| « Back to article | Print this article |

Builders start raising home prices again

DLF, the country's largest property developer, will soon conduct a poll among property brokers to decide the pricing and number of apartments to be offered in the second phase of its Capital Greens project in West Delhi.

It's a novel experiment, but property brokers in Delhi say the company is trying to test the waters in view of the vastly changed situation in the real estate market.

Though DLF's spokesman said the company is yet to fix a final price, feedback from brokers suggests the company is exploring the option of charging around Rs 7,000 a square foot (sq ft).

At this level, the price is 56 per cent more than Rs 4,500 a sq ft it charged in the first phase of Capital Greens, when DLF had sold 1,356 apartments in a single day in April this year.

Builders start raising home prices again

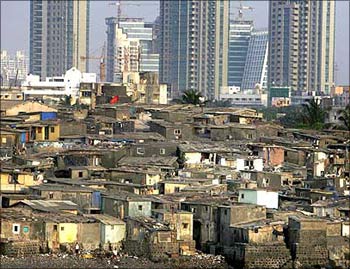

Developers such as DLF, Unitech, Omaxe, Parsvnath and HDIL were among those that cut property prices or forayed into mid-income housing, which were 25 to 30 per cent lower than prevailing prices, in the last quarters of 2008-09, as the economic slowdown and fears of job losses impacted home sales.

Property sales fell 50 per cent from their peak in 2007-08 (when prices had more than doubled froom 2004-05) as buyers stayed away.

Those days are rapidly becoming a distant memory, with many developers increasing prices 15 to 30 per cent the moment they became sure of demand returning.

Builders start raising home prices again

Take Mumbai-based Lodha Developers. The developer has increased prices 30 per cent in its premium housing project, Lodha Primero in South Mumbai, since its launch about four months ago. It has already sold 90 per cent of the apartments. For its mid-income projects, Lodha has increased prices 12 to 14 per cent.

Neptune Group, another Mumbai-based property developer, has increased prices in its Neptune Flying Kite project in Bhandup 26 per cent, from Rs 4,691 a sq ft a couple of months ago to Rs 5,900 a sq ft.

The national capital region (NCR) is not far behind with housing prices in Gurgaon having moved up to Rs 3,200 a sq ft from Rs 2,800 a sq ft six months back, brokers in the locality say.

Builders start raising home prices again

Unitech, the country's second largest developer, which is mostly focusing on mid-income housing projects under the Unihomes brand, is also considering a minor price rise in its home prices, a company official says.

"Markets are looking up and this is prompting developers to come up with increased prices for their Navratra launches. Prices are up by 15 to 20 per cent in the secondary market," says Anil Singhal, a property consultant based in Connaught Place, Delhi.

Navratra, a Hindu festival, is considered auspicious for property buys and developers generally launch new projects in the 10-day period.

Builders start raising home prices again

Developers say the move to increase prices is in tune with rising demand from home buyers.

"We are not hoarding our property. When the market was down, we were quoting low prices. Since it has moved up, we have increased prices. We sell according to the forces of demand and supply," says Nayan Bheda, chairman and managing director of Neptune Group.

Adds R Karthik, senior vice president of marketing at Lodha Developers: "It is a standard way of operating projects. It is a strategic as well as tactical move so as to offer value for those who have bought properties."

Builders start raising home prices again

However, the move to raise housing prices has had its fair share of criticism. Analysts warn that property sales may fall again if developers increase prices sharply since the economic recovery is hardly complete.

"Demand is coming back with much difficulty. It does not make sense to increase prices now. They have to hold prices steady till demand comes back fully," says Anuj Puri, chairman of Jones Lang LaSalle Meghraj (JLLM), an international property consultant.

According to a recent CII study, the Indian real estate market is expected to recover only in 2010-11.

However, the government growing fiscal deficit is expected to impact the sector negatively with increases in the cost of funding and falling return on investments through exchange rate variations.

Builders start raising home prices again

Some have been once-bitten-twice-shy and have avoided raising prices. Parsvnath Developers Chairman Pradeep Jain says he doesn't see any scope to increase prices for the next couple of months.

"We have to concentrate on selling properties and generating internal accruals first. We are planning to sell properties with attractive discounts in the festive season," says Jain who is also president of NCR chapter of the Confederation of Real Estate Developer's Associations of India (Credai).

Going by the trend in property prices in recent weeks, few of his counterparts in other real estate companies agree with Jain.