In the Tenth Five-year Plan (2002-07), Gujarat's Gross State Domestic Product grew by 10.2 a year. Enthused, the state has now set a growth target of 11.2 per cent a year for the Eleventh Plan (2007-12).

To accomplish this target, the state government is leaving no stone unturned in providing policy and infrastructure support to industry.

According to Gujarat Chief Minister Narendra Modi, "The state government's investor-friendly policies are helping Gujarat grow at this pace. This is reflected in the fact that there is zero labour-hour loss in the state. Gujarat is not rich in several minerals like coal. Notwithstanding this, power and steel companies are still flocking to the state."

Gujarat accounts for 15.14 per cent ($114.52 billion) of the total investments in India, highest amongst all states in India, according to the Vibrant Gujarat web site.

The state is home to some of India's finest and successful entrepreneurs. Click NEXT to check out 10 of the top entrepreneurs in Gujarat. . .

Dishman Pharmaceuticals and Chemicals Limited (DPCL), the company that Jay R Vyas heads, was incorporated in 1983 as a research-oriented organisation. It was originally incorporated as Dishman Pharmaceuticals and Chemicals Private Limited, a private limited company with J R Vyas as a shareholder and director.

The company was dormant until 1989 when Vyas -- who holds a bachelor's degree in chemistry from St. Xavier's College, Ahmedabad and a bachelor's degree in Pharma & Fine Chemical Technology from the UDCT, Mumbai -- activated it and was appointed its managing director.

Ahmedabad-based Dishman Pharma, now a Rs 1,000 crore (Rs 10 billion) company, operates in two segments: contract research and contract manufacturing (CRAMS), and bulk drugs, intermediates, quaternary compounds and specialty chemicals.

It is involved in the manufacture of active pharmaceutical ingredients (APIs), intermediates, quaternary compounds and fine chemicals.

Dishman Pharma is a global outsourcing partner for the pharmaceutical industry, offering a portfolio of development, scale-up and manufacturing services. The products and services offered span customers' needs from chemical development to commercial manufacture and supply of active pharmaceutical ingredients.

Dishman has established two wholly-owned subsidiaries -- Dishman Europe Ltd. and Dishman Cyprus Ltd. Listed on the Bombay Stock Exchange (BSE), the company has five business units.

Dishman Specialty Chemicals in India and China makes phase transfer catalysts, supplying high-quality intermediates, fine chemicals, and products for the pharmaceutical, cosmetics and related industries. Carbogen Amcis in Switzerland, with operations in UK and India, is a process R & D facility that supplies APIs to support clinical trial requirements.

Dishman Corporate Research and Manufacturing Services (CRAMS) in India and China provides a high-value, cost-competitive contract services facility. Dishman Vitamins & Chemicals in Netherlands and India offers Vitamin D2, Vitamin D3, Vitamin D analogues, cholesterol and lanolin-related products for the pharmaceuticals, cosmetics and related markets.

Dishman Disinfectants in India, Australiasia and Saudi Arabia on the other hand is a next-generation innovative antiseptic and disinfectant formulations unit.

"I saw the need for a company that could provide high-quality, high-value products and services and be a good and reliable partner to pharmaceutical companies worldwide," says Vyas.

Click NEXT to read on . . .

Leading India's largest and most popular soft drink concentrates brand is a mammoth task, and no one knows this better than Piruz Khambatta.

Having joined Rasna Pvt. Ltd. at the age of 18 and armed with a bachelor's degree in biochemistry and another in law, apart from several management courses from Wharton School, Philadelphia and Indian Institute of Management (IIM) Calcutta, Khambatta became chairman and managing director of the company in 1997.

The brand that launched a legendary campaign in 1980, "I love you Rasna," which an entire generation grew up with, recently changed its tagline to 'Relish a Gain' with the aim of focusing on the health aspect of the drink. It has now been positioned as an affordable drink for the masses.

And the repositioning of the brand is reflected in Rasna's new ad, which has replaced the endearing little girl with a mischievous kid who is more assertive. Khambatta believes that kids today have a greater say in deciding which products should grace the shelves at home. However, the company has done all this without changing the value-for-money image of Rasna.

