A day before the Budget, the Economic Survey on Thursday predicted up to 8.75 per cent growth in 2010-11 while recommending a gradual roll back of stimulus -- a move that could entail hike in excise duty and service tax.

Warning that high double digit food prices could lead to "higher-than-anticipated" general level of inflation, the Survey called for effective steps to be taken to remove supply-side bottlenecks together with other policies.

The Survey said the government policy, other calibrated measures and tax reliefs as contained in the stimulus have helped the economy shrug off effects of slowdown triggered by global financial meltdown in 2008.

The buoyancy in the economy in tandem with reforms would make India possibly the fastest growing economy in the next four years, it said while recommending that there was a need for improving government financial by way of raising tax and non-tax revenues and containing deficit.

Last week, the Prime Minister's Economic Advisory Council too had suggested partial roll back of stimulus measures, including raising excise duty and service tax rates.

The Survey also echoed this view: "The broad-based nature of the recovery creates scope for a gradual rollback, in due course, of some of the measures undertaken over the last 15-18 months. . . so as to put the economy back on to the growth path of nine per cent annually."

The economy is projected to grow by 7.2 per cent this fiscal with industrial and services sectors growing at 8.2 and 8.7 per cent, respectively. Full recovery is likely over the next two fiscals with up to 8.75 per cent growth in 2010-11 and nine per cent the subsequent year.

. . .

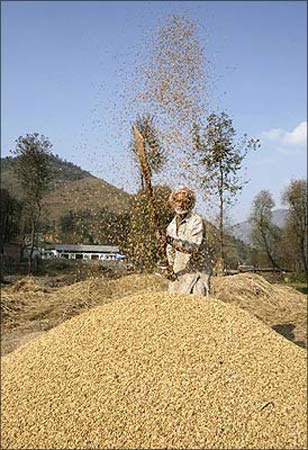

Critical about the government's policy, particularly over the very high consumer price inflation, the Survey said that the "hype" over kharif crop failure without taking into account the comfortable food stocks and rabi prospects "may have exacerbated inflationary expectations encouraging hoarding and resulting in a higher inflation in food items.

". . . in the case of sugar, delay in the market release of imported raw sugar may have contributed to the overall uncertainty, thereby allowing prices to rise to unacceptably high levels in recent months," it added.

Elaborating on the prospects in the short and medium terms, the Survey observed that gross domestic savings stood at 32.5 per cent of GDP in 2008-09, while the gross domestic capital formation (investment) was 34.9 per cent.

"The rates of savings and investment have reached levels that even ten years ago would have been dismissed as a pipedream for India. On this important dimension, India is now completely a part of the world's fastest growing economies."

Indian economy has been one of the least affected by the global crisis. "In fact, India is one of the growth engines, along with China, in facilitating faster turnaround of the global economy. Risks, however, remain," it added.

On the foreign trade front, which had taken a beating in 2009, the economic document said it is looking up with the prospects of recovery in the world output and trade volumes. The downside risks for world and Indian trade lie in the fact that though the fall has been arrested, both output and trade recoveries are still fragile given the fact that the recovery has been pumped up by the stimulus given by different countries, including India, the effects of which may dry up if natural recovery does not follow.

. . .

High food prices may trigger higher inflation

The Economic Survey warned that overall prices would go up further in the next few months and partially blamed poor food management policies for double-digit food inflation.

"Since December 2009 there have been signs of these high food prices, together with the gradual hardening of non-administered fuel products prices, getting transmitted to other non-food items, thus creating some concerns about higher-than-anticipated generalised inflation over the next few months," Economic Survey, tabled in Parliament, said.

On a year-on-year basis, Wholesale Prices-based inflation in December 2009 was 7.3 per cent, while food inflation was 19.77 per cent.

Higher food prices were mainly because of supply-side constraints, compounded by poor monsoons in 2009.

The government has taken a number of short-term and medium term measures to improve domestic availability of essential commodities and moderate inflation, it said.

. . .

Survey asks for gradual roll back of stimulus

Buoyed by the prospects of economy bouncing back to 9 per cent economic growth, the Economic Survey today suggested gradual roll back of stimulus steps unveiled in the wake of the global financial meltdown.

This, it said, would help cut down the fiscal deficit that is estimated at 6.8 per cent of GDP in 2009-10 that was fed by a fall in indirect tax collections and delay in 3G auction.

