Photographs: Uttam Ghosh/Rediff.com Raj Sharma

Be it the affluent pre-retiree, small business owner, corporate executive, or recent college grad, all investors have different needs.

To help address those varied and unique needs, over the coming months, I will discuss relevant solutions for supporting long-term financial strategies amidst today's economic environment.

During my conversations with clients, we often discuss how to prepare and empower their children to make responsible financial decisions, as this is important in preserving the family's financial legacy.

In this column, I will share insights on how the next generation can build positive financial habits that may benefit them for years to come.

This year, millions of young people will enter the workforce. Gone are the carefree days of college and financial support from parents. It is now time for the next generation to forge a new path -- a path of independence, self reliance and financial responsibility.

As a young adult, making smart and sensible financial decisions from the very beginning of your career will serve you well on the path to financial independence.

Here are 10 keys to consider when planning your financial future:

. . .

Raj Sharma, managing director, investments, is a private wealth advisor for the private banking and investment group at Merrill Lynch in Boston. Sharma has earned recognition as one of the financial advisors who are ranked on Barron's 2010 list of the 'Top 100 Finance Advisors'. This the seventh consecutive year Sharma was selected for this honour.

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

1. Start with a budget

This is a simple, but important exercise to help you understand how to make the most of the money you earn.

Start by listing every category of expense, including housing, utilities, groceries, transportation, medical, clothing, insurance (life, car, home) and any other categories that may apply to you.

Also create a category for savings, so that you are putting away funds every month for your future dreams and goals. Check out www.learn.bankofamerica.com for information and tools on budgeting and balancing short and long-term goals.

A budget will help you track the money you spend and prioritize your expenses. The key thing to remember is that you should not spend more than what you make. You may need to get accustomed to a more modest lifestyle than the one you've previously enjoyed with the support of your parents.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

2. Manage debt wisely

Many of you may start your working career saddled with student loans. It is important to pay your bills on time and create a long-term plan to pay your debt.

Long-term planning, much like what we do for individuals with established wealth, is an imperative mindset to adopt at a young age.

A credit card is a convenient tool in a modern economy, but do not look at it as an unending supply of cash.

Credit card debt is expensive and not deductible for taxes. Make sure you pay your credit bills completely at the end of the month and do not get tempted by minimum payment deals.

A prudent strategy is getting a debit card tied to a savings account so that you can never spend more than what you have.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

3. Be conscious of your credit rating and score

As you enter the workforce, credit rating companies are keeping track of your credit and payment history.

Missed payments can have negative impacts on your ability to secure future credit for the larger expenses in life -- like a home purchase, an automobile or financing a wedding.

Employers can also look at credit history as a criterion for employment.

Be conscious of your credit, make payments on time and check your credit scores at least annually. To learn more about credit scores, visit any of the popular credit service websites.

If you establish good financial management habits early on, you will be more apt to understand the value of making your wealth grow when you have the opportunity.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

4. Protect your future with insurance

Secure coverage for your home, automobile and any valuables. Consider signing up for group disability coverage that is offered by most employers.

You never know what circumstances life may bring and this will protect you in the event of injury or disability.

Also, consider exploring a term policy on your life to help protect your beneficiaries and the people you love. As your wealth grows, this type of policy can become ever more important as you have more assets that can transfer.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

5. Save for the long term

Take advantage of pre-tax plans such as a 401(k) or 403(b) offered by most employers. Set aside a per centage of your paycheque into these retirement plans.

Since all contributions are pre-tax, you cut down your income tax liability and enjoy potential tax-deferred growth until retirement. Many employers also match, to some degree, the contributions you make.

This is perhaps the single most powerful method of saving for the long term, as planning for your retirement is paramount.

Save a portion of your after-tax funds in order to plan out future costs such as buying real estate or financing a vacation. Overall, a good guideline is to put away 20 per cent of your income into savings and investments.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

6. Be sensible about risk

As you begin your investing, avoid frequent trading or speculation. Consider utilizing diversified vehicles such as mutual funds, taking a modest approach to grow your wealth.

Take a long-term view of investing by adopting an appropriate asset allocation mix. Do not be tempted by short-term trading or market timing.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

7. Remember the rule of 72

The rule of 72 is a simple formula to determine the length of time required to double your money.

For example, if you were to invest your money at a rate of 8 per cent a year, using the rule of 72, 72 divided by 8 equates that it will require nine years for your investment to be worth double the amount of your original fund.

. . .

10 golden keys to a RICH financial future

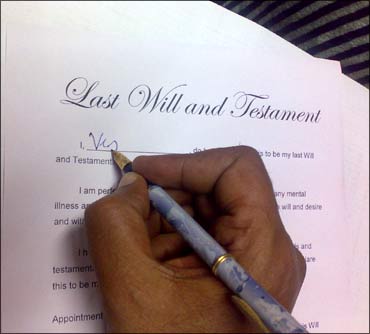

8. Create a basic will/trust

You may need a basic will and/or trust to help ensure that your assets pass on to your beneficiaries in the event of an untimely death.

A trust can be used to transfer property to your beneficiaries. A will requires that you take an inventory of your assets, which may include your investment portfolio, your first house, your retirement plan and funds from your insurance plan.

Through this exercise, you may even be surprised that you are financially worth more than you think.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

9. Build equity, not just income

Income does not equal wealth. Only after years of consistent savings and intelligent investing does income grow into wealth.

Many companies today offer stock options or stock purchase plans. This is often an excellent way, once you are secure with your job, to become a shareholder in your firm and build equity capital for the long term.

. . .

10 golden keys to a RICH financial future

Photographs: Uttam Ghosh/Rediff.com

10. Develop your personal business plan for success

Consider yourself to be not just an employee, but the president of your own self-services corporation.

How can you make your services valuable to your current and future employer? What are your plans for self development and enhancement of knowledge?

In this business plan, list your short and long-term goals for career growth, income, wealth and other metrics.

As the saying goes, 'People do not plan to fail; they fail to plan.'

Raj Sharma, managing director, investments, is a private wealth advisor for the private banking and investment group at Merrill Lynch in Boston. Sharma has earned recognition as one of the financial advisors who are ranked on Barron's 2010 list of the 'Top 100 Finance Advisors'. This the seventh consecutive year Sharma was selected for this honour.

article