Aiming to tackle inflationary pressures, the Reserve Bank on Tuesday increased a key statutory deposit ratio for banks by one percentage point to 25 per cent but the move is not expected to push interest rates up.

Barring the hike in Statutory Liquidity Ratio, the deposits that commercial banks are to park in government securities, the central bank left other key policy rates and ratios unchanged.

Retail and corporate loan rates may stay the same as bankers ruled out any increase in lending rates in the next three to four months, thanks to the RBI keeping almost all key rates unchanged.

"I do not see any change in the interest rates till March. There is no liquidity problem in the system and credit off-take is less than expected," Corporation Bank Executive Director Asit Pal told PTI.

SLR hike

In view of difficult macroeconomic situation and liquidity conditions in the global and domestic financial markets after the collapse of Lehman Brothers, the statutory liquidity ratio (SLR) of scheduled commercial banks (SCBs) was reduced from 25 per cent to 24 per cent of their NDTL with effect from November 8, 2008.

The liquidity situation has remained comfortable since mid-November 2008 as reflected in the surplus funds being placed by banks daily in the LAF window of the Reserve Bank. Accordingly, it has been decided to restore the SLR for scheduled commercial banks to 25 per cent of their NDTL with effect from the fortnight beginning November 7, 2009.

SCBs are currently maintaining SLR investments at 27.6 per cent of their NDTL, net of LAF collateral securities, and 30.4 per cent of NDTL, inclusive of LAF collateral securities. As such, the increase in the SLR will not impact the liquidity position of the banking system and credit to the private sector.

Although the one percentage point hike in SLR could suck up over Rs 30,000 crore (Rs 300 billion) from the system, the average SLR of banks is already at 27.6 per cent.

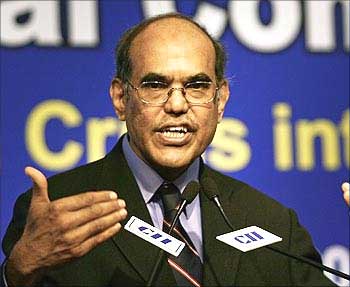

"As such the increase in SLR will not impact the liquidity position of the banking system and credit to the private sector," RBI Governor D Subbarao said, releasing the second quarterly review of the Monetary Policy.

Maintaining the easy credit flow to the private sector would help increase economic activity.

Taking a cue from RBI's Monetary Policy stance, banks are unlikely to hike their auto, home and education loans in the near term.

. . . but loans for commercial real estate may be expensive

However, credit flow to commercial real estate may be affected as the RBI raised the requirement for banks to keep the money aside while lending to this sector from 0.40 per cent to one per cent.

It means banks will have to keep Re 1 aside for every Rs 100 lent to commercial real estate against 40 paise now.

"In view of large increase in credit to commercial real estate sector over the last one year and the extent of restructured advances in the sector, it would be prudent to build cushion against likely non-performing assets," Subbarao said.

The GDP growth projection for FY'10 has been pegged at 6 per cent, same as earlier, assuming a modest decline in agriculture production and a faster recovery in industrial production," the RBI said.

Bank Rate

The Bank Rate has been retained unchanged at 6.0 per cent.

Repo Rate

The repo rate under the Liquidity Adjustment Facility (LAF) has been retained unchanged at 4.75 per cent.

Reverse Repo Rate

The reverse repo rate under the LAF has been retained unchanged at 3.25 per cent.

The Reserve Bank has the flexibility to conduct repo/reverse repo auctions at a fixed rate or at variable rates as circumstances warrant.

The Reserve Bank retains the option to conduct overnight or longer term repo/reverse repo under the LAF depending on market conditions and other relevant factors. The Reserve Bank will continue to use this flexibly including the right to accept or reject tender(s) under the LAF, wholly or partially, so as to make efficient use of the LAF in daily liquidity management.

Cash Reserve Ratio

The cash reserve ratio (CRR) of scheduled banks has been retained unchanged at 5.0 per cent of their net demand and time liabilities (NDTL).

The collateralised borrowing and lending obligation (CBLO) liabilities of scheduled banks were exempted from CRR prescription in order to develop CBLO as a money market instrument. Volumes in the CBLO segment have increased over the years, especially after the phasing out of the non-banks from the inter-bank market. The daily average volume in the CBLO segment, which was only Rs.6 crore in January 2003, is now over Rs.60,000 crore. Since the objective of developing CBLO as a money market instrument has been broadly achieved, it is proposed that:

Liabilities of scheduled banks arising from transactions in CBLO with Clearing Corporation of India Ltd. (CCIL) will be subject to maintenance of CRR with effect from the fortnight beginning November 21, 2009.

Growth projection pegged at 6%

RBI retains economic growth projection to 6 per cent with upward bias for the current fiscal, while upping inflation estimate to 6.5 per cent with upward bias by March end from 5 per cent earlier.

"As always the Reserve Bank will endeavour to ensure price stability and anchor inflation expectations," the central bank said.

IDBI Bank Executive Director Sushil Munot said the signal is quite clear that RBI does not want to hurt growth, but wants to check inflation. It is nevertheless a signal of reversal of easy Monetary Policy.

The central bank kept repo-rate at which banks borrow from RBI in exchange of government bonds at 4.75 per cent, reverse-repo at which the apex bank accepts deposits from banks at 3.25 per cent and Cash Reserve Ratio (CRR), the portion of cash banks park with the Reserve Bank, at 5 per cent -- all unchanged.

Inflation

On inflation, the RBI said, "the base effect, which resulted in negative WPI-inflation till August, is now expected to work in the reverse direction accentuated by high food prices."

The RBI projected inflation to reach 6.5 per cent with upward bias by this fiscal end.

After remaining below one per cent for five consecutive weeks and at sub-zero levels for 13 weeks in a row, the wholesale-price based inflation rose to 1.2 per cent as on October 10 on account of increasing food prices.

Surging food prices, global trend in commodity prices and domestic demand-supply imbalances, are expected to escalate the headline inflation in the months ahead, the central bank said, adding that it will "keep a vigil on inflation" and was prepared "to respond swiftly and effectively to stabilize inflation expectations".

Quoting its inflation expectation survey for households, the apex bank said that while inflationary expectations will remain contained, a majority of the respondents expect inflation rate to increase over the next three months as also over the next year.

With a view to pushing financial inclusion in the country, the Reserve Bank has proposed to allow banks to appoint kirana/medical shop owners, petrol pump owners, PCO operators, retired teachers, agents of small savings schemes of GOI, insurance companies and authorised functionaries of well-run SHGs as banking correspondents.

Besides, banks will be allowed to collect reasonable service charges from customers under their Board-approved policy for delivering services through BCs, the RBI said, adding, "it will review the working of the BC scheme after a period of one year."

Sensex tumbles over 300 points

The Bombay Stock Exchange benchmark Sensex tumbled by over 300 points in mid-session on Tuesday, after the Reserve Bank hiked inflation projection by this fiscal end in its second quarter monetary review.

With the selling pressure rising, the second wide-based National Stock Exchange index Nifty fell below the crucial 4,900 level by losing 90.55 points at 4,880.45 at 1225 hrs. The 30-share Sensex, which commenced the day on a weak note as investors took to cautious trading, fell further to record a loss of 240.07 points at 16,500.43 at the same time.