"The fast-paced recovery of the economy underscores the effectiveness of the policy response of the government in the wake of the financial crisis. Moreover, the broad-based nature of the recovery creates scope for a gradual rollback, in due course, of some of the measures undertaken over the last 15 to 18 months," said the Survey, tabled in Parliament.

This was part of the policy response to the global slowdown, "so as to put the economy back on the growth path of nine per cent per annum," it added.

With the stimulus measures primarily comprising cut in indirect taxes, the Survey said there is likely to be a shortfall in tax collections under these heads.

. . .

40 million households get jobs

With a budgetary outlay of over Rs 70,000 crore on various poverty alleviation and employment generation schemes, nearly four and half crore households have availed job opportunities, the Economic Survey said.

"During the year 2009-10, 4.34 crore households have been provided employment under the National Rural Employment Guarantee Scheme (NREGS)," the Survey for 2009-10 said.

In the previous financial year, over 4.51 crore households were provided employment under the scheme.

As against the budgetary outlay of Rs 39,100 crore for 2009-10 for NREGS, an amount of Rs 24,758.50 crore has been released to the states and union territories till December 2009, the Survey, tabled in Parliament, said.

. . .

Survey for freeing food, fertiliser, diesel prices

The Economic Survey asked the government to decontrol prices of food, fertiliser, diesel and kerosene, saying subsidies given to these sectors have a "questionable" impact.

Freeing prices from government control could help deploy large resources for financing other vital activities in the economy that could promote productivity and eradicate poverty.

"The impact of these (food, fertilisers, kerosene and diesel) subsidies, using the yardstick of poverty mitigation is, however, questionable", the Survey said.

The high level of subsidies "now constitutes a major fiscal burden and tends to crowd out the government's ability to finance other vital activities in the economy that could promote productivity and eradicate poverty," it added.

Already, the government's resources are strained due to various fiscal stimulus and the Survey has separately noted that high growth environment creates scope for partial rollback of these stimuli.

. . .

Banks fail to bring down rates; borrowers tap other sources

In a sort of reprimand to the banking sector for its failure in brining down interest rates, the Economic Survey said borrowers are turning to alternate and cheaper funding sources while liquidity-flush banks are parking their surplus money with the Reserve Bank.

"The transmission of monetary policy measures (geared towards reviving economic growth momentum) continues to be sluggish and differential in its impact across various segments of the financial markets," said the pre-budget statement on the country's economic health.

The RBI has been revising down its policy rates since the outbreak of the global financial crisis in September 2008. While the downward revision got transmitted to the money and the government securities markets, "the transmission has been slow and lagged in the case of credit market."

The Survey noted that the marginal decline in the lending rates of banks -- public, private and foreign -- was "not sufficient to accelerate the demand for bank credit."

. . .

Indian stock market aligning with global bourses

Domestic equity markets are fast integrating themselves with the major global peers, a trend that helped in larger capital inflows from overseas investors during the current fiscal, the Economic Survey said.

"The movement in equity indices in the Indian capital market was in line with trends in major international equity markets, a sign of increasing integration," the survey tabled in Parliament said.

Moreover, the regulatory measures initiated during the year were clearly in the direction of introducing greater transparency, protecting investors' interest and improving efficiency in the working of the Indian equity markets, while also ensuring soundness and stability.

The equity markets, started on a subdued note in 2009 and remained rangebound during April-March last year, but after that it showed signs of recovery.

"With (the) revival of foreign institutional investors' (FIIs) interest in emerging market economies, including India, the equity markets gained strength during May-July 2009," it said.

FIIs investment in equity market rose to Rs 83,424 crore in 2009 compared to withdrawals of Rs 52,987 crore in 2008.

Moreover, the total net investment by FIIs in equity and debt markets taken together, increased considerably to Rs 87,987 crore in 2009 compared to a net decline of Rs 41,216 crore in 2008.

. . .

Two-third of India's forex kitty due to rupee rally

The country's foreign exchange reserves grew by $31.5 billion in the first nine months of this fiscal, but credit for two out of every three of these dollars go to the rupee appreciation.

The Indian currency's sharp appreciation against dollar -- an eyesore for the export sector that has been the main contributor to forex reserves traditionally -- contributed $20.3 billion or 64.4 per cent to the total accretion in forex reserves till December 2009 in the current fiscal.

The total foreign exchange reserves increased by $31.5 billion in 2009-10 fiscal, from $252 billion at the end of March 2009 to $283.5 billion in December 2009, according to the Economic Survey presented in Parliament.

. . .

Infant deaths to fall below 30/1,000 live births by 2012

With the gradual fall of crude birth and