underwent price correction last year.

In fact in locations like Banjara Hills and Jubilee Hills, where capital values are now around Rs 3,500-4,000 per sq. ft, prices dipped by 11-12 per cent in the last one year and corrected by 3 per cent and 1 per cent, respectively, in the past three months. In other locations like Himayathnagar, Madhapur and Gachibowli, prices went down by 10 per cent in the past one year.

Capital values in these locations are in the region of Rs 2,500-3,000 per sq. ft now. Prices in locations like Begumpet and Somajiguda dipped by 4 per cent in the past one year and by around 9 per cent in Kukatpally during the same period.

What to buy & where Hyderabad

| Household income (p.a.) | Rs 5 lakh-6 lakh | Rs 6 lakh-8 lakh | Rs 8 lakh-10 lakh |

| Maximum EMI (Rs) | 16,800-21,300 | 23,300-26,200 | 27,100-32,800 |

| Maximum loan eligiblity (Rs) (9% int. rate, 20-year loan tenure) | 18,66,000-23,63,000 | 25,95,000-29,09,000 | 30,15,000-36,40,000 |

| Buyer's own contribution (Rs) (Assuming 85% loan) | 3,29,000-4,17,000 | 4,58,000-5,13,000 | 5,32,000-6,42,000 |

| Affordable house property value (Rs) | 21,96,000-27,80,000 | 30,52,000-34,22,000 | 35,47,000-42,83,000 |

| Preferred size (sq. ft) | 750-850 | 900-1,050 | 750-1,100 |

| Price (Rs/sq. ft) | 2,800-3,500 | 3,000-3,800 | 3,800-4,700 |

| Locations available considering preferred size and few residential areas | Gachibowli, Begumpet, Secundrabad, Madhapur, Uppal, Nacharam, Kukatpally, Miyapur, Kompally, LB Nagar, Dilsukhnagar | Gachibowli, Begumpet, Secundrabad, Madhapur, Uppal, Nacharam, Kukatpally, Miyapur, Kompally, LB Nagar, Dilsukhnagar | Srinagar Colony, Gachibowli, Begumpet, Secundrabad, Madhapur, Uppal, Nacharam, Kukatpally, Miyapur, Kompally, LB Nagar, Dilsukhnagar |

Existing and new projects: Completion of ongoing projects is the priority for most developers. The western part of the city that includes Gachibowli, Gopanpally and Kondapur and the north-west regions of Miyapur and Nizampet Road have most ongoing developments that are nearing completion.

Only four projects offering a total of 2,100 units were announced during the June quarter in Gachibowli, Kokapet and Kukatpally. Nearly 80 per cent of these were middle-level apartments with the balance being villa developments.

Despite the continuing slowdown, both mid-end as well as high-end projects have together managed 25 per cent bookings. To move with demand, some developers restructured their product mix (projects that are either under execution or in the foundation stage) with a focus on affordable housing.

What to do: Even though prices have corrected over the past year, this is a good time to buy a property in Hyderabad. Except for locations like Begumpet or Somajiguda, where prices are expected to go down further, and capital values are expected to remain stable going forward.

Developers facilitating flexible payment options along with lowering of home loan rates by various financial institutions could be a boost for your buy decision.

WHY BUYING SCORES OVER RENTING

RENT

Rentals from residential units typically range between 5-6% of the market value of the house. However, during the boom period this figure dipped to 2-3%, a sign of inflated capital.

It is during such times that it makes sense to live on rent. However, this should at best be a short-term option

| Rent | Rs |

| 1 Annual rental outgo | 1,44,000 |

| 2 Tax benefit on HRA | 44,000 |

| 3 Interest lost on deposit | 1,680 |

| 4 Home insurance | 5,000 |

| 5 Total cost of renting (1+2+3+4) | 1,94,680 |

BUY

So far renting looks a better option. However, you need to keep in mind that the value of the house you buy, will appreciate with time.

Also with every EMI you towards servicing the loan, your equity in your house will increase. Something that won't happen when you live on rent

| Rent | Rs |

| 6 Annual EMI | 2,91,916.08 |

| 7 Property tax | 3,020 |

| 8 Home insurance | 5,000 |

| 9 Tax savings from principal repayment | 17,210.29 |

| 10 Tax savings from interest repament | 50,985 |

| 11 Total cost of buying (6+7+8-9-10) | 2,31,740.79 |

| 12 Annual appreciation (@ 8% p.a.) | 2,80,000 |

| 13 Net gain from buying (12-11) | 48,259.21 |