| « Back to article | Print this article |

The rise and fall of Rajaratnam

Raj Rajaratnam, founder of Galleon Group, a New York-based hedge fund, arrested for insider trading describes himself as a 'focused' man.

His favourite quote: "Only the paranoid survive." How he will survive now is however a million-dollar question.

He is among the six arrested in connection with the largest hedge fund insider-trading ever, which includes two Indian Americans and a Sri Lanka-born billionaire.

Besides the Tamil-origin Raj Rajaratnam, the two Indian Americans Rajiv Goel, director, strategic investments at Intel and Anil Kumar, a director at McKinsey were arrested in the $20 million hedge fund insider-trading case.

Jim Walden, Rajaratnam's attorney, said his client is innocent and will fight against the insider-trading charges. Rajaratnam has been released on a bail of $100 million. He has to limit his travel to a 110 mile radius of New York city and has surrendered his passports to the court.

If convicted all of them face imprisonment of up to 20 years, according to the indictment, which reads that the defendants "routinely received inside information directly or indirectly from insiders and provided it to each other for the purpose of trading based on the information.

The rise and fall of Rajaratnam

Raj and his accomplices are alleged to have made millions by using inside information from people at companies like Intel, Moody's and McKinsey.

The FBI for the first time used court-authorised wire taps to make these arrests. The agency has transcripts of phone conversations between Rajaratnam and executives of Bear Stearns, IBM, Intel and McKinsey. Prosecutors also used recorded conversations with an unnamed individual who became a witness for the government.

Prosecutors said Rajaratnam used insider information to trade ahead of results announcements and big ticket deals of the companies. The trade included companies like Google, IBM, Sun Microsystems and Hilton group of hotels.

Danielle Chiesi from New York, Robert Moffat from Connecticut and Mark Kurland from New York were also arrested. Rajaratnam, Kurland, Chiesi, and others traded on material, non-public information given as tips by insiders and others at hedge funds, public companies, and investor relations firms -- including Intel, IBM, McKinsey, Moody's Investors Services Inc., Market Street Partners, Akamai Technologies, Inc. and Polycom Inc.

Rajaratnam, Chiesi, Kurland and others earned millions of dollars of illegal profits for themselves and the hedge funds with which they were affiliated.

One of the insiders, Kumar, profited from investments in Galleon. Goel, also an insider, received profitable trades in a personal account managed by Rajaratnam, the complaints said.

The rise and fall of Rajaratnam

A billionaire hedge manager

Rajaratnam is estimated to have received $200m in 2007 from Galleon, making him one of the best-paid hedge fund managers in the world.

A self-made billionaire hedge fund manager, Rajaratnam is the 236th richest American according to Forbes magazine with an estimated net worth of $1.8 billion. He is the world's 559th richest man.

He is also the richest Sri Lankan in the world. As of 2009, his Diversified Fund has returned 22.3 per cent, outperforming the Nasdaq by 33 per cent.

Rajaratnam has been featured among the elite US money managers in a book called The New Investment Superstars: 13 Great Investors and their Strategies for Superior Returns by Lois Peltz.

His hedge fund is currently valued at $3.7 billion, down from its peak of $7 billion in 2008.

Raj Rajaratnam received a bachelor's degree in engineering from the University of Pennsylvania and MBA from the Wharton School.

The rise and fall of Rajaratnam

How he started

Rajaratnam started his career as a lending officer at the Chase Manhattan Bank where he cleared loans to high-tech companies.

He joined the investment banking firm Needham & Co as an analyst in 1985. He then became the head of research in 1987 and in 1991, at the age of 34 became the president.

He later started a hedge fund, Needham Emerging Growth Partnership in March 1992, which he later bought and renamed as 'Galleon'.

Galleon invests in global public equity markets and in private equity. Galleon is focused on analysis of stocks in technology and communication companies.

The rise and fall of Rajaratnam

Charity drive

A generous Rajaratnam has contributed over $20 million in the last five years to various charities.In September 2009, Rajaratnam pledged to donate $1 million to help the rehabilitation of LTTE combatants. He has also donated to clear land mines in the war-affected areas in Sri Lanka.

Rajaratnam has also made significant contributions to promote development in the Indian subcontinent and supported programs for lower income South Asian youth in New York.

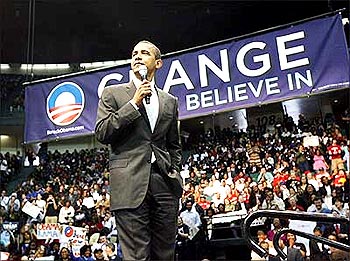

Rajaratnam has made over $87,000 in political contributions in the past five years including President Barack Obama's campaign, the Democratic National Committee, and various campaigns on behalf of Hillary Rodham Clinton.