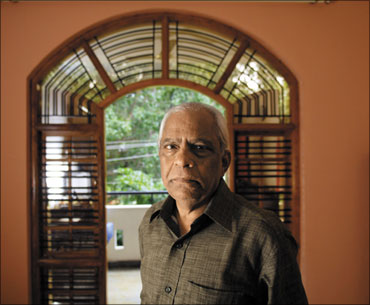

Shankar's dream of living in his own home has become an unending pursuit. After putting in nearly four decades of service in various medical colleges all across Karnataka, the 70-year-old doctor decided to settle down in Bengaluru -- India's information technology capital -- for a quiet, retired life.

Four years after he retired in 2006, this septuagenarian is yet to find that elusive calmness retired life is supposed to provide.

In 2004, Dr Shankar booked two flats -- one for himself and another for his daughter -- in a housing project developed by the Sahara group in Bengaluru.

"I was hoping that finally I would have my own flat when I retired," says Shankar, who liquidated his bank savings towards paying the advance amount for the two flats. "I am tired of paying rent," he adds.

So far Dr Shankar's family has paid nearly Rs 8 lakh (Rs 800,000) -- Rs 3.9 lakh each (Rs 390,000) -- as advance money and installment for buying the two two-bedroom flats measuring 850 sq ft each.

Four years after the initial deadline to complete the flats has passed, the doctor, who now teaches pro bono in medical colleges, says construction activity is yet to begin.

In reply to a letter written by Dr Shankar, Sahara claimed an alternate site has been identified and land acquisition is in progress, following "uncalled-for interference from various quarters" in buying the original piece of land.

"There is not even clarity on whether Sahara has land to develop the project," Shankar rues.

Shankar's experience is not an exception. Outlook Business spoke with nearly a dozen people in three cities who have experienced such delays in projects developed by Sahara Prime City, the Sahara Group company that has filed its draft red herring prospectus (DRHP) with the market regulator.

. . .

By arrangement with Outlook Business (21st August issue)

Take the case of G Krishnamurthy, who, in 2004, booked a two-bedroom flat in a housing project developed by Sahara in Chennai.

He even sold his relatively small flat located very close to T Nagar, one of the city's busiest market areas, hoping to move into a more spacious apartment in the promised two years.

Krishnamurthy has so far paid nearly Rs 6 lakh (Rs 600,000) for the 1,249 sq ft flat and has been waiting for the last five years to occupy his own flat. At present, he lives in a rented house.

"We all believed in the popularity of the company," says Krishnamurthy, who took voluntary retirement as legal officer from a state-run transport corporation.

The Sahara group is known for its high-profile sponsorship of the Indian cricket team, with its logo displayed prominently as well as its own Indian Premier League team, Sahara Pune Warriors. Such endorsements are one reason for high brand recall for Sahara.

If the cricket connection was enough to convince some people of the legitimacy of the group, for others it was Sahara's para-banking operations and the wide network of field agents that was the clincher.

Dr Shankar, for instance, had been a depositor for nearly five years before he booked the flat in 2004. "I used to keep deposits with them (Sahara) as they paid higher interest compared to banks. It was at this time that the local area manager asked me to book a flat developed by Sahara," he adds.

Both Shankar and Krishnamurthy are now in touch with each other, sharing their common plight and deciding on their future course of action to realise their dreams of owning a flat.

Indeed, Krishnamurthy has institutionalised his crusade. In March 2010, he helped form the Sahara City Homes Chennai Members Association comprising home owners-in-waiting like him. In less than four months, membership has grown to over 200.

. . .

Among its grouses, the association claims Sahara has not disclosed key details regarding the Chennai project in the Initial Public Offer documents submitted to the Securities and Exchange Board of India nearly a year back.

Incorrect information in the IPO document?

Companies that want to tap the market for funds are required to submit the DRHP with the market regulator. Only after Sebi gives its nod can companies raise money from the public.

In the case of Sahara Prime City, the real estate arm of the Sahara group, the DRHP was filed in September last year. With more than 10 months having passed, Sebi seems to be in no hurry to give its nod.

Although it's common for the market regulator to take more time to clear an IPO document filed by real estate companies, as in the case of Emaar MGF and DLF, it is quite unusual to take nearly a year.

"Such a long delay is an indication that Sebi is raising concerns on disclosure level in the document," says Prithvi Haldea, managing director of Prime Database, which maintains 20-year data on money raised by companies from the market and also a database on directors.

Krishnamurthy, who is also the president of Sahara City Homes Chennai Members Association, says Sebi should take action against Sahara for disclosing incorrect information about land reclassification regarding the Chennai project.

