Are you one of those who go through their weekly astrological forecasts in your newspaper or favourite television channel on Sundays? If forecasts didn't predict the news of an impending transformation in your financial world, you have obviously been wasting your time.

For, on August 2009, Finance Minister Pranab Mukherjee unveiled the Direct Taxes Code Bill, 2009, to be introduced in Parliament later this year.

If enacted, the Bill will not only change the amount of tax you will pay and how but will also transform how you invest, borrow and spend your money. The finance minister successfully managed to make good his promise made during his 6 July Budget speech -- of ushering in a new direct tax code within 45 days.

Unlike his rather insipid Budget proposals, this time Mukherjee has brought in a transformational blueprint of a new tax system, the analysis of whose impact can only make jaws drop.

If one were to describe the system in short, it has tried to simplify the way you will be taxed while taking away most tax-breaks that ultimately complicated yours and the government's life.

Among other things, the Code attempts to provide stability in 'rates of taxes' by bringing them within its own fold.

At present, the tax rates come under the Finance Bill and, thus, are open to change every Budget. Any amendments in the rates of taxes as mentioned in the Code would call for amendments in Parliament, which cannot happen on a regular basis.

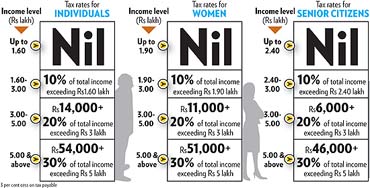

(SEE IMAGE) How much tax do you pay now: Here are the tax rates that are applicable as per the Budget 2009 for financial year 2009-10 depending on your income and the category you fall into.

The unveiling of the Direct Taxes Code will be followed by public debates before Parliament debates it. It will not be before financial year 2011-12 that this tax code will be put in place, if passed by Parliament.

Even as experts examine the finer details of the revolutionary proposals of the new tax code, we have enough information to make you aware of the impending radical changes in your personal finances.

The hand that giveth

One of the hallmarks of the new tax system is the substantial expansion of income slabs.

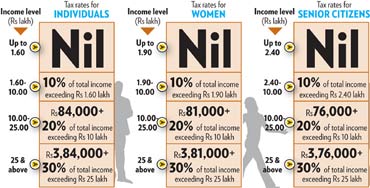

For instance, for an individual, annual incomes up to Rs 1.60 lakh (Rs 160,000) would be tax-exempt, a 10 per cent tax rate would be applicable for incomes between Rs 1.60 lakh and Rs 10 lakh (Rs 1 million), 20 per cent for income between Rs 10 lakh and Rs 25 lakh (Rs 2.5 million), and 30 per cent for income above Rs 25 lakh.

All this will mean significant tax savings when the Code comes into force.

(SEE IMAGE) How much tax you may pay in future: The tax rates that could apply under the proposed Direct Taxes Code Bill, 2009, in financial year 2011-12. Note here that the income slabs have been stretched, bringing down the tax liability.

The present income slabs are much narrower and the tax liability is significantly higher.

Says Vikas Mallan, chief financial officer, Unicon Financial Intermediaries, "Under the proposed Direct Taxes Code, the slabs have been significantly enhanced to take into account realistic income levels."

The hand that taketh away

If generosity marks the changes in income tax slabs, its absence marks other areas. Says Sanjay Grover, tax partner, Ernst & Young, "Currently exempt allowances and benefits such as leave travel assistance and medical reimbursements would be fully taxable under the Code."

There's more grief in store for tax-saving junkies. Prepare to sing a requiem for the existing tax benefit for interest payment on home loans with an annual limit of Rs 1.5 lakh (Rs 150,000) per individual.

This critical driver of the recent real estate boom will be withdrawn if the Direct Tax Code Bill is implemented. But if you have rented out your home that you don't occupy, you will continue to get the existing tax break for unlimited tax deductions for interest payments on loans taken to acquire it.

At the same time, removal of deduction for house rent allowance (HRA) has been proposed.

Capital Gains: Body blow

In keeping with its philosophy of obliterating numerous tax breaks that created a maze out of the existing tax system, the new Direct Tax Code doesn't distinguish between short- and long-term capital gains.

