| « Back to article | Print this article |

13 Indian firms in Asia's Fab 50 list

Thirteen Indian companies have found a place in Forbes's annual ranking of the best of Asia-Pacific's biggest listed companies. Infosys Technologies and Wipro have made it to the list every year since the ranking was introduced in 2005.

These companies have 'staying power', says Forbes. "Our list is a mix of giant, established companies -- this year that list includes Australian miner BHP Billiton, Hong Kong conglomerate Noble Group and Indian oil and gas heavyweight Reliance Industries -- and smaller outfits such as Agile property Holdings, Anhui Conch Cement and digital China Holdings," Forbes Asia said in a statement.

China has the largest number of companies in the list with 16 companies.

The criteria for selection was at least $3 billion in revenue or a $3 billion market capitalization. The company's five-year track record for revenue, operating earnings and return on capital were taken into consideration for the ranking.

The recent results, share-price movements and the outlook for the year ahead were the other criteria for companies to make it to the prestigious list.

Check out the Indian companies that made it to the Forbes Asia's Fab 50 list. . .

13 Indian firms in Asia's Fab 50 list

The Reliance Group, founded by the late Dhirubhai H. Ambani is one of India's largest private sector enterprises, with businesses in exploration and production of oil and gas, petroleum refining and marketing, petrochemicals, textiles, retail and special economic zones.

The net profit of Reliance Industries dropped 11.5 percent to Rs 3,636 crore (Rs 36.36 billion) for the quarter ended June 30, compared to Rs 4,110 crore (Rs 41.10 billion) in the corresponding period last year.

Market cap: $70.6 billionSales: $28.8 billion

Market cap as of Sept. 15, 2009.

13 Indian firms in Asia's Fab 50 list

Telecom giant Bharti Airtel is the flagship company of Bharti Enterprises, one of India's leading provider of telecommunications services.

The Bharti Group recently forayed into retail business with Wal-Mart for the cash and carry business.

It has successfully launched an international venture with EL Rothschild Group to export fresh agri products exclusively to markets in Europe and USA and has launched Bharti AXA Life Insurance Company Ltd under a joint venture with AXA.

Bharti Airtel reported a 4 per cent rise in net profit at Rs 2,239 crore (Rs 22.39 billion) for the quarter ending March 31, 2009.

Market cap: $32.4 billionSales: $7.4 billion

13 Indian firms in Asia's Fab 50 list

Infosys Technologies Ltd was started in 1981 by seven people under the leadership of N R Narayana Murthy. It is one of India's largest IT companies that delivers technology-enabled business solutions that help global companies.

Infosys' offerings span business and technology consulting, application services, systems integration, product engineering, custom software development, IT infrastructure services and business process outsourcing

The net profit of the company stood at Rs 1,527 crore (Rs 15.27 billion) for the quarter ended June 2009.

Market cap: $26.8 billion

Sales: $4.2 billion

13 Indian firms in Asia's Fab 50 list

A part of the Tata Group, TCS is India's biggest software exporter. Established in the year 1968, it offers a wide range of IT services, outsourcing and business solutions.

TCS reported a net profit of Rs 1,534 crore (Rs 15.34 billion), up 19 per cent year-on-year (Y-o-Y) for the first quarter ended June 30, 2009.

Market cap: $23.0 billion

Sales: $5.4 billion

13 Indian firms in Asia's Fab 50 list

BHEL is among the largest engineering and manufacturing enterprise in India in the energy-related/infrastructure sector.

The company was established more than 40 years ago and the company has been making profits since 1971-72 and paying dividends since 1976-77.

Despite the recession, BHEL recorded an all time high turnover of Rs 28,033 crore (Rs 280.33 billion) in 2008-09.

The company reported its highest ever net profit of Rs 3,138 crore (Rs 31.38 billion) in 2008-09.Market cap: $22.8 billion

Sales: $5.2 billion

13 Indian firms in Asia's Fab 50 list

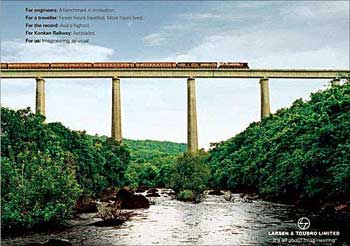

Larsen & Toubro Limited (L&T) is India's leading engineering and construction conglomerate with interests in electricals, electronics and IT.

