Credit cards have made our lives easier in more ways than one. But they also leave us susceptible to frauds. Here's how to protect yourself:

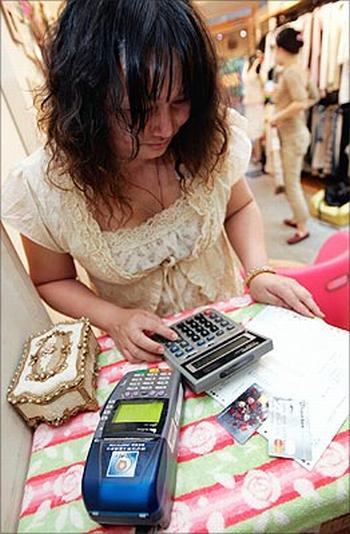

1. What precautions should I take at the time of making transactions in a shop establishment ?

Before using the credit card, ensure that you have signed on the signature panel on the reverse of your card with a non-erasable pen. Also ensure that the amount spent is within the credit limit sanctioned to you by the credit card company.

Always guard your card, i.e., whenever you hand it over at the billing counter, be present while the card is being swiped. Once the transaction is approved, a charge slip will be generated. Ensure that your name, date of transaction, card number and, most importantly, the amount billed are correct before signing the charge slip.

You may also enter the amount in words. At certain shop establishments, you may be asked to sign on the bill in addition to the charge slip. You should ensure that the amount on the bill is the same as the amount on the charge slip. You must always retain the charge slip till the transaction is reflected in your credit card statement.

Also ensure that the amount in the statement matches with that of the charge slip. Any irregularities in your card account should immediately be brought to the notice of the bank.

Click NEXT to read on. . .

Remember to take back your credit card as soon as the transaction is completed. Sign only one charge slip per transaction. If there is an error on the charge slip, don't sign it and ensure that the erroneous charge slip is destroyed in your presence.

2. How should I avoid any damage to or misuse of the card?

To prevent damage to the card, don't keep it in an area having a continuous magnetic field, for example, near a TV; don't scratch or tamper with the magnetic strip that contains coded information for the security of your card; don't bend the card or keep two cards with their magnetic strips facing each other; and keep the card away from extreme heat and direct sunlight.

Never hand over your card to any stranger or share its details with anyone, not even to some one claiming to represent the card-issuing bank or its associates.

Never reveal your PIN (personal identification number) to anyone; don't keep the card and the ATM PIN together. Surrender the card only to a designated official of the bank after cutting it diagonally into two pieces across the magnetic strip.

Keep a record of your credit card numbers and telephone numbers for reporting lost or stolen cards.

Click NEXT to read on. . .

To avoid frauds in online transactions, the Reserve Bank of India (RBI) has advised banks to undertake the following risk mitigation for online card transactions:

A system of providing for additional authentication/validation based on information not visible on the cards for all online transactions; and

A system of 'online alerts' to the cardholder for all transactions of the value of Rs 5,000 and above.

By taking certain precautions, users can prevent their credit or debit card from being misused both online and offline:

a. Do not provide photocopies of both the sides of the credit card to anyone. The card verification value (CVV) which is required for online transactions is printed on the reverse of the card. Anyone can use the card for online purchases if the information is available with them. Do not click on links in emails seeking details of your account: they could be phishing emails from fraudsters. Most reputed companies will ask you to visit their website directly;

b. While using a credit card for making payments online, check if the website is secure. The address bar will begin with "https". The CVV will also be required;

c. Do not give any information to persons seeking credit card information over the phone.

d. Notify your bank/credit card issuer if you do not receive the monthly credit card statement on time. If a credit card is misplaced or lost, get it cancelled immediately.

Click NEXT to read on. . .

3. Can a credit card be issued without applying for the same?

Banks/NBFCs have been advised that unsolicited cards should not be issued. The written consent of the applicant would be required before issuing a credit card.

If an unsolicited card is issued and activated, the card-issuing bank shall not only reverse the charges, but also pay a penalty to the recipient amounting to twice the value of the charges reversed. Any loss arising out of misuse of such unsolicited cards will be the responsibility of the card issuing bank/NBFC.