Khambatta, a hands-on manager with a knack for zeroing in on successful promotional strategies, has made Rasna a legendary Indian success story. The brand has braved competition from giants like International Best Foods, Unilever, Coca Cola, Rallis and a host of smaller players.

Yet the company and brand alike have shown rock-steady market growth and gained a significant market share. Currently enjoying 93 per cent of the pie, Rasna has left its competitors far behind.

With the aim of spreading the message of the health benefits of daily consumption of milk, Khambatta also introduced 'Rasna Shake Up'. The fruit-drink concentrate maker has also ventured into the fast foods business with Devil's Workshop, which started in Ahmedabad through franchise outlets.

The company, which currently has 44 outlets in Ahmedabad, Pune and Gurgaon, plans to expand the number of outlets to 100 by December 2010 by targetting two more cities -- Mumbai and Hyderabad.

Having commenced international operations in 1993, Rasna has been selling soft drink concentrates and instant drink powders and an ethnic range of products to global markets.

Khambatta's introduction of the Rasna 'Ek ka Do' campaign is cited as the single biggest attempt by a company of this category to grow the market.

Armed with down-to-earth marketing, the localisation of the flavour names and the introduction of 'paan wallah' salesmen, Rasna has penetrated into the remotest corners of the country and reached out to the masses.

Khambatta has duplicated Rasna's success in foods, especially with 'Rasna Spread Maker' and 'Rasna International'. With these products Rasna is available in over 40 countries. Its overseas operations make concentrates worth two billion glasses -- making it one of the biggest brand concentrate businesses in the world.

The company today has a vast product portfolio in exports, comprising instant drinks, sports drinks, low-sugar drinks, soft drink concentrates in both powder and liquid forms, fruit jams, fruit cordial, fruit syrups, pickles, curry paste, and chutneys.

In 2008, under Khambatta's R&D leadership, Rasna introduced the world's first fruit powder drink with high content of fruit, vitamin and minerals -- Fruit Plus.

Click NEXT to read on . . .

Pankaj R Patel is chairman and managing director of the Zydus Cadila group, whose turnover has grown from a modest Rs 250 crore (Rs 2.50 billion) in 1995 to over Rs 3,700 crore (Rs 37 billion) today. The group is poised to join the billion-dollar league in the current financial year (2010-11) and become a global research-driven company by 2020.

Founded by the late Ramanbhai B Patel in 1952, Zydus Cadila is one of the top five pharma companies in India. In 1995, the group restructured its operations and in 1996 it became a public limited company, operating as Cadila Healthcare Ltd. Pankaj Patel is the founder's son, and has 30 years of experience in the pharmaceutical industry.

The company has its manufacturing facilities in Ahmedabad, Ankleshwar and Vadodara in Gujarat, Ponda in Goa, Raigad in Maharashtra and Solan in Himachal Pradesh. The company's operations include pharmaceuticals (human formulations, veterinary formulations and bulk drugs), diagnostics, herbal products, skin care products and OTC products.

Patel has made numerous acquisitions and struck a series of strategic alliances. In 1996, Cadila entered into a strategic alliance with Gulin Pharma of China and launched Falcigo in India, an anti-malarial drug.

In May 2000, it acquired the formulations business of Recon Ltd, which strengthened the company in the southern market. In 2001, it acquired German Remedies (this was then the largest pharma M&A in Indian). In the same year, it entered into a joint venture with US-based Onconova for collaborative research in the field of Oncogenomics.

In 2002, the company acquired Banyan Chemicals, a Vadodara-based company with a US FDA approved plant. In 2003, German Remedies, Recon Healthcare, Zoom Properties and Zydus Pathline merged with the company.

Also, they acquired Alpharma France, which spearheaded the group operations in France. Also in 2003, the company emerged as a 'partner of choice' for Schering AG to manufacture and market the products in India.

In 2004, the company entered into a strategic alliance with Zambon Group in Italy to explore new avenues in contract manufacturing. In the same year, it entered into a long-term strategic pact with Boehringer Ingelheim India Ltd, a wholly-owned subsidiary of Boehringer Ingelheim, (BI) to manufacture and market BI's products in India.

