Assuming that this United Progressive Alliance government finishes its current term, how should its economic policies over the 10 years of its rule be assessed?

By one metric: the public debt-to-GDP ratio in 2014.

Only if that number is close to 70 per cent (from about 80 per cent today) and is on a plausibly downward trajectory towards 60 per cent or less, can this government take credit for its economic stewardship.

Why shouldn't growth be the metric? Growth under this government has been sustainedly high and remarkably resilient even during the worst global economic crisis. The capacity of governments to botch things up is considerable and for not having done so, the government deserves some credit.

But India's high growth is somewhat of a mystery and the most plausible (or least bad) explanation is that growth is on auto-pilot, being propelled by growth itself.

High growth is not an outcome that can be attributed to strong government action or major policy reforms. In short, growth cannot be the metric, not just for the broader reason that it is an outcome over which the government has limited control but for the India-specific reason that growth is occurring, and will probably continue to occur, despite limited policy impetus from the government.

. . .

What about governance reform or upgradation of infrastructure as metrics of performance?

Governance reform as an active policy agenda is a daunting prospect in India and hence a fool's errand: where and how does one even begin to combat corruption in the police and civil service, to arrest the criminalisation of politics, to jolt babudom out of its complacency and inertia, or to clear the backlog of pending cases in the courts.

A corollary of the growth-begetting-growth dynamic is that it is futile and perhaps even unnecessary for this government to set itself the task of governance reform or upgrading infrastructure or any such grand, ambitious objective.

For example, if governance reform occurs at all, it will be slow, will be bottoms-up -- a consequence of people demanding change -- or will be due to unintended consequences. It will certainly not be the result of active agency on the part of a weak State.

Similarly, the upgradation of infrastructure, especially in the power and water sectors, will occur with the government responding to rather than forcing change.

. . .

Why focus on fiscal stability? Abandoning a grand agenda of growth and reforms does not mean that the government has no role to play. The provision of stability not least by creating the cushion for seeing through bad times will remain an important objective.

The recent global economic crisis has proven that the lender/guarantor of last/ultimate resort is the government. Governments have to take over substantial amounts of private sector liabilities in crises and governments have to implement counter-cyclical fiscal policies during steep downturns.

The United States demonstrated the former; and the Chinese fiscal stimulus illustrated the latter. India was fortunate in that it did not have to open the fiscal spigots to the same extent as China because it was less affected by the crisis.

Had a China-type response been warranted, India would have found to be wanting because its sovereign balance sheet was shaky. That vulnerability to future crises needs to be addressed, a task that India's buoyant growth and low interest rates renders both feasible and imperative.

The need for good boom-time management of the public sector balance sheet is perhaps the single most important lesson from this crisis, a lesson that China had heeded, that Spain, Greece and other European countries ignored at great cost, and that India should learn for the future.

. . .

Is fiscal consolidation feasible? The bad news, of course, is the perennial lure of fiscal populism and recourse to various price-distorting subsidies relating to fuels, fertiliser, power, and water.

But the good news is twofold, relating respectively to tax reform and the unique identification number.

First, the implementation of the GST, once the glitches and teething troubles are resolved, represents serious tax reform and will expand the medium run tax base of the economy.

The GST could generate additional annual revenues of about 1.5 per cent of GDP, create an Indian common market, and solve some structural tax problems. If implemented, and complemented with spending restraint, a path for medium-term fiscal adjustment could be within reach.

Second, there is also the prospect that fiscal populism will mutate into something more legitimate and less costly. Recall that the sad saga of Indian economic policy-making has been that policies pursued on behalf of the poor were not just macroeconomically ruinous and microeconomically inefficient, they also ended up being not very pro-poor.

The 'Grand Bargain' that would change this tale would be a credible and targetted pro-poor programme that could serve as the political basis for pursuing fiscal prudence and economic efficiency.

. . .

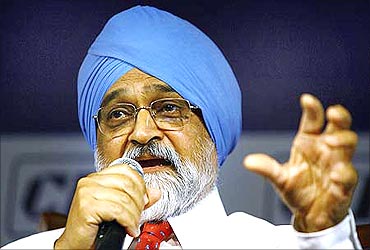

Nandan Nilekani's objective of creating a unique identification number for every Indian could provide the basis for implementing such targetted programmes. That is the reason why his assignment could be amongst the most important for this government in sustaining India's medium-term economic prospects.

In short, economic growth is on auto-pilot, unlikely to be derailed by any lapse into dirigisme and controls or to be boosted by serious policy reforms; governance reform and infrastructure strengthening are either beyond the ability of this government to tackle or will be facilitated by growth and the pressures it will generate.

What is left for this government is a modest but important agenda of providing stability and creating the wherewithal to survive shocks in the future by strengthening the public sector balance sheet. Delivering on this agenda would be plenty.

Fortunately, it does not have to do much more. But if complacency, distraction or the usual political pressures lead the UPA government to doing much less on this score, its 10 long years in power should not be viewed as a success of economic policy-making.

The author is senior fellow, Peterson Institute for International Economics and Center for Global Development.