| « Back to article | Print this article |

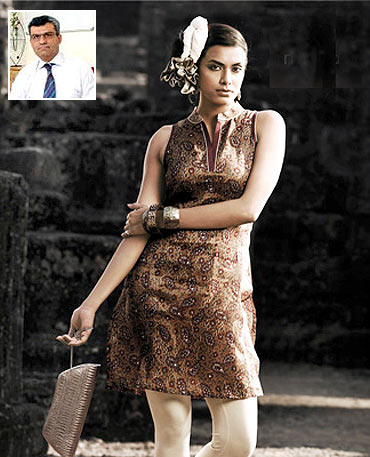

How he is putting Lifestyle back on track

Some time towards the end of February last year, credit rating agency Crisil had downgraded Lifestyle International, a part of the $3.2-billion Dubai-based Landmark group, a notch.

The closely-held company, which runs 22 Lifestyle departmental stores, 11 Home Centre furniture and household accessory stores and six value format Splash stores, had totted up losses of Rs 46.5 crore (Rs 465 million) in the first nine months of 2008-09, up sharply from Rs 18.9 crore (Rs 189 million) in the whole of 2007-08.

Crisil put down the mounting losses to high rentals and people cost, low productivity and weak debt protection measures.

The prognosis was grim.

The economic slowdown was at its peak, and consumers had started to down-trade heavily.

Retailers like Lifestyle could not expand, and that kept economies of scale from kicking in -- aggregation holds the key in modern retail.

Crisil, little surprise then, predicted more losses in the future.

Cut to the present.

Lifestyle International managing director Kabir Lumba hopes to end the current financial year with a net profit -- lower than the global average of 4-8 per cent but healthier than Indian rivals like Kishore Biyani's Pantaloon Retail, Tata Group's Trent and the Raheja group's Shoppers' Stop.

Profit margins in the business happen to be wafer thin.

Click NEXT to read further. . .

How he is putting Lifestyle back on track

In 2009-10, Trent posted a net profit of Rs 1.56 crore (Rs 15.6 million) on a turnover of Rs 1,956.22 crore (Rs 19.56 billion) and Shoppers' Stop reported a net profit of Rs 35.88 crore (Rs 358.8 million) on a turnover of Rs 1,585.29 crore (Rs 15.85 billion).

Pantaloon Retail hasn't come out with its 2009-10 numbers because its financial year ends in June.

In 2008-09, its net profit stood at Rs 10.07 crore (Rs 100.7 million) on a turnover of Rs 7,669.04 crore (Rs 76.69 billion).

The losses mentioned in the Crisil report happened, says Lumba, because the company was in investment mode, ramping up the Home Centre and Splash chains.

"The Lifestyle stores were always cash positive. This year, Home Centre will turn positive too," says he.

The furniture store suffered because of the two-year lull in residential real estate.

As the sector has regained momentum, the demand for furniture too has picked up.

Most of the furniture sold at Home Centre is imported.

In West Asia, the Landmark group sells furniture worth $1 billion every year.

The same supply chain has been leveraged to sell through Home Centre stores in India.

Driving performance

Clearly, Lumba has been helped by the economic recovery.

On his part, Lumba says it's more than that: Key costs have been trimmed, supply chain has been made efficient and revenues have been augmented through some clever planning.

"Had it been just economic recovery, our growth would have been the same as others. Our same-store sale growth was 19 per cent last year," says he.

The industry average, sector experts say, is anywhere between 8 per cent and 10 per cent.

Almost two-thirds of the company's business comes from Lifestyle stores.

Click NEXT to read further. . .

How he is putting Lifestyle back on track

Naturally, much of Lumba's efforts have gone towards driving efficiencies here.

After merchandise, real estate is the highest cost for any retailer.

Under ideal circumstances, it should not exceed 7-8 per cent of the revenue.

Lumba admits that it had climbed to 11 per cent in 2009 for Lifestyle, but says it has now come down to 9 per cent. The ratio improved partly because revenue has grown.

(He hopes to end 2010-11 with sales of over Rs 1,800 crore or Rs 18 billion, up from Rs 1,070 crore or Rs 10.7 billion in 2009-10.)

Two, Lumba says rentals have dropped by as much as 20-25 per cent.

Though most stores were on 12- to 20-year leases, landlords in malls have brought down the rent.

The wellbeing of an anchor store, they have perhaps realised, was important for their own survival.

All the new stores have been taken on revenue-share of 6-7 per cent and not on rent.

This will be the trend in the days to come.

In two years' time, a majority of Lifestyle stores will be on revenue-share with landlords.

Having put the brakes on expansion during the slowdown, Lumba now wants to ramp up fast.

From 22, he wants to raise the count for Lifestyle stores to 40 in two years.

"Lifestyle did not go for rapid expansion when real estate prices were high; it is only now that it has drawn up aggressive plans for new stores," says Technopak Advisers Associate Vice-president Purnendu Kumar.

The next biggest item of expenditure for Lumba is wages -- 5-6 per cent of the revenue. The Lifestyle stores have one attendant for every 400-450 square foot.

This is better than the Indian average of one for every 350 sq ft but way below the global best practice of one for every 700-800 sq ft.

Here, Lumba's hands are tied. One, bigger staff at the store is often taken for better service in India.

