| « Back to article | Print this article |

The world's 10 sustainable value creators

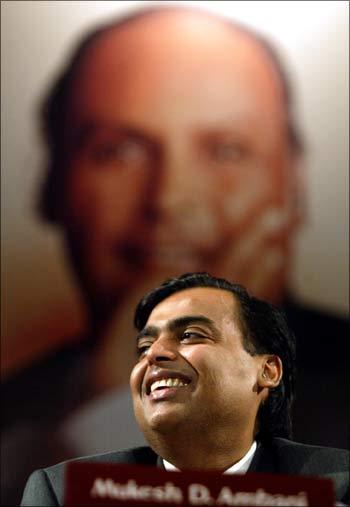

The petrochemicals giant is the only Indian company on the list, which has been topped by US-based pharma major Gilead Sciences and has been compiled by Boston Consulting Group in an annual report from its Value Creators series.

Reliance Industries has risen on the back of India's strong economic growth to become India's largest private sector company with annual sales seeing a growth of 33 per cent since 1998.

RIL is ranked even higher than NRI billionaire Lakshmi Mittal-led global steel major ArcelorMittal, and also many other global giants like BHP Billiton, Samsung, Tesco, Rio Tinto, BASF, McDonald's, Colgate-Palmolive and Procter & Gamble.

The report, 'Searching for Sustainability: Value Creation in an Era of Diminished Expectations' has identified 25 firms, with a market capitalisation of at least $30 billion, that have consistently outperformed their local stock-market average during the 10 years from 1999 to 2008.

The US has the most number of companies in the list. Check out the companies that make it to the top ten list...

The world's 10 sustainable value creators

Gilead Sciences is the world's most 'sustainable value creator'. The company, which develops and markets drugs to treat anti-viral diseases has recorded a 44 per cent rise in sales since 2003, the report states.

Gilead's performance has been boosted by its cost effective strategies. It is the only company in the list to have beaten the local stock market average for all the ten years included in the study.

Headquartered in California, the company with annual revenues over $5 billion, operates in four continents and has 4,000 employees. John C. Martin is the CEO of the company.

Market cap: $46.5 billion (as of Dec 31, 2008)

The world's 10 sustainable value creators

Steve Jobs founded company, Apple is the world's seond best value creator. It has transformed itself from a niche player in the computer business to a leader in the consumer electronics business with products like iPod, iTunes online music business and iPhone, the study states.

Innovation has triggered Apple's phenomenal growth. Established in California on April 1, 1976, Apple has about 35,000 employees and a worldwide annual sales of $32.48 billion in its fiscal year ending September 29, 2008.

Fortune magazine named Apple the most admired company in the United States in 2008 and in the world in 2009.

Companies suffering a massive decline in stock market valuation in the wake of the global economic crisis should learn the lessons of an elite group of so-called sustainable value creators that have generated sizable and sustainable shareholder returns over a decade, according to The Boston Consulting Group report.

Market cap: $75.8 billion as of (Dec 31, 2008)

The world's 10 sustainable value creators

The result is a total shareholder return (TSR) of 23.8 per cent. The world's second largest tobacco group in terms of global market share, it has brands sold in more than 180 markets.

The company was founded in 1902 and by 1912, it became one of the world's top 12 companies by market capitalisation. Paul Adams is the CEO of the company.

Market cap: $53.2 billion (as of Dec 31, 2008)The world's 10 sustainable value creators

It is a diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore, pellets, and second largest producer of nickel.

The company was founded in Itabira, Minas Gerais, as a public company by the Brazilian Federal government on June 1, 1942. Roger Agnelli is the CEO of the company.

Market cap: $61.9 billion (as of Dec 31, 2008)

The world's 10 sustainable value creators

Exelon has one of the industry's largest portfolios of electricity generation capacity, with a nationwide reach. Exelon operates the largest and most efficient nuclear fleet in the United States and the third largest commercial nuclear fleet in the world. John W. Rowe is the CEO of the company.

Market cap: $36.6 billion (as of Dec 31, 2008)

The world's 10 sustainable value creators

BHP Billiton is among the world's largest mining companies. It was created in 2001 by the merger of Australia's Broken Hill Proprietary Company (BHP) and the UK's Billiton.

It is a dual-listed company with head offices in Melbourne and London. BHP's annual revenues have grown by 15 per cent. It also figures among the top ten largest cap companies from 2004-2008.

It deals with major commodity businesses, including aluminium, energy coal and metallurgical coal, copper, manganese, iron ore, uranium, nickel, silver and titanium minerals, and has substantial interests in oil, gas, liquefied natural gas and diamonds.

The company has 40,990 employees working in 25 countries. In FY 2009, the company generated revenues to the tune of $50.2 billion. Don Argus is the chairman of the company.

Market cap: $119.5 billion (as of Dec 31, 2008)

The world's 10 sustainable value creators

Arcelor Mittal headed by L N Mittal is ranked 8th among the most sustainable value creators. It is the largest steel company in the world, with 326,000 employees in more than 60 countries.

The company was formed in 2006 with the merger of Arcelor and Mittal Steel. The company is headquartered in Luxembourg City. Its revenues in 2008 stood at $ 124.9 billion.

Its crude steel production of 103.3 million tonnes, representing approximately 10 per cent of world steel output. It ranks 28th in the 2009 Fortune Global 500 list

Market cap: $32.3 billion (as of Dec 31, 2008)

The world's 10 sustainable value creators

Teva Pharmaceutical is the world's 9th best value creator. A global pharmaceutical company specialising in the development, production and marketing of generic and proprietary branded pharmaceuticals, Teva is among the top 20 pharmaceutical companies in the world.

Headquartered in Israel, above 80 per cent of Teva's sales, which totaled $11.1 billion in 2008, are in North America and Europe.

Teva has over 38,000 employees worldwide and production facilities in Israel, North America, Europe and Latin America. Shlomo Yanai is the president and chief executive officer.

Market cap: $38 billion (as of Dec 31, 2008)

The world's 10 sustainable value creators

Taiwan Semiconductor Manufacturing Company is one of the world's largest dedicated independent semiconductor foundry, with its headquarters in Hsinchu, Taiwan.

TSMC posted annual sales of $9.83 billion in 2007 and currently employs over 20,000 people worldwide. In 2002, TSMC became the first semiconductor foundry to enter the ranks of the top 10 IC companies in terms of worldwide sales.

Morris Chang is the chairman and chief executive officer.

Market cap: $34.7 billion (as of Dec 31, 2008)

.