In fact, the new Code proposes to implement a critical recommendation of previous tax reform panels, which suggested that the contribution and return of all investments be made tax exempt with maturity proceeds being taxable -- an exempt-exempt-tax or EET system.

Like other investments, this proposal will impact your stocks and equity mutual fund (MF) investments. At present, in case you sell units of equity-oriented MFs after a year, you do not need to pay any capital gains tax. But if the Direct Tax Code is implemented, you will need to pay tax when you sell your MFs -- be it equity or debt.

The gains get added to your income and taxed as per your income slab. However, in case of gains made after one year, the Code will allow you the indexation benefit before adding the gains to your income. Indexation is a facility offered by the income tax laws to adjust your security's cost price for inflation over the years.

This enables you to inflate your cost price in order to reduce the difference between your selling price and cost prices.

This is done because it is typically presumed that the price you paid for acquiring an asset years back is worth much more today because of inflation. The lower this difference, the lower is your tax liability.

How your investments will be taxed

While some instruments, such as National Savings Certifi cate, will lose tax benefits that they carried at the contribution stage, none of them will offer tax exemption on the final maturity value.

| Contribution | Returns before maturity | Maturity returns | ||||

| Now | Proposed1 | Now | Proposed1 | Now | Proposed1 | |

| POST OFFICE | ||||||

| Public Provident Fund | Exempt | Exempt | Exempt | Exempt | Exempt | Taxable |

| National Savings Certificate | Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable |

| Kisan Vikas Patra | Non-Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable |

| Senior Citizens Savings Scheme | Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable |

| Time Deposits (5 years) | Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable |

| BANK DEPOSITS | ||||||

| Bank FDs | Non-Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable |

| Tax-saving FDs | Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable |

| MUTUAL FUNDS | ||||||

| Equity (Growth) | Non-Exempt | Non-Exempt | NA | NA | Exempt2 | Taxable3 |

| Equity (Dividend) | Non-Exempt | Non-Exempt | Exempt | Exempt | Exempt2 | Taxable3 |

| Debt (Growth) | Non-Exempt | Non-Exempt | NA | NA | Taxable | Taxable3 |

| Debt (Dividend) | Non-Exempt | Non-Exempt | Exempt | Exempt | Taxable | Taxable3 |

| ELSS4 | Exempt | Non-Exempt | Exempt | Taxable | Taxable | Taxable3 |

| Liquid funds | Non-Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable3 |

| Pension MFs | Exempt | Non-Exempt | Taxable | Taxable | Taxable | Taxable3 |

| INSURANCE | ||||||

| Endowment | Exempt | Exempt | Exempt | Exempt | Exempt | Taxable5 |

| ULIPs | Exempt | Exempt | Exempt | Exempt | Exempt | Taxable5 |

| Pension | Exempt | Exempt | Taxable | Exempt | Taxable | Taxable |

| Superannuation Fund | Exempt | Exempt | Taxable | Exempt | Taxable | Taxable |

| GOLD | ||||||

| Physical gold | Non-Exempt | Non-Exempt | NA | NA | Taxable | Taxable3 |

| ETF gold | Non-Exempt | Non-Exempt | NA | NA | Taxable | Taxable3 |

| REAL ESTATE | Non-Exempt | Non-Exempt | NA | NA | Taxable | Taxable3 |

| Exempt: Tax benefit on contribution or returns or maturity amount. Non-exempt: No tax benefit. Taxable: Returns or maturity amount taxable. NA: Not Applicable. 1As proposed in Direct Taxes Code Bill, 2009. 2Over one year. 3 Indexation benefit over one year. 4May be discontinued as no more within the list of tax-saving instruments. 5If premium is less than 5% of sum insured. | ||||||

For investments in equity shares, mutual funds, physical gold, gold exchange traded funds (ETFs) and real estate that are less than one-year-old, the capital gains will be added to the taxable income without indexation benefits.

Gains from investments in these assets for more than a year will be added to the taxable income after allowing for indexation benefit.

Tax savings

The Code may have done away with the numerous tax breaks, but it still provisions for tax-saving investments and guess what the limit has gone up to? It is Rs 3 lakh (Rs 300,000) per annum.