In 2005, the company entered into a strategic alliance with Mallinckrodt Pharmaceuticals Generics, a business unit of Tyco Healthcare, to market products manufactured by the company under a joint label.

In the same year, the company signed a 50:50 joint venture agreement with Mayne Pharma of Australia to manufacture generic injectable, cytotoxic (anti-cancer) medicines as well as active pharmaceutical ingredients (API) for global markets. The examples abound.

In recognition of his entrepreneurial vision, Patel was awarded the Ernst &Young Entrepreneur of the Year -- Life Sciences Award for the year 2009.

Click NEXT to read on . . .

Karsanbhai Khodidas Patel, founder of the Rs 3,550 crore (Rs 35.50 billion) Nirma group -- maker of detergents, soaps, cosmetics and salt -- epitomises the proverbial rags-to-riches journey.

Born in 1945, into a north Gujarat family of farmers, Karsanbhai finished his BSc in chemistry and became a lab technician in the New Cotton Mills, Ahmedabad, and later worked with the Gujarat government's geology department.

In 1969, at age 24, Karsanbhai started manufacturing phosphate-free detergent powder (named Nirma after his daughter Nirupama) in his backyard. He continued with his day job, and sold the detergent while cycling to work.

The handmade detergent packets were sold at Rs 3 per kg, which was one-third the price of the cheapest popular detergent of the day. Consumers now had a quality detergent powder that was affordable. Patel also gave a money-back guarantee on every pack sold.

A little while later, he also set up shop in Ahmedabad and with the right marketing practices like housewife-friendly advertisement jingles, Nirma took leading multinationals by surprise and quickly established itself in Gujarat and Maharashtra.

What started as a one-man operation in 1969 created a whole new segment in the Indian domestic detergent market, with one of the most recognisable Indian brands becoming Sabki Pasand Nirma. Nirma focused on cost reduction strategies to make a place for itself in the market.

In the 1980s Nirma took on the might of Hindustan Lever (now Hindustan Unilever) and moved ahead of Surf to capture a large market share. In fact, Nirma's success is also known to have forced Unilever and Procter & Gamble to launch cheaper clones.

After establishing its leadership in economy detergents, Nirma entered the premium segment, launching toilet soaps, Nirma beauty soap and Shuddh Salt.

In 1995 Patel founded the Nirma University of Science & Technology, Ahmedabad. Over the last decade, he has turned his attention to the growing challenges in the educational sector. Patel believes that "Higher education stands for humanism and for adventure of ideas through constant research. If these functions are performed well, then it is well with the nation and the people."

In 2004, the Nirma group expanded into pharmaceuticals by acquiring an IV fluid factory in Ahmedabad. It also acquired US-based Searles Valley Minerals to become one of the top producers of soda ash in the world.

Karsanbhai now plays the role of elder statesman at the group, his two sons having taken over day-to-day management. Rakesh oversees procurement and logistics, Hiren heads marketing and finance.

Click NEXT to read on . . .

Starting from tea plantations, processing and trading, the Sandesara Group has come a long way to become a diversified multi-billion dollar business conglomerate.

The man who has played a pivotal role in its growth over the last 27 years is Chetan Sandesara, the promoter of the group and joint managing director of the flagship group company -- Sterling Biotech Limited.

After having graduated from Mumbai University with a bachelor's degree in commerce, he and his elder brother Nitin Sandesara, a first-generation entrepreneur and chairman & managing director of the group, established the Sandesara Group.

In the late 1990s, the group forayed into the healthcare segment by setting up a green field gelatin manufacturing facility in Vadodara, the capacity of which has been enhanced by 10 times in the past 10 years. Sterling Biotech Ltd is the largest manufacturer of pharmaceutical and nutraceutical gelatin in Asia with a global and pan-India presence.

The younger Sandesara, 48, identified gelatin as a core focus business for the group early on and took care to develop an understanding of all the aspects of the gelatin business, including manufacturing and marketing. Today the group is focused on energy and infrastructure -- future sectors of opportunity -- in a big way.

