The impact was so huge and shocking that it led to a global meltdown.

The recession triggered unemployment, which rose to all-time highs in the US and around the world. Markets felt the ripples of the meltdown wiping off trillions of dollars of investor wealth.

Many companies including auto giants General Motors and Chrysler went bankrupt.

Global economies are still reeling under the aftereffects of the recession. Consumer spending fell by 1 per cent in the second quarter in the US.

An International Monetary Fund study estimates losses on US loans and securities at $2.7 trillion through 2010. It pegs global losses were pegged at $4.1 trillion.

In the US, over 6 million lost their jobs. Housing prices in the US fell by 12 per cent after the Lehman's bankruptcy, thousands in the US were rendered homeless.

Scared investors moved out in search of safer markets.

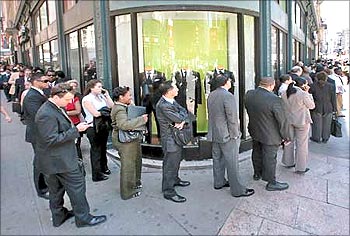

The retail sector was been hit hard, many stores were forced to shut shop, lay off thousands and offer goods at throwaway prices.

The fall in demand in one of the world's largest consumer markets had hit exports in several countries including India.

The world trade is set to shrink considerably by 11 per cent in real terms and by more than 20 per cent in current dollars (terms), a United Nations Conference on Trade and Development report said.

The White House has forecast a whopping $9.05 trillion deficit for the 2010-2019 period, up by $2 trillion from the February estimate.

The rising fiscal deficit could hit further reforms and economic growth. The Office of Management and Budget forecasts a weaker economic recovery as the gross domestic product falls by 2.8 per cent this year.

Stimulus to revive the economy

US President Barack Obama pumped in a $787-billion stimulus to revive the economy, a total collapse was thus avoided.

The world leaders also announced a $1.1 trillion injection of financial aid into the global economy at the G20 summit in London.

In other measures, the US government strengthened banks and other financial institutions. The real estate, which faced the brunt of the recession, is now under higher government regulation and scrutiny.

The US economy will go through a tougher phase as it struggles for more credit to revive the economy. The banks have now cut down the issuance of credit cards and home loans. But experts say these measures anr not enought to avert another crisis.

The Federal Reserve's latest survey of businesses found economic activity improving in most regions. But this momentum can be sustained only if consumers start spending more money.

The US GDP fell just one per cent in the second quarter of 2009 compared to a fall of 6.4 per cent in the first three months. The GDP growth is expected to turn positive with a growth of 2 percent in 2010, and rise to 3.8 per cent after a year.

The economy is gradually showing signs of stability but unemployment continues to be a major issue though the rate at which jobs were being slashed has come down.

The pace of US job losses slowed in August while the unemployment rate reached a 26-year high, signaling the recovery from recession will be slow to develop.

On a positive note, banks have started seeing second-quarter profits.

"Thanks to the bold and decisive actions we have taken since January, I can stand here with confidence and say that we have pulled this economy back from the brink." Obama said last week.

Goldman Sachs, JPMorgan Chase, which are back on track after getting bailout packages are again focusing on potentially risky businesses like bonds and certain financial products.

The Bank of America and Citibank have been given several tax sops and loan guarantees to enable them grow faster. The administration continues to take advice from the same people in the industry who could not foresee the earlier risks and dangers in the system.

No significant changes have been made to federal rules. Many experts warn that if such risks are not taken care of in the beginning, it could lead to further major financial crises in the future.