But the trick is that you will be permitted to invest only in certain options -- Public Provident Fund (PPF), Employees' Provident Fund, life insurance, superannuation funds and National Pension System (NPS), besides claiming for children's tuition fee expenses.

This simply means no more tax breaks for National Savings Certificates, Senior Citizens Savings Scheme, tax-saving bank fixed deposits and equity-linked savings schemes (ELSS) of MFs.

It has been proposed that the maturity proceeds of PPF and insurance be taxed.

In case of insurance policies, there is an exception. Says Ernst & Young's Grover: "Deduction will be allowed in respect of any sum received under a life insurance policy, including any bonus, only if the premium payable for any of the years during the term of the policy does not exceed 5 per cent of the capital sum assured and the sum is received only upon completion of the original period of the contract of the insurance or upon the death of the insured."

Receding tax shelter: The impact on the taxability of home loan for a self-occupied and a rented out house (See table below).

| | Now | Proposed*** |

| SELF-OCCUPIED HOUSE | ||

| Interest payments | Deductible up to Rs 1.5 lakh | No Tax benefit |

| Principal repayments | Deductible up to Rs 1 lakh | No Tax benefit |

| HOUSE ON RENT | | |

| Interest payments | Unlimited deduction | Unlimited deduction |

| Principal repayments | Deductible up to Rs 1 lakh | No Tax benefit |

| Note: HRA benefits will be fully taxable. ****As per the Direct Taxes Code Bill, 2009 | ||

Argues Ajay Seth, senior director (legal & compliance), Max New York Life Insurance, "Adopting the exempt-exempt-tax model that has been proposed will imply that savings above Rs 3 lakh be taxed twice, at the time of making the contribution and again on maturity on the full amount, including the principal."

While Outlook Money's all-time favourite PPF continues to be a permitted tax-saving investment, it loses some sheen as its maturity proceeds will become taxable.

"This will change the way people look at PPF, which has, so far, always enjoyed tax-free returns," says Veer Sardesai, a Punebased financial planner.

The message is clear: You can get tax breaks for retirement savings or educational expenses. The existing tax breaks for health insurance, with the existing annual limits of Rs 15,000 and Rs 20,000 for senior citizens, as well as those for interest repayment for educational loans and notifi ed donations continue in the new regime too.

When considered in the backdrop of growing retirement periods and the high cost of retirement living, educational and healthcare costs, this exception to the general rule of erasing tax exemptions makes a lot of sense.

"People will look at permitted savings options as long-term investment and wealth creation products rather than merely tax-saving options as is the case today," feels Sardesai.

The impact of a fundamental change in taxation can't realistically be encapsulated in a few pages. We have so far brought before you the major changes that immediately come to notice. In the days to come, many more aspects that could have far-reaching impact may come to light and debates may get more intense.

We will keep bringing you the analysis and updates as the events unfold. For now, it will suffice to say that we feel that the gains from wider and simpler tax slabs, larger provisions of tax-advantaged long-term savings far outweigh the loss of the plethora of tax savings.

Albert Einstein, possibly the world's most cerebral physicist and the person who changed the course of mankind with his discoveries, had once remarked, "The hardest thing to understand in the world is income tax." Einstein proved Newton wrong. Can Pranab Mukherjee's new Direct Tax Code prove Einstein wrong?

| THE TAX ROUTE |

| Here's how your taxable income will be calculated if the Direct Taxes Code Bill, 2009, is enacted |

| GROSS TOTAL INCOME: From ordinary sources |

| Income from employment |

| Income from house property |

| Income from business |

| Capital gains |

| Income from residuary sources |

| LESS: |

| Deduction on: Permitted savings |

| PPF, EPF, insurance, NPS, tuition fees |

| ADD: Total income from special sources |

| All income taxed at special rates. |

| Example: Capital gains on transfer of shares/equity mutual funds |

| = TOTAL INCOME |

| LESS: |

| Incentives |

| Medical, donation, higher education |

| = TAXABLE INCOME |

With Kayezad E Adajania and Deepti Bhaskaran, Outlook Money