Sandesara is responsible for devising group strategy and for business development. Besides healthcare, he also handles the Special Economic Zone (SEZs), ports, oil exploration and production, engineering, infrastructure and mining.

His efforts put have the Sandesara group among a select group of companies that has been granted operatorship in oil exploration in OPEC countries.

Under his leadership, the group set up a 3,300-acre greenfield multiproduct SEZ at Baruch, acquired the Masar plant of Gujarat Torrent in 2006, established health malls in Gujarat and Sterling Port Limited at Dahej.

The multi-product SEZ is fully operational and being marketed aggressively in the domestic and international markets, while the port caters to large panamax vessels which will have the capacity to handle all types of cargo, including POL, coal, fertiliser, chemicals and food.

The key companies promoted by Chetan Sandesara include Sterling Biotech Limited, Sterling International Enterprises Limited, Sterling SEZ & Infrastructure Limited, Sterling Port Limited, Sterling Oil Resources Limited, PMT Machines Limited and Sterling Healthcare Private Limited.

Over the last 27 years, the Sandesara group has transformed itself into a leading business conglomerate with a focus on high-growth industries such as healthcare/ pharmaceuticals, precision engineering components, crude oil exploration and production, leasing of rigs and oil trading across the globe.

The group, with a market valuation of about $6.5 billion, recently forayed into the infrastructure sector.

Click NEXT to read on . . .

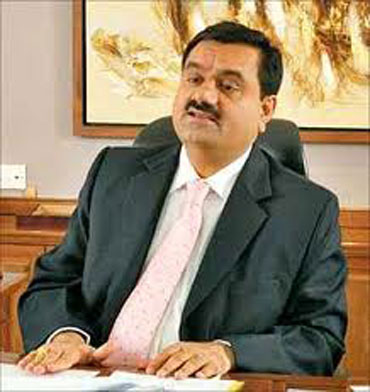

Forty-seven-year old Gautam Adani is the chairman of the Rs 27,000 crore Ahmedabad-based Adani Group, which has business interests ranging from energy to infrastructure and commodities. It comprises three listed companies -- Adani Enterprises Ltd, Adani Power Ltd and Mundra Port and Special Economic Zone Ltd -- whose combined market capitalisation places the Adani group among India's top 10 business houses.

The flagship company, Adani Enterprises Ltd., has been rated among the 50 top performing Asian Companies by Forbes magazine, which also adjudged Gautam Adani the 10th richest Indian in November 2009.

Born in a family of oilseed traders in Ahmedabad, Gautam Adani moved to Mumbai after matriculating, to explore opportunities and for higher studies. Staying in Mumbai with a cousin who was a trader enabled him to learn trading. In 1980, his family required his presence in Ahmedabad, and this proved to be a turning point in his life.

He was forced to quit college and manage a small plastic manufacturing unit. Faced with acute scarcity of raw materials, Gautam persuaded government organisations that were exporting large number of products across the world to import the much-needed raw material, and the raw material supply constraint eased.

By 1985 Gautam Adani had mastered international trade. He deployed his trading and entrepreneurial skills by forming a partnership firm and got into trading in a big way, exporting commodities that were abundant in India and importing those that were scarce. After that there was no looking back.

Adani Enterprises Ltd., the group's flagship company, which was incorporated over two decades ago and listed on the stock exchanges in 1992, today has varied business interests ranging from energy to infrastructure and commodities.

Adani has the knack of identifying opportunities and doggedly pursuing them to their logical end. A derailed proposed joint venture with Cargill of the US, set up during the mid-nineties for salt farming and export through a captive jetty in Kutch, is today's Mundra Port and Special Economic Zone, duly connected by rail, road and pipelines.

Adani has invariably aligned his business development plans with the country's needs. He has operationalised Gujarat's port development policy and the Central government's SEZ policy in Mundra.

This sleepy town, known only for its date palms until a decade back, is one of the most efficient ports in India, handling close to 40 million tonnes of cargo today. This is likely to cross 100 million tonnes on the commissioning of the world's largest coal import terminal.

