Photographs: Reuters Surajeet Das Gupta in New Delhi

A few months after he took over as Air India chairman, Arvind Jadhav's plan to turn the financially crippled state-owned airline around was contingent upon his saving Rs 2,000 crore (Rs 20 billion) in 2009-10 -- only then would the government inject fresh equity of a similar amount into the airline.

Of this, Rs 800 crore (Rs 8 billion) were to come from halving the Performance-Linked Incentive part of the airline's Rs 3,100-crore (Rs 31 billion) wage bill.

With the unions up in arms, the airline's board, which includes independent directors like Ficci's Amit Mitra, Mahindra & Mahindra's Anand Mahindra, has jettisoned the plan to cut costs (Air India achieved a cost reduction of just Rs 800 crore last year and didn't touch the PLI).

Instead, while announcing the new plans, Air India said if traffic continued to increase, it might even need to expand the fleet from the current 130 planes to around 250 (no date was mentioned for this, but it would be a significant addition to the 111 planes that were ordered in 2006 -- of these, around 60 have already been delivered).

. . .

Despite grand plans, Air India still losing passengers

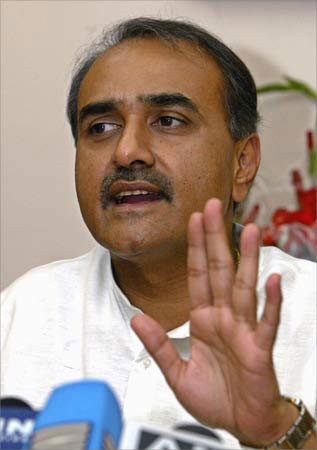

Image: Civil Aviation Minister Praful Patel.Photographs: Reuters

The plans included increasing efficiency by launching more flights and achieving higher passenger load factor (PLF) of 75 per cent in the domestic market.

A plan to start a low-cost carrier (LCC) is still on the cards, though no explanation has been asked for as to why the airline was unable to do this by September last year as had been planned -- Jadhav's original plan was to have 27 pairs of daily domestic flights by moving 10 aircraft to the new Air India Express low-cost carrier.

Civil Aviation Minister Praful Patel has already justified the new thrust on expansion, and on not touching the unions, by arguing that the market has improved and that AI will now need the staff as well as extra planes. The passenger growth in the year's first quarter, he said, was up by 18 per cent.

Apart from the fact that smarter managements try to control costs in an upturn, the point worth keeping in mind is that Air India's performance continues to plummet and there is nothing to show it has done anything to take on the competition -- an LCC is all very well, but unless its costs match those of the competition, how is it going to succeed?

. . .

Despite grand plans, Air India still losing passengers

Photographs: Reuters

Getting SBI Caps to restructure the airline's expensive debt is a good idea, so is the plan to try and monetise some part of its land and buildings (think of the iconic Nariman Point headquarters!), but if the airline's operating costs are out of whack, how long will the band-aid help?

In the domestic market, Air India's market share in March was 17.8 per cent and this fell to 16.9 per cent by June. During this period, market share of JetLite went up from 7.1 per cent to 7.8 per cent; that of SpiceJet from 11.9 per cent to 13.3 per cent; for GoAir it was 5.3 per cent to 5.8 per cent.

Full-service airlines have lost market share -- for Jet it fell from 18.9 per cent to 18.7 per cent and for Kingfisher, it has come down from 23 per cent to 21 per cent. So, the move to LCC looks sensible.

Except, while the cost per available seat per kilometre for most efficient LCCs in India is Rs 2.40, that for AI is supposed to be around double this (the airline does not divulge its numbers).

. . .

Despite grand plans, Air India still losing passengers

Photographs: Reuters

Air Asia, the Malaysian LCC, has a cost per available kilometre of less than Rs 2, and it already operates in Indian from nine destinations to Kuala Lumpur. With aggressive LCCs like Air Asia already penetrating the hinterland of India, it would be very difficult for AI to take it on -- more so, since Air Asia, benefitting from the liberal bilaterals policy, has aggressive expansion plans in India.

Nor is Air India's planned PLF of 75 per cent particularly high. It is, of course, high considering where the airline is today -- 75 per cent for domestic flights and 66 per cent for international flights.

But LCCs in India have PLFs of 85-90 per cent; it is 81 per cent for Kingfisher (including the international) and 79.1 per cent for Jet. On the international circuit, Emirates' PLF is 80 per cent, that of Jet is 80.1 per cent and Air Asia's is 77 per cent.

Not surprisingly then, while Air India's traffic grew 18 per cent in the first quarter, that for Jet grew 35 per cent. While Air India's revenues rose 28 per cent, Jet's rose 31.7 per cent, SpiceJet's by 34 per cent and Kingfisher's 29 per cent.

. . .

Despite grand plans, Air India still losing passengers

Photographs: Reuters

Air India also seems to have overlooked the fact that even the higher growth in revenues this quarter has been more than offset by the fact that its costs have gone up even more.

So while traffic revenues grew by Rs 638 crore (Rs 6.38 billion), its costs -- fuel costs and depreciation and interest costs for the new aircraft which it is buying -- went up by Rs 688 crore (Rs 6.88 billion).

Any well thought-out turnaround plan cannot be successful on the basis of expectation of a revenue growth alone.

That is only one part of the puzzle; the more important element is a relentless attempt to reduce operational costs. AI seems to have forgotten the latter.

article