The DRHP says that Sahara Prime has filed an application and is waiting for approval for reclassification of land with the relevant authorities, which in this case is the Chennai Metropolitan Development Authority.

Krishnamurthy claims there was no file pending with CMDA when the association enquired about the status of the application with the urban authority.

"When we verified, we found CMDA has returned the file with some preliminary queries. Thereafter, Sahara has not yet filed another application," he adds.

. . .

"The IPO document says Sahara Prime has paid Rs 31 crore (Rs 310 million) for acquiring 117 acres of land for the Chennai project. Till now, we have not been taken by Sahara for a site visit to the land they have acquired," says Ramesh Haritwal, secretary of the Chennai-based association.

CMDA officials could not be reached for comments.

Now, Sahara City Homes Chennai Members Association is planning to write to Sebi, claiming the DRHP did not fully disclose the facts about the company's operations.

Rejecting there is any incorrect information, Abhijit Sarkar, head, corporate communications for Sahara, in a written reply to Outlook Business, says, "The application for Reclassification (Conversion) of Land uses submitted to the CMDA (in November 2007) came back with some queries in June 2009. Therefore, the application was with CMDA at various levels and under examination. After that, most of the queries have been resolved and the application for CLU will be resubmitted very soon."

Even in the case of the Bengaluru project, the information given in the DRHP varies from the information given to the allottees through written communication.

In a letter addressed to Shankar's daughter and dated just two months before the prospectus was filed last year, Sahara Prime City wrote, " the land acquisition is under process. You would certainly appreciate that facilities required for the committed lifestyle demands a large area and, therefore, a total of 360 acres of land is required for the Bengaluru project."

However, the prospectus paints a completely different picture when it comes to land details. Bengaluru is listed under the forthcoming projects for which the money from the IPO will be used.

Sahara claims it has 77.69 acres of land for the Bengaluru project and has paid the entire amount of Rs 70.83 crore (Rs 708.3 million) for the land.

Thus, in less than three months, Sahara Prime's project size shrunk from 360 acres to 78 acres -- and buyers were not intimated of this.

. . .

"The communique to the prospective buyers as well as the information given in the DRHP are both correct," says Sarkar in the email reply.

"We had planned for 360-acre land acquisition in Bengaluru. The same information was provided in the communique. We have acquired 60 acre land [Outlook Business's initial email mentioned the size as 60 acres, not 78 acres] so far and it is a known fact that the acquisition of land and its due readiness for construction is a lengthy legal process which runs parallel to acquisition. Therefore, there is no dichotomy in our communique to prospective buyers and statement in the DRHP."

But it is not just the level of disclosure that is under question. Experts also point to related party transactions between promoter group companies that will hurt the interests of outside shareholders.

At arm's length?

The entry of Sahara Prime into the real estate business coincided with closure of its non-banking finance company operations in 2007.

The way it was done was not through building up the operations from the ground up but through a single multi-crore transaction.

Until two years ago, Sahara India Commercial Corporation held almost all the real estate assets of the group, with the promoters -- Sahara Group chairman Subrata Roy and his family -- holding 100% stake in this firm.

But in an agreement dated March 31, 2008 -- the last day of the financial year -- SICCL transferred its real estate assets in 186 cities and towns to Sahara Prime for Rs 814 crore (Rs 8.14 billion).

It didn't end there. Less than six months after this transaction, Sahara Prime sold the rights to sell the residential units it builds to SICCL for Rs 736 crore (Rs 7.36 billion).

Under the terms of the agreement, SICCL paid Rs 473.3 crore (Rs 4.733 billion) as advance money, with the balance to be paid when the final agreement was signed. Further, a discount of 10-15% on the prices of the residential units was given to SICCL.

. . .

The bare bones of this proposed transaction are given in the DRHP, but the IPO document is strangely silent on many pertinent questions: who did the valuation when a promoter company sold its real estate assets to Sahara Prime?

What valuation method was used to arrive at the final value? And why was the right to sell the residential units given to SICCL?

If Sahara Prime has paid less than the market value of the assets it took over, then its shareholders would benefit. But if it has over paid, it would work otherwise.

"These appear to be pertinent questions and definitely need an answer, and these could be only a few of the several issues that Sebi could be worried about," says Haldea.

Typically, when an acquisition is made, companies undertake due diligence by employing third-party firms so as to estimate the fair value. If that procedure was followed with the Sahara Prime-SICCL deal, surely it would have been mentioned in the DRHP as an example of good corporate governance?