The group has also set up a private railway line from Mundra to Adipur, has inland container depots and operates container trains across India to provide comprehensive logistics solutions to customers.

Mundra is also set to become India's largest multiproduct SEZ, with an area of almost 100 sq km, and will generate employment opportunities for over 400,000 persons.

Adani has also forayed into power generation and power transmission in a big way.

Click NEXT to read on . . .

What started in the early 1970s as Trinity Laboratories has turned into a $1.41-billion global business conglomerate with diversified interests in pharma and power. The company was founded by the late U N Mehta, and after his death, his elder son Sudhir took on the responsibility of nurturing the business.

The 1954-born Sudhir Mehta consolidated the initial success of the company and put the emphasis on exports. He also initiated the diversification of the Torrent Group into the power sector, and made Torrent Pharma one of India's biggest exporters of pharma products. He took office as the Chairman of the Torrent conglomerate in April 1998.

Displaying an astute entrepreneurial mind and an appetite for calculated risks, Mehta forayed into the turbulent Russian market at a time when the region was embroiled in deep political turmoil.

Today, Torrent Pharma has a strong presence in the European countries, Russia and Brazil. Sudhir and his brother Samir Mehta have added to the assets of the company by establishing another pharma plant at Chattral, apart from commissioning a Penicillin G plant.

Flush with funds from the success of Torrent Pharma in the Soviet Union, Mehta decided to diversify into the power sector in the late 1980s. His first move was to acquire a company that manufactures power cables (now called Torrent Cables Ltd.).

In 1991, the Central government announced major policy changes enabling the Indian private sector to enter the power sector. Around this time, Sudhir quietly started acquiring shares of the then Ahmedabad Electricity Company Ltd and Surat Electricity Co. Ltd., gaining a controlling stake in both by the late 1990s.

Simultaneously, he announced plans to set up a 655 Mw dual fuel combined cycle power project in Gujarat. He commissioned the project within the budgeted schedule and cost, and then proposed setting up the 1,147.5 Mw Sugen gas-fired power station, which was recently dedicated to the nation. It is the largest gas-based power project of an independent power producer.

Today the Torrent Group has a strong presence throughout the entire power sector value chain -- generation, transmission and distribution. Torrent Power has a total generation capacity of 1650 Mw and plans are afoot to add an additional 6,000-8,000 Mw generation capacity.

It distributes power to over 2 million customers in the cities of Ahmedabad, Gandhinagar and Surat in Gujarat and in Bhiwandi in Maharashtra. Torrent Power has also been awarded the distribution franchise for Agra and Kanpur in Uttar Pradesh.

Sudhir and Samir of recently made their maiden entry in the Forbes India Rich List. They have a net worth of $2.02 billion and are at number 23 in the list of the 100 richest Indians.

Click NEXT to read on . . .

Known as the denim king or cotton man, Sanjay Lalbhai has played a pivotal role in making Arvind Limited (formerly The Arvind Mills Ltd.) a force to reckon with in the textiles sector.

Now the chairman and managing director of one of the largest manufacturers of denim in the world, Lalbhai has been instrumental in placing Ahmedabad -- the Manchester of the East -- on the global map.

Lalbhai, who holds a bachelors degree in science from Gujarat University and a master's degree in management from the Jamnalal Bajaj Institute of Management Studies, Mumbai, hails from an entrepreneurial family of Lalbhai. He has displayed vision, innovation and courage.

At a time when fierce competition was taking a toll of Arvind Mills Ltd. in the late 1980s and early 1990s, Lalbhai withdrew from the market all 250 products that the company was manufacturing -- from handkerchiefs to saris -- and focussed exclusively on denim by modernising the factories.

Having become one of the largest denim makers in the world, Arvind Mills Ltd. is now Arvind Limited, a move that was meant to allow the company to straddle other sectors and verticals.

In all the years of its existence, Arvind Mills, founded by Shri Kasturbhai Lalbhai, has made rich contributions to not only the industrial but also the social fabric of Ahmedabad and Gujarat and Sanjay Lalbhai, the third-generation textile baron, has been religiously following this legacy.