So, Lumba cannot prune his workforce overnight.

Two, retail wages are on the rise with most chains expanding rapidly.

He has to factor in that cost. The answer lies in improved productivity.

With 3,000 men and women on its rolls and the projected turnover of Rs 1,800 crore (Rs 18 billion), Lifestyle will likely end 2010-11 with annual revenue per employee of Rs 60 lakhs (Rs 6 million).

This, Lumba claims, represents a gain of 30-40 per cent in productivity in the last two years.

Click NEXT to read further. . .

How he is putting Lifestyle back on track

The average for comparable stores, according to analysts, is below Rs 45 lakhs (Rs 4.5 million).

After real estate and wages, the next biggest bill is advertising and marketing -- 2-5 per cent of revenue.

Lumba says this expenditure has been kept in check by opening more stores in the same city; this brings down the need to buy space in the media (print as well as out of home).

Thus, there are five Lifestyle stores in Mumbai, four in Bangalore and four in the National Capital Region (in and around Delhi).

"We know that 75 per cent of the business will always come from the top seven or eight cities," says Lumba.

Interest payments eat up 2-3 per cent of Lifestyle's revenue.

The Landmark group has recently brought in Rs 200 crore (Rs 2 billion) as equity into the company, which has brought down the debt-equity ratio down from two a year ago to one now.

(Though foreign direct investment in multi-brand retail is not allowed, non-resident Indians can invest on a non-repatriation basis.)

By working closely with its 800-odd vendors and going long on fabric (apparels account for almost 50 per cent of Lifestyle sales), Lumba says he has been able to bring lead times down by a month to 30 to 120 days.

This means working capital is locked for lesser time, which helps the company save on interest outgo.

More important, says Lumba, this has cut by half the lost opportunity (the probability that the sore dose not have what the customer is looking for) which had risen to as high as 10-15 per cent.

The right pick

At the same time, Lumba has tried to drive up revenues.

When consumers began to down-trade, Lifestyle brought in some new price points: Kurtas for women at Rs 299, T-shirts for boys at Rs 199 and shirts for men at Rs 699.

"This wasn't significantly lower than the existing price points, but it became a larger hook during the slowdown.

Click NEXT to read further. . .

How he is putting Lifestyle back on track

"People's mind went to the price more than at other times," says Lumba.

The army of vendors was rationalised by 15 per cent to about 800, and the savings were passed on to customers.

About a third of them have been connected online, which helps in better inventory management.

Brands that were moving slowly were given lesser space, a handful of them were even thrown overboard, and those in demand were displayed more prominently.

All told, Lifestyle stocks 338 brands.

Mobile phones have been more or less removed from all the stores, because the profit margins are very slim.

Space has been sold to concessionaires at prices way above the rent or revenue share; these account for 20 per cent of Lifestyle's turnover now.

The contribution of private labels has been increased from 18-20 per cent two years ago to 25 per cent now.

Profit margins on private labels for a retailer can be as high as 50 per cent, way above the 20-25 per cent offered by other brands.

Pantaloons thus gets 50-60 per cent of its business from private labels, while Westside gets around 70 per cent.

Why is the share of private labels low in Lifestyle?

"As a departmental store, we feel we should have a healthy mix of brands and private labels," says Lumba.

"We don't decide the optimum mix of brands and private labels; we leave that to the customer."

Some experts say that Lifestyle is positioned as a premium store; so it cannot be seen selling too much of private labels.

Result? Lumba claims that revenue is up sharply.

At the end of 2011, Lifestyle will have 1.4 million sq ft of space and Rs 1,800 crore (Rs 18 billion) of revenue.

Click NEXT to read further. . .

How he is putting Lifestyle back on track

In other words, it will record sale of Rs 12,850 per sq ft per annum. Experts reckon this is at least 25 per cent better than rivals.

The average ticket size of purchases at Lifestyle, he claims, has gone up 10-15 per cent in the last two years to Rs 1,800-2,000 now.

As much as 45-50 per cent of the business comes from customers who have opted for the company's loyalty programme.

And conversion of footfalls into purchases has touched a high of 30-35 per cent. The industry average is around 25 per cent.

"The conversion of footfalls has improved significantly since April 2009 because we became more relevant, even though footfalls didn't increase.

"And now we are seeing an increase in footfalls as well. The trigger possibly was the low price points," says Lumba.

And of course, there will be the first profit for the company at the end of the year.

Lumba has spent over 15 years in the retail business. Before that, he worked for a tea auctioneer in Kolkata and a bank.

Putting Lifestyle back on track is one thing; can he take on worthy rivals like Biyani and the Tata group in the long run? That will be his next challenge.

Lifestyle changes

- Drive down rents by 20-25 per cent in the downturn, go slow on expansion

- Go for revenue-share with landlords in new stores

- Open more stores in the same city to cut publicity costs

- Cut lead times in supply chain to unlock working capital

- Pump in Rs 200 crore (Rs 2 billion) in equity capital

- Introduce lower price points to draw customers

- Rationalise vendor base by 15 per cent, connect them online

- Weed out slow-moving brands, give more space to fast-moving brands

- Ramp up private labels to 25 per cent of business

- Bring in concessionaires to set up shop in the stores