Photographs: Courtesy, Volkswagen. Swaraj Baggonkar in Mumbai

Volkswagen, who? That's the common question the bosses at the world's third largest car maker faced every time they made a marketing pitch in India.

While its two sister brands -- Audi and SkodaAuto -- had a high recall value, very few were aware of the VW brand name here.

Not anymore.

Look at the long queue for the German car maker's latest offering -- Polo -- launched in India just two months back.

Consumers are willing to wait three to four months for the hatchback priced at Rs 4,55,000 (ex-Mumbai), although cheaper models of other manufacturers are being offered off-the-shelf.

. . .

How Volkswagen is making it big in India

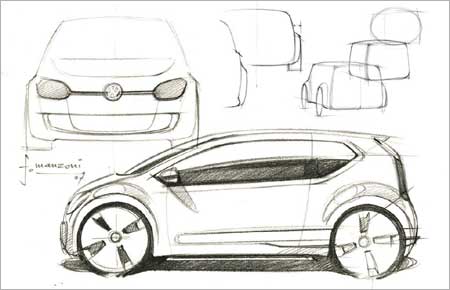

Image: Technical drawings of Volkswagen's UP! concept.Photographs: Courtesy Volkswagen India

VW claims it has confirmed orders for about 6,500 units for Polo, while 500 have been delivered already.

Neeraj Garg, director, Volkswagen Passenger Cars, Volkswagen Group Sales India, says VW indeed had a very low brand recall in India.

To correct that, Garg says, "The company opted for a continuous activity in the market because brand awareness always has a shelf life. We need to improve our brand awareness, we need to improve our reach. The fact that we have been successful in being different from others in the market is what is going to work for us".

VW is taking the 'continuous activity' part quite seriously.

. . .

How Volkswagen is making it big in India

Image: Volkswagen Polo.Polo was the latest in a chain of six models ranging from compact cars to big sedans to giant sports utility vehicles launched in the last two years.

The company produces/assembles the Polo, Jetta and Passat in India while it imports the Phaeton, Touareg and Beetle.

While Polo is manufactured in the company's 110,000 units per year capacity Chakan plant, the Passat and Jetta are assembled at Skoda's Aurangabad plant.

And there's more to come. VW is gearing up to launch a sedan in the mass market segment later this year.

The new car in the mid-level category will compete against models such as Maruti's SX4, Fiat's Linea, Hyundai's Verna and Ford's Fiesta.

It is also working on a car that would replace Polo in the entry-level segment. VW hopes this will generate almost double the volumes compared to Polo, which will remain its flagship premium, yet volume generating car.

. . .

How Volkswagen is making it big in India

Image: A Volkswagen plant.Photographs: Courtesy: Volkswagen India

All these initiatives are expected to increase the VW group's share in India from the current 1 per cent to 10 per cent in the next five years.

What makes VW's gameplan in India all the more interesting is its decision in December last year to pick a significant minority stake in Suzuki.

Though the details are sketchy, there has been intense speculation in industry circles that the tie-up will lead to joint development activities in India -- a country where Maruti makes one in two cars sold.

With so much at stake in India, VW figured out that it needed to make a huge noise about its challenger status in India.

So when it launched Touareg and the New Beetle Sedan late last year, VW did the most expensive print advertising campaign in India with a multi-crore roadblock campaign across all editions of The Times of India.

. . .

How Volkswagen is making it big in India

Image: Volkswagen oficials addressing a press conference during the launch of the Pune plant.Photographs: Courtesy www.vicky.in

Roadblock refers to an advertiser paying a premium to black out all other advertisers.

Mumbaikars also saw other initiatives such as a giant banner in the sky displaying the new Beetle and the VW logo -- a first such campaign for any automobile manufacturer.

The company is now looking at more innovative ways for taking its brand forward in a tough market, which is controlled by only three manufacturers -- Maruti Suzuki, Hyundai Motors and Tata Motors with combined sales of well over 1.4 million units (as of March 31, 2010).

Lutz Kothe, chief general manager, marketing and public relations, Volkswagen Group Sales India, says innovation is the way to go.

"Our cars carry innovation and so our marketing campaign should also carry innovation. We had to do something which could make India talk about us. We had a significant double digit jump in sales after the campaign," Kothe says.

But will good cars and innovative campaigns be enough for a late entrant like VW to take on the established leaders in areas of technology, distribution and reach?

The jury is out on this.

. . .

How Volkswagen is making it big in India

Image: The Volkswagen Phaeton is on display at a Geneva car show.Photographs: Jean-Bernard Sieber/Reuters

While many point to the uphill task that a late entrant like VW has in building its brand in India, VW executives are confident.

"The loyalty factor for auto brands", says Kothe, "is quite low in India compared to other markets. This means customers are looking for newer things in their cars. We do not see a situation where we have to pull customers, they are and will readily come to us".

Adds Garg: "The Indian car market is going to grow to three million units from 1.7 million units in another three to four years time. That gives enough opportunity to all players for expansion".

VW has also been building distribution. It presently has about 25 stand-alone dealers and intends to take it up to 40 in India as the company does not want to utilise the dealer resources of its sister brands for distribution.

There will be gradual ramp-up in the number later with the next phase of expansion planned for areas outside the main cities.

Watch this space.

article