| « Back to article | Print this article |

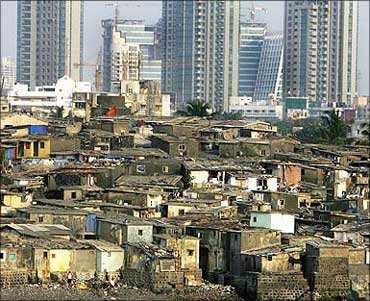

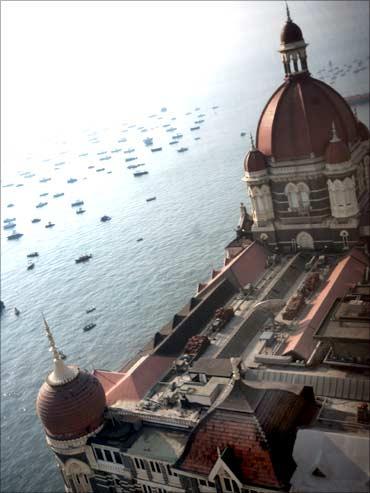

Housing prices in Mumbai aim for the sky, again

Apartments at Ashok Towers in the Parel area of Mumbai command a price of Rs 28,000-29,000 a sq ft. This is higher than what developers were charging at the peak of the property market boom during 2007-08.

The prices then were Rs 25,000-26,000 a sq ft. During the slowdown in 2008-09, the rates had come down to Rs 16,000-Rs 17,000 a sq ft.

Ashok Towers isn't alone, something noted by the Reserve Bank of India's governor last week. In his monetary policy statement, the governor mentioned real estate prices in Mumbai having gone beyond the pre-crisis levels.

There are other instances. Flats in Lodha Bellissimo, another upscale project in the nearby Mahalaxmi area, are selling at Rs 23,000-24,000 a sq ft, nearly 10 per cent higher than at their peak. Prices had gone down to Rs 15,000 a sq ft during the slowdown.

Apartments at Raheja Vivaria in the same locality today quote at Rs 28,000 a sq ft, about the same as the peak levels.

That's a smart recovery from the slowdown days, when the same apartments were available at 40 per cent lower prices.

Click NEXT to read further. . .

Housing prices in Mumbai aim for the sky, again

Home prices across the country's commercial capital have crossed their peak levels as developers raised prices in the backdrop of improved demand.

Home buyers had returned to the market since the second quarter of 2009, as developers cut prices by 20-30 per cent to woo buyers.

But, since then, according to property consultants, Mumbai developers have increased prices by up to 40 per cent in both new and existing projects, depending on the possession target and locality.

The result, say observers, is that residential sales have come down by 20-25 per cent since December 2009. What has surprised industry-watchers is that developers are not ready to cut prices even after this.

Click NEXT to read further. . .

Housing prices in Mumbai aim for the sky, again

"Since March this year, sales are almost at a standstill. I clearly see a bubble in the making, as prices are going up without sufficient sales to back it up.

"If the same situation continues, I think developers will face a huge debt pile-up, like in 2008-09,'' says Pankaj Kapoor, managing director of Liases Foras, a real estate research firm.

By government estimates, developers have accumulated debt of Rs 75,000 crore (Rs 750 billion) and need to pay Rs 25,000 crore (Rs 250 billion) in interest and principal in the current financial year.

According to Liases Foras' research, the difference between the weighted average price of properties sold a year earlier and those available today is up by 86 per cent.

If the weighted average price of properties sold in the Mumbai Metropolitan Region was Rs 3,700 a sq ft in 2009, today they are at Rs 6,900 a sq ft.

Click NEXT to read further. . .

Housing prices in Mumbai aim for the sky, again

Take the instance of areas adjoining the Jogeshwari-Vikhroli Link Road, which connects Mumbai's western and eastern suburbs.

Apartment prices here are around Rs 10,000 a sq ft, as against the Rs 6,200 a sq ft at which apartments were sold in 2009.

"If properties were not selling at these rates at the peak of 2008, how can they sell now during the recovery phase? Besides, home loan rates have also gone up to 9 to 9.5 per cent now,'' Kapoor adds.

According to Pranay Vakil, chairman of property consultancy Knight Frank India, property transactions with most developers have dropped to just three to four a month, as compared to 20-25 a month earlier.

"There is a clear resistance to price rise. I don't think prices will go up from here,'' Vakil says.

Click NEXT to read further. . .

Housing prices in Mumbai aim for the sky, again

If sales are not happening, why are developers bidding for big-ticket land deals and launching new projects?

According to Vakil, developers have increased the carpet to built-up area ratio, the proportion between the net usable area you get and the total constructed area, which includes thickness of walls.

This ratio, he says, has risen from 42 per cent to over 50 per cent now.

"Developers are making up high-value land deals with higher loading (the term for the carpet to built-up ratio). In such cases, buyers end up paying more for what they get," says Vakil.

In first three months of the year alone, deals worth Rs 5,000 crore (Rs 50 billion) have taken place in Mumbai. Liases Foras's Kapoor also sees an initial public issue angle in the skyrocketing of prices. "Developers are not bothered about sales.

"They are hiking prices to show higher valuations to investors, so that they can dilute less in their issue," he adds. A dozen developers have lined up IPOs worth Rs 17,000 crore (Rs 170 billion).

Click NEXT to read further. . .

Housing prices in Mumbai aim for the sky, again

Some developers are seeing the benefit of not raising prices. Vijay Wadhwa, promoter of the Mumbai-based Wadhwa group, claims the company has not raised any prices since January and sells around 150 apartments a month as against 80-100 a month in December.

"We believe those who have raised prices irrationally will face problems. We want to maintain affordability and steady sales," he says.

But in contrast to Mumbai, other cities such as Bangalore, Chennai and many places in the national capital region may see continued buyer demand, as home prices have risen at a comparatively slower rate.

"In other cities, prices went up by 10-15 per cent as against 30-40 per cent increase in Mumbai because of high demand from users and investors," says Ashish Joshi, managing partner, real estate, at Milestone Capital.

"Any correction is welcome, as even a small correction brings enormous demand with it. Fence sitters will come into the market," Joshi adds.