Larsen & Toubro's net profit rose to Rs 1,598 crore (Rs 15.98 billion) in quarter ending June 2009 for the financial year 2008-2009 compared to Rs 502 crore (Rs 5.02 billion) in the same period the previous year.

Market cap: $19.7 billionSales: $8.0 billion

13 Indian firms in Asia's Fab 50 list

Wipro offers comprehensive IT solutions and services, including systems integration, information systems outsourcing, IT enabled services and research and development services to corporations globally.

Wipro has grown to be among India's top IT companies under the leadership of Azim Premji.Wipro started as a vegetable oil trading company in 1947.

For the quarter ended June 30, 2009, revenue of Wipro Limited business was Rs 627.4 crore (Rs 62.74 billion), a YoY growth of 5 per cent and PBIT at Rs 101.6 crore (Rs 10.16 billion), an increase of 12 per cent YoY.

Market cap: $16.9 billion

Sales: $5 billion

13 Indian firms in Asia's Fab 50 list

HDFC Bank was incorporated in August 1994. It currently has an nationwide network of 1416 branches and 3382 ATMs across India.

HDFC Bank net profit rose by 30.53 per cent to Rs 606.11 crore (Rs 6.06 billion) in quarter ended June 2009 for the financial year 2008-2009 compared to Rs 464.35 crore (Rs 4.64 billion) in quarter ended June 2008.

Market cap: $13.3 billionSales: $3.9 billion

13 Indian firms in Asia's Fab 50 list

With an annual turnover of over Rs 10,000 crore (Rs 100 billion), Jindal Steel & Power Limited (JSPL) forms a part of the over Rs 60,000 crore ($12 billion) Jindal Group. JSPL is a leading player in steel, power, mining, oil & gas and infrastructure. Market cap: $11.8 billion

Sales: $2.1 billion

13 Indian firms in Asia's Fab 50 list

Tata Steel is among the top ten steel producers in the world. Established in 1907, it is the first integrated steel plant in Asia and the world`s second most geographically diversified steel producer and a Fortune 500 Company.

Tata Steel has global presence in over 50 developed European and Asian markets with manufacturing units in 26 countries.

Tata Steel has reported a 61 per cent drop in its consolidated net profit at Rs 4,849 crore for the year ended March 31, 2009, against Rs 12,322 crore registered in the same period last year

Market cap: $9 billion

Sales: $28.7 billion

13 Indian firms in Asia's Fab 50 list

The Mahindra Group is among the top 10 industrial houses in India. Mahindra & Mahindra is the only Indian company among the top three tractor manufacturers in the world.

The group has a presence in key sectors including the financial services, trade and logistics, automotive components, information technology and infrastructure development.

The net profit for the quarter ended June 30, stands at Rs 400.9 crore (Rs 4 billion) against Rs 159.3 crore (Rs 1.59 billion) in Q1 last year, a growth of 151.7 per cent.

Market cap: $5.5 billion

Sales: $5.1 billion

13 Indian firms in Asia's Fab 50 list

Axis Bank was the first among the new private banks to start in 1994.

Axis Bank, formerly known as UTI Bank provides commercial banking services which include merchant banking, direct finance, infrastructure finance, venture capital fund, advisory, trusteeship, forex, treasury, investment banking, insurance, credit cards, mortgage financing, depository services and other related financial services.

Axis Bank's net profit rose by 70.2 per cent to Rs 562.04 crore (Rs 5.62 billion) in the quarter ended June 2009.

Market cap: $6.7 billionSales: $2.7 billion

13 Indian firms in Asia's Fab 50 list

The Adani Group is one of the fastest growing enterprises in India. The flagship company, Adani Enterprises was established by Gautam Adani in 1988 as a partnership firm with a seed capital of Rs 5 lakh.

Today, the Adani business portfolio includes edible oil, logistics, power generation, coal, oil and gas exploration, gas distribution, real estate, ports, special economic zones and IT enabled services.

Adani Enterprises posted an over 36 per cent rise in its consolidated net profit to Rs 127.67 crore (Rs 1.27 billion) for the first quarter ended June 30.

Market cap: $3.2 billionSales: $5.1 billion