Sanjay has made Arvind Mills, the flagship company of the Lalbhai Group, one of India's largest composite manufacturers of textiles. Headquartered in Ahmedabad, the textile capital of India, it manufactures a range of premium cotton shirting, world-class denim, knits, bottom weights (Khakis) fabrics.

Lalbhai also took prompt steps to exploit opportunities when he realised that following the abolition of the quota system in 2005, Asia would emerge as the hub of the global textile industry, as it is the key textile outsourcing base. Lalbhai took immediate steps to improve yields and competitiveness.

Under his stewardship, Arvind Limited has been able to spread its wings in international markets and become a global brand. The company has acquired the international licences of Lee, Wrangler, Arrow and Tommy Hilfiger. Its domestic brands such as Flying Machine, Newport, Excalibur and Ruf & Tuf are flying high in the denim market.

Today, with Sanjay Lalbhai at the helm, the company has moved on from being just a denim major. Arvind Limited has forayed into sectors like real estate, retail and food products.

Click NEXT to read on . . .

Last year he made his maiden entry into the elite club of India's richest men for the first time, with his net worth swelling to $455 million.

Born in a family of doctors, Bhadresh Shah, managing director and promoter of AIA Engineering, chose to tread a different path.

Shah, who studied engineering at Indian Institute of Technology (IIT), Kanpur, started his own foundry in 1979. Later, he diversified into the manufacture of grinding components for machinery used in the power, mining and cement industries. Today, his company is the world's second largest in its niche segment.

In three decades, AIA has seen a transformation from a small foundry in Ahmedabad into a multi-million dollar company with a sales and service network spread across 75 countries.

After setting up the foundry with the support of his father, Shah founded Ahmedabad Induction Alloys in partnership with a friend. His partner later sold off his minority stake to Shah. With more focussed targets, he now started establishing joint ventures with international partners.

The company joined hands with Slegten S A of Belgium in 1988, to produce energy-saving parts that are mainly used in cement plants.

It was time for another partnership in 1991, when he tied up with Belgian company Magotteaux and its foundry network by selling 51 per cent stake of his company to the Belgian company, which is the number one manufacturer of grinding parts in the world. Both partners enjoyed working together and also saw growth in the business.

In fact, AIA Engineering Ltd was incorporated in March 1991 with the name Magotteaux (India) Pvt Ltd. Shah's Ahmedabad Induction Alloys Pvt Ltd was merged with AIA Engineering in April 1991 and the name of the company was changed to AIA Magotteaux Pvt Ltd. with effect from May 1992.

In 1996, Shah bought back a 51 per cent stake in Magotteaux, which had seen a change of guard by then. AIA managed to buy back the stake after a legal battle. The name of the company was further changed to AIA Engineering Ltd. in 2000 due to the termination of the JV with Magotteaux.

With the two companies parting ways, AIA began exporting in the year 2000 and started competing in the international market instead of marketing its products through Magotteaux. Shah with his family and associates owns 70 per cent of AIA.

From 2001, AIA expanded its export operations and after its initial public offer in 2005 the company scaled up its production capacity to 165,000 tonnes in 2008-09.

AIA Engineering now specialises in the design, development, manufacture, installation and servicing of high chromium wear, corrosion and abrasion-resistant castings used in the cement, mining and thermal power generation industries.

Under Shah's leadership, the company made a technical collaboration with Southwestern Corporation (SWC), USA for process improvement in Raymond Mills in 1995. September 2003 saw a merger between AIA Exports Pvt Ltd and AIA Engineering.

Significantly, none of Shah's immediate family, including his two daughters, is in the business. A consulting group is conducting a systematic and comprehensive search to identify his eventual successor.

Click NEXT to read on . . .

Mukesh Bhandari has made Electrotherm (India) Ltd. a formidable player in the foundry, steel and automobile industries.

An electrical engineer from Indore University, Bhandari started his career as a Research Assistant with BHEL/RDOEI Bhopal in 1972. Later he worked with companies like Automatic Engineers (Indore), Electronic Controls Corporation (Ahmedabad) and GEC (I) Limited (Calcutta) in various capacities for 10 years.

In 1982 he started a small company to service metallurgical equipment. Bhandari has never looked back since, his service shop soon became a manufacturing unit to make metal melting equipment designed and developed by himself. His success in developing increasingly sophisticated equipment transformed the Indian metal melting industry and eroded the hold of imported equipment and services.

Being the largest supplier of induction melting furnaces for steel making, Electrotherm also set up a steel plant of its own, with the incentives offered by the government after the Kutch earthquake providing the company with an opportunity.

Making most of the big demand-supply gap in steel in Gujarat, especially for long products, Electrotherm began to grow rapidly.

The group set up the steel plant (with an investment of more than Rs 1,000 crore) in Gujarat -- instead of in states like Chhattisgarh, Orissa, West Bengal or Karnataka which are rich in iron ore. Bhandari chose Gujarat because it is a big consumer of steel, most of which came from outside the state.

Today, Electrotherm comprises three divisions: Engineering & projects; special steels and pipes; and electric vehicles. The induction furnace products have been so far sold in 27 countries.

The company has also established a 180,000 tonne per year Ductile Iron pipe making capacity in the Kutch plant, apart from expanding its distribution network within Gujarat for TMT bars, which are sold under the brand name 'Electro TMT Plus', and within India for DI pipe sales.

Electrotherm has also completed the acquisition of HANS Ispat Ltd, a steel manufacturing plant at Bhuj (Kutch) at an investment of 60 crore (Rs 600 million). Besides, the company has also acquired a facility for the manufacture of transmission line towers at Karjan, Baroda, Gujarat with an investment of around Rs 25 crore (Rs 250 million).

Bhandari's electrical engineering expertise has led Electrotherm's electric vehicles division to become India's largest manufacturer of electric two-wheelers, marketed under the brand name 'YoBykes'.

An ardent flyer, Bhandari is a registered HAM hand and constantly looks for new entrepreneurial avenues. His ventures also include a flying training institute and an academy to promote microlight flying, among other things.

Click NEXT to read on . . .

At 43, Amit D Patel, is one of the brains behind the Sintex Group's growth story. He has two decades of experience in the textile, chemicals and plastics industries.

In 1993, Patel was appointed whole-time director of Sintex Industries Limited (SIL). Since then, the company has diversified into many textile products (marketed under the brand name BVM) and plastics products (marketed under the brand name Sintex).

Having inherited a conservative organisation, he turned it around into a growth-driven professionally managed one, spearheading modernisation and expansion programmes in both divisions that have yielded scale on the one hand and innovative products on the other.

Patel has introduced monolithic construction, prefabricated structures, quality corduroy fabric and structured yarn dyed textiles. He has entered into strategic tie-ups with international partners in the plastics and textile divisions.

As the one who fashions corporate strategy for the Sintex Group, he is responsible for its mergers and acquisitions activities, managing the finances and liaising with prospective investors.

The company has achieved numerous milestones under his leadership. These include attracting investment from private equity funds like JP Morgan (in 1994-95) and Warburg Pincus (in 2004-05); making the first acquisition in the telecom industry space by acquiring a 74 per cent stake in Noida-based German JV Zeppelin Mobile Systems India Limited; and the acquisition of US-based Wausaukee Composites Inc., Nief Plastic of France and Bright AutoPlast Private Limited.

Patel has also successfully raised around $600 million via FCCBs, QIBs and preferential allotment of warrants. Sintex Industries has grown to an over Rs 3,200 crore (Rs 32 billion) company with a strong growth outlook, driven by innovation and acquisitions. It is a leading player in innovative plastic products and value-added niche textile segments.

The company follows different strategies in its two business segments. In plastics the thrust is on innovating and identifying mass utility products across the industrial as well as household segments. In textiles its focus is on structured fabrics. The company consistently explores new avenues of opportunity and partners with the best in the business in order to achieve excellence and create continuing value.

From a Kalol-based Indian company, Sintex has become a global group with a presence in nine countries across four continents. It has delivered an unbroken dividend track record over the last seven decades besides achieving five-year revenue CAGR of 26 per cent and net profit CAGR of 49 per cent.