The opportunities and threats relating to China are an unending source of discussion and debate. How do we move beyond, to grasp the nettle of practical considerations and undertakings?

What emerges is India's need to strategise its commercial interests and execute projects in terms of clear objectives.

One aspect is related to internal coordination: getting our act together, e.g., in domestic manufacturing. A second aspect has to do with external orientation, and engaging with China.

In a previous article, I had suggested the need to orchestrate supportive policies for domestic manufacturing, to capitalise on India's growth. The central idea: emulate China's approach in areas where it has successfully established policies that yield scale economies with appropriate financial and commercial linkages, to result in high-quality products delivered at low cost.

Click NEXT to read more...

Another dimension that also needs to be explored is positive, constructive engagement with Chinese enterprises. The potential for engaging in a number of areas with the scope for mutually beneficial participation may exist.

This kind of collaboration could mitigate risk by enhancing access to raw materials as well as to expanded markets for finished goods, while reducing capital investment through equity participation.

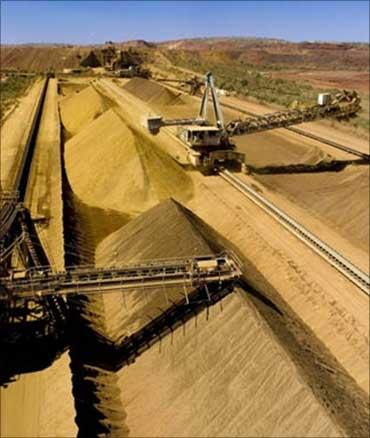

Take sectors like energy and metals. Both provide tremendous opportunities for mutual benefit. One dimension is joint bidding for projects for exploration and development in sectors such as oil and gas, instead of competing bids. (The Sudan venture doesn't count, because India and China became partners by default, and not by conscious choice.)

Another is joint participation in projects in both countries, e.g., for aluminium. China itself is guarded about FDI in strategic sectors, so such ventures will require significant efforts and accommodation from both countries.

Click NEXT to read more

The potential benefits to Indian companies such as Nalco are access to substantial capital for expansion, as well as increased access to markets.

A Chinese partner like Chinalco would also gain significantly by access to its share of low-cost raw materials as well as to a more diversified market, in return providing access to Chinese and international markets to its Indian partner.

China has for years acted decisively on setting up joint ventures in its overall interests. In the early 1990s, I saw a phosphoric acid plant in Florida, where China had a 50-50 joint venture with a US company, Seminole Fertiliser Corporation.

This enabled Chinese phosphoric acid imports at favourable prices, circumventing cartelised export restrictions by US producers. (China and India have been and are major importers of phosphoric acid for phosphatic fertilisers.)

Click NEXT to read more...

This is an instance of how China strategises its approach to be an acceptable partner.

While breakthroughs in information and communications technology (ICT) with India may be more difficult in the near term, because of mutual wariness as well as the need for complex structuring, mainstream ventures in sectors like steel, aluminium, copper and energy (oil and gas, coal) may be more easily structured and executed, provided there is mutual (a) reciprocity and (b) transparency.

In this, our decision-making and delivery processes must keep up with the required pace. This major change in approach between the two countries, open reciprocity with no game-playing, and in India's own methods, are necessary conditions for major commercial developments that lead to optimal economic engagement.

Click NEXT to read more...

However, it is a reality that has to be included in the final solution, just as major energy ventures that India participates in are likely to be driven by state-owned enterprises like ONGC, Indian Oil Corporation, or GAIL.

A possible way to achieve a first step may be to structure a venture that is in a third country, with substantive contributions from both India and China, with benefits to all three.

An example could have been (could be?) a very large copper and gold mining project in Mongolia, close to the Chinese border. The Oyu Tolgoi ("Turquoise Mountain") project is currently being developed by Ivanhoe Mines, a Canadian company, and Rio Tinto, the mining giant in which Chinalco is the largest shareholder, with the Mongolian government as the third partner.

Click NEXT to read more...

This can only happen if there is a national initiative to evaluate and act on the opportunity, with a concerted bid in a manner that all parties -- the Mongolian government, Ivanhoe Mines, Rio Tinto, and the Indian government -- can have a meeting of minds on valuation and direction, with an open, collaborative approach.

Other potential areas for participative ventures could include logistics and transportation, including airlines and freight/shipping.

While the possibilities are open-ended, the actual unfolding of promising pathways may require success with simpler 'asset-plays' like metals or energy projects, to establish what is pragmatic and feasible. These could provide substance to what is currently just talk of a strategic partnership with China.