The agreement to sell was revisited in August last year, just a month before Sahara Prime filed the IPO document with the market regulator. Unlike last time where it was only a letter of intent, this time around, a definitive agreement was reached to sell residential units.

However, there was one huge difference. In the second agreement dated August 2009, the transaction value nearly doubled to Rs 1,419.72 crore (Rs 14.197 billion). Again, no explanation was given why the transaction value doubled in less than one year when it is based on the selling price of residential units.

Has the company managed to double its selling price in less than one year or has it sold more units to SICCL? These questions remain unanswered.

According to the information given in the DRHP, out of the agreed transaction amount, only 33 per cent or Rs 473.29 crore (Rs 4.733 billion) has been received by Sahara Prime. The rest will be paid based on the progress of the construction activities and money realised from allottees.

. . .

What is likely to impact the minority shareholders of Sahara Prime post-listing is the fact that nearly 80 per cent of the residential units developed are to be sold to SICCL, which is entirely held by promoters, at a fixed price of 10 per cent discount to the listed price.

The nature of this agreement means that SICCL will pocket any upside from the selling price, whereas Sahara Prime -- which is running on money raised from the public -- would end up with fixed earnings.

Typically, the value of a residential unit goes up when the pace of construction activity increases and it nears completion. Developers often hold a percentage of residential units for sale at the last stage of the project, hoping to cash in on a higher selling price.

However, in the deal between Sahara Prime and SICCL, the former will not benefit from last stage price spikes.

The agreement says SICCL will sell 4,198 units out of the total 5,410 units sold to end users in the 10 ongoing projects executed by Sahara Prime. "This agreement is not friendly to the interests of the minority shareholders," says Haldea.

When asked about these transactions, Sahara's reply was, "The replies to your queries are available in the DRHP itself. Any further disclosures as may be legally required will be done at RHP (red herring prospectus) stage."

If the unanswered questions regarding valuation on bulk sales of residential units aren't worrying enough, there are also concerns that Sahara Prime will not be the only entity within the group that will operate in the real estate business, leading to conflict of interest.

Conflicting interests

When Sahara Prime acquired all the real estate assets from Sahara Commercial in 2008, the intention was that the IPO-bound company would manage all realty activities of the group. But Aamby Valley, Sahara group's most ambitious township project, has been kept outside of Sahara Prime.

Further, Sahara Prime's DRHP says, "Although it is intended that we will exclusively hold and manage all of our promoters' and group companies' real estate development and construction activities, except for Aamby Valley City, there is no non-compete agreement in place between us (Sahara Prime) and any promoter of any group company."

. . .

"There can be no assurance that our promoters or group companies will not provide comparable services, expand their presence or acquire interests in competing venture in the locations in which we operate," Sahara Prime's DRHP adds.

Simply put, that means Sahara's promoters are free to float another company that will compete against Sahara Prime's core area of operations -- real estate.

Sahara, in response to a questionnaire sent to them, now claims, "There has never been any statement to the effect that all kinds of real estate activity will be under the aegis of SPCL (Sahara Prime City)."

"From the point of corporate governance, it's always better not to have any conflict of interest. Shareholders of Sahara Prime would be better served if Aamby Valley is merged," says an accounting expert, who did not wish to be identified.

"It is pertinent to note that the products of AVL & SPCL are quite different from each other and cater to different market segments.

Moreover it is to be particularly noted that Aamby Valley is much beyond plain vanilla real estate activity as it constitutes an entire city development work, hence the decision to keep AVL outside the purview of SPCL," says Sarkar's email reply to Outlook Business.

Aamby Valley, near Lonavla, Maharashtra, is one of Sahara's relatively successful projects, where the group claims to have built 15 million sq ft of space (including facilities).

The project potential is so high that serial investor C Sivasankaran took a 49 per cent stake in Aamby Valley in 2007 and 2008. Further, his firm Siva Ventures has subscribed to preference share capital and debentures of Aamby Valley (for an undisclosed amount). (See: Sivasankaran's Footprints In The Sand).

Sivasankaran's footprints in the sand

. . .

At the time of filing the DRHP, Siva Ventures was the single-largest shareholder in Aamby Valley, the remaining shares held in the names of different promoters and their entities.

Now, Sarkar of Sahara group says, "The entire stake of SVL (Siva Ventures) in Aamby Valley has been re-acquired by Sahara."

According to the IPO document, Aamby Valley received Rs 810 crore (Rs 8.10 billion) as advance from Sahara Prime in 2008-09, but the same amount was taken back in the same fiscal.

The DRHP says the amount was "paid to acquire substantial assets of Aamby Valley Lit and alternatively to be allotted equity share of Aamby Valley to make it subsidiary of the company. Transaction as above could not be agreed at acceptable price between the parties, hence the money was refunded."

