Thus, within the first half of 2010, service providers could end up with lesser market shares if they don't guard against the marketing moves of rivals.

IMRB, the market research outfit, has come out with a syndicated study called Switch to forecast the behaviour of mobile phone users after portability. Read on. . .

IMRB quizzed users on the importance of their numbers, their satisfaction with service providers and if the criteria set by TRAI such as paying Rs 250 and going without a network for two hours would deter a switch.

They were then asked if they wished to change and why. Thus, the study was able to track the likely churn or the number of subscribers who will shift from one service provider to the next, GSM to CDMA, pre-paid to post-paid and so on.

As many as 70 to 90 per cent subscribers feel it is extremely important to retain their current mobile number. After portability is allowed, the survey expects an average 20 per cent of the people to move out of their existing operators.

Delhi could see the highest churn of 24 per cent and Ahmedabad the lowest of 8 per cent. It says that 25 to 35 per cent subscribers will switch operators due to network congestion and another 17 to 25 per cent due to tariff options -- grievances that often top the dissatisfaction list of Indian subscribers.

Service providers say that with prepaid customers comprising more than 85 per cent of the Indian mobile telephony market, they are no strangers to churn. Says Idea Cellular chief corporate affairs officer Rajat Mukarji: "We already have a vibrant prepaid market where customers switch service providers periodically."

This is crucial because such customers turn in higher revenue. Market estimates suggest the average revenue from a postpaid user is up to twice that of a prepaid user.

Fifty per cent of the postpaid users in the survey were willing to switch once portability is activated.

Ernst & Young Leader (telecommunication) Prashant Singhal points out that portability will appeal more to users in socio-economic categories A and B -- people who opt for a postpaid connection that requires a certain credit criteria and stronger address proof.

Subscribers in socio-economic categories C and D, Singhal feels, will not be affected much because they are primarily tariff-sensitive and don't dwell much on customer service or convenience of use.

Among post-paid users, reveals IMRB Group Business Director Sanjay Pal, there is a feeling of getting less from service providers than what they deserve.

There are satisfied subscribers also who might get tempted to switch to a new service provider if they can carry their number along, according to the survey.

Pal observes that despite a satisfaction rate of around 60 to 65 per cent among GSM users, the percentage of satisfied customers willing to move after portability could range from 6 to 20 per cent.

Only 6 per cent of Delhi's satisfied customers are willing to move, while Ahmedabad clocks the highest at 20 per cent. Pal attributes it to an "anti- incumbency factor" -- the tendency of users who still want to choose another operator even when it has nothing special to offer.

Switch estimates that for most players, the maximum movement of inflow and outflow (nearly 65 per cent) would occur in the first two months because those who have waited for portability will do so immediately.

It also underlines the importance to brace for churn in a brief span of time. It would trigger the need to pull customers as it would the need to retain existing customers.

Hence, Singhal says this will bring the quality of service to the fore in marketing campaigns of operators. "More and more players will talk about their network and what their customer service means, rather than harp on tariff schemes which most players have been doing till now."

Abdul Khan, head of marketing, Tata DoCoMo, says, "Both incumbents and challengers will have to shore up their overall customer experience measures."

It won't be inexpensive, mind you. Portability will require operators to share data and agree on porting charges and timelines as well as upgrade their technology. Singhal puts the investment at a few hundred million dollars. "The cost will work out to around $70 per subscriber that is acquired," he estimates.

Operators' bandwidth, service and accounting would be put to test with the extra inflow and outflow of subscribers. The survey also identifies outflow and inflow patterns that will help operators fine-tune their post-portability strategy.

Playing spoilsport for the operators will be disproportionate outflow and inflow ratios. In Mumbai, the survey found, a leading GSM player might get more subscribers than it loses, but the outflow is expected to take place at a faster pace.

Another GSM player in the city stands to gain 128 per cent (if 100 subscribers move out, 228 will move into its network from other operators).

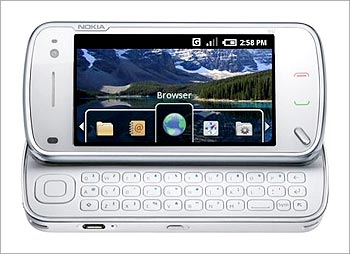

In the same market, a CDMA player will experience a net impact of 80 per cent (will lose 180 subscribers for 100 it gains). The upshot is that CDMA users are more than willing to port to GSM networks. "High-revenue CDMA users are most likely to migrate to GSM," says Pal.

"A general shift from CDMA to GSM is too simplistic. CDMA operators issue handsets with connections that are locked to the operator's network. So when migrating to GSM, it would cost CDMA users more than just the cost of a SIM card.

They will have to invest in a handset as well," says Tata Teleservices Chief Marketing Officer Lloyd Mathias. "We are in the process of profiling users on their usage and handsets. For instance, we will contact those who have been with us for two years and have a monthly bill of Rs 1,000 and more with special offers such as discounts. This could be a group of a few hundreds or even 10,000."

While CDMA operators are expected to be hit the hardest, market leaders stand to gain the most because of their strong brand equity.

Players in the middle rungs, who don't lead yet, could be in the eye of the churn too, according to Pal. Singhal differs: "Players who are neither leaders nor newcomers will gain subscribers because of less congested networks (unlike leaders) and stronger customer service and infrastructure than new players, so they can handle the traffic better."

Brand pull and customer service will decide the drift for the operators. In Delhi, IMRB found that a GSM operator has a very strong pull over its rivals. Its market share is set to increase after portability, according to the survey.

"High-end customers will be more sensitive to branding and customer experience. Branding power in telecom becomes clear when users are ready to forgive their operator for its errors because the brand resonates with them," says Mukarji.