The gas dispute between the Ambani brothers is hurting global investors' confidence in India, says an industry report, urging the government to set priorities for the usage of gas and the pricing to prevail.

The report in a United States-based monthly magazine Energy Tribune says the Indian government owns the natural gas resources at stake in the Ambani dispute.

"The government-set price must prevail to continue to provide an attractive domestic business environment, increase domestic energy supply and strengthen global energy security," Energy Tribune editor-in-chief Michael J Economides said in the report.

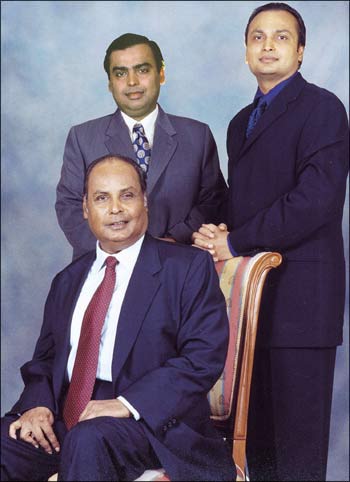

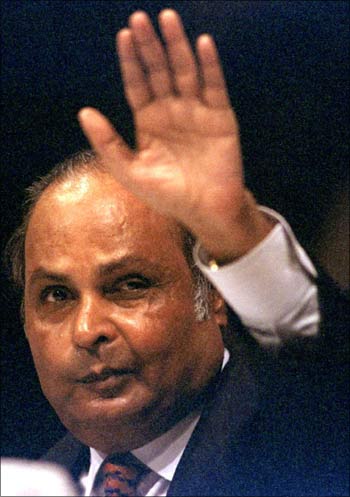

Anil Ambani is seeking to enforce a family agreement that gives his group firm RNRL natural gas from elder brother Mukesh Ambani-run RIL at $2.34 per mmBtu, 44 per cent lower than the government approved rates. The case is now in the Supreme Court.

"As other economies around the world start to regain their confidence in global markets, investors are again beginning to look for new places to build companies, create jobs and facilitate new social development. Yet, the current Ambani brother dispute seriously hurts investors' confidence in India, and that spells danger for future generations in India who will need a greatly-expanded energy supply to power their dynamic economy," the report stated.

The history of successful developing nations suggests that a strong government hand in setting clear rules for the market is critical to long-term economic development.

Effective governance requires that private actors not be permitted to undermine the integrity of sensible law.

As such, the Indian government should use this opportunity to step in and ensure a smooth functioning marketplace, the report said.

Moreover, the legal battle continues to lock up abundant and affordable energy, while 400 million Indians remain without what is considered a basic necessity in most developed countries - electricity.

"The government must maintain as its number one priority the advancement of its citizens' welfare by ensuring a smoothly functioning market," the report said.

It said the Indian government needs to ensure a price that accounts for the true cost of production and development which will enable the country's growing energy market to attract investors and develop over the long term.

A successful settlement, it said, of the suit would open up abundant and affordable energy that is presently threatening businesses and power supplies, and increase the domestic and foreign investment that has been stymied by the Ambani disagreement.

"Millions of Indians would improve their daily lives in the process," the report added.

Elaborating on the necessity of energy development in the country, the report pointed out that it is vital for not only the country's energy security but also for international security.

"Currently, though, the natural gas dispute between Mukesh and Anil Ambani over the memorandum of understanding (MoU) brokered by the brothers' mother in June 2005 is marring efforts to expand India's clean energy reserves, to the detriment of consumers, businesses and investors alike," Economides said.