It is not clear from whom Sahara Prime was trying to acquire the stake: Siva Ventures or from the promoters of the Sahara group.

Based on the advance amount given, the valuation for Aamby Valley alone would surpass the total amount paid by Sahara Prime to acquire real estate assets of SICCL in 186 cities.

"No disagreements per se. The transaction was not finalised, as the parties could not arrive at a mutually agreeable price," explains Sarkar.

For Shankar and Haritwal, these issues are yet to resonate with them. They only complain of the frequent changes in the name of the entity they are dealing with.

Shankar booked his flat with a company called Sahara City Homes Marketing and Sales Corporation. Now he is dealing with Sahara Prime City. But when enquiries are made with civic authorities, it turns out that another Sahara group company -- SICCL -- has moved the application for permission from civil authorities to use the land for non-agricultural purposes.

. . .

The multiplicity of companies has only added to the confusion, claims Krishnamurthy.

In fact, Sahara Prime has changed its name four times since its inception (See: The Name Game). Initially starting as Sahara India Financial Corp in March 1993, the company's name was then changed to Sahara Prime in February 2008. Prior to this, the company carried on its business as an NBFC that ran into rough weather.

The name game

Sahara Prime's name changes over the years:

The devil is in the DRHP details

(Source: Sahara Prime's DRHP filed with SEBI)

. . .

Winding up of NBFC operations

The Sahara group's rise was on the back of its NBFC operations. Its gargantuan network of agents collected as little as Rs 50 and Rs 100 from depositors -- which had added up to a staggering 15,000 crore (Rs 150 billion), when the Reserve Bank of India clamped down on Sahara India Financial Corp in 2008, citing various irregularities and violation of regulations.

In 2007, Sahara group had two licences from the RBI. Sahara India Investment Corporation, which later changed its name to Sahara Prime, had the NBFC licence.

Another group company, Sahara India Financial Corporation, functioned as a residuary NBFC -- a company whose principal business is acceptance of deposits and investing in approved securities.

While Sahara India Investment voluntarily exited the non-banking finance business in September 2008 after the RBI cancelled its certificate of registration, SIFCL fought its case till the end before the RBI asked it not to accept new deposits beyond June 30, 2011.

It is also required to reduce its deposits to zero by June 30, 2015.

Earlier, in June 2008, the RBI cited five violations of guidelines by SIFCL that forced the central bank to issue an order prohibiting the company from accepting new deposits.

Among the violations cited were not adhering to Know Your Customer (KYC) norms while opening the accounts, and lack of details of the agents employed for deposit mobilisation. Another one related to how the company's investments violated RBI's directions.

Until the time the RBI intervened, SIFCL's operations were running profitably. For example, in fiscal 2007, the company reported an income of Rs 1,289.74 crore (Rs 12.897 billion) and a profit after tax (PAT) of Rs 17.74 crore (Rs 177.4 million).

In the next fiscal, the income rose to Rs 1,727 crore (Rs 17.27 billion) while PAT rose sharply to Rs 232.85 crore (Rs 2.328 billion). But in fiscal 2009 -- that is, after the RBI intervened -- SIFCL reported a loss of Rs 38 crore (Rs 380 million) on an income of Rs 1,702 crore (Rs 17.02 billion).

. . .

"Given several concerns, including the company's track record with the RBI intervening to stop their NBFC operations, Sebi is unlikely to approve this IPO (Sahara Prime's) without proper scrutiny," says Haldea of Prime Database.

But it will take more than just convincing the market regulator about the information supplied in the IPO prospectus for Sahara Prime to successfully tap money from the public.

"The Sahara group aspires to become a large real estate company in India and has launched a lot of projects. But consumers need to see completed projects to gain confidence in the builder," Vineet Kumar Singh, business head of real estate portal 99acres.com.

Outlook Business's enquiries enquired about the status of Sahara's project in three other locations (Aurangabad, Jaipur and Zirakpur) apart from Chennai and Bengaluru don't inspire confidence.

In all three places, the project has been delayed: either the construction is going slow or it has not started at all.

"People who have invested their money in Sahara's projects have lost money because of continuous delay. The company has to move in fast to regain the lost confidence," says a real estate consultant, who declined to be named.

As for Dr Shankar, his only hope is that the wait is not too long for him to own a flat in Bengaluru, a dream for which he has worked all his life.

Of course, after already waiting for half a decade, the pensioner is under no illusions. "I doubt whether Sahara will deliver in my lifetime!"

By arrangement with Outlook Business (21st August issue)