| « Back to article | Print this article |

Budget may bring some cheer to taxpayers

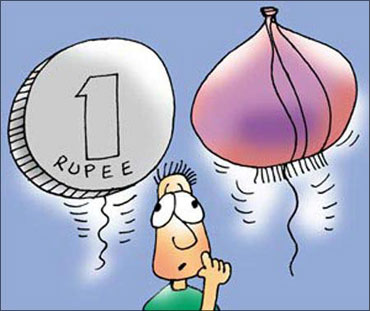

The Budget is likely to bring some cheer to the average taxpayer in a year of rising inflation by increasing the basic exemption limit for all income levels.

Sources familiar with the developments said the finance minister may increase the basic exemption limit for individuals from Rs 1,60,000 to Rs 1,80,000-Rs 200,000.

There could be an increase in the exemption limits for women and senior citizens as well, in the range of Rs 10,000 to Rs 30,000.

Click NEXT to read further. . .

Budget may bring some cheer to taxpayers

The ministry, sources said, had explored the option of a further increase, but was dissuaded by the high fiscal deficit.

Similarly, the 80C limit, which refers to tax breaks on certain financial products and investments to encourage savings, is also likely to raised from Rs 100,000 to Rs 1,50,000-Rs 200,000 -- a move being perceived as an incentive to save in long-term instruments like the Public Provident Fund, National Savings Certificates and others.

Click NEXT to read further. . .

Budget may bring some cheer to taxpayers

At present, many in the higher income brackets find the 80C limit is exhausted largely by the employee provident fund.

In addition, there are children's school fees and principal payout on home loans that easily exhaust the limit. An increase in this limit would help to enhance tax benefits on some of these expenses.

"A higher 80C limit is important because the instruments under this section are long-term in nature. This will lead to forced savings for individuals," said tax expert Kanu Doshi.

Click NEXT to read further. . .

Budget may bring some cheer to taxpayers

Sources also said the Central Board of Direct Taxes did not want to propose any sweeping measures for this Budget because the Direct Tax Code is in the final stage of discussion and is likely to be implemented from next year.

The direct tax code has proposed sweeping changes in the basic exemption limit. While retaining the basic exemption limits at Rs 1,60,000 (for individuals), Rs 1,90,000 (for women) and Rs 2,40,000 (for senior citizens), the next slabs have been raised substantially.

Click NEXT to read further. . .

Budget may bring some cheer to taxpayers

That is, for individuals after the basic exemption, there will be a 10 per cent tax for incomes between Rs 1,60,000 and Rs 10 lakh (Rs 1 million). At present, the 10 per cent tax is for incomes between Rs 1,60,000 and Rs 300,000.

For incomes of Rs 10-25 lakh (Rs 1-2.5 million), the proposed tax rate is 20 per cent (plus Rs 84,000) and for incomes of Rs 25 lakh (Rs 2.5 million) and above, the proposed rate is 30 per cent (plus Rs 3,84,000).

Also, under the DTC, Section 80C is likely to be rechristened Section 66. And there is a proposal to raise the limit from Rs 100,000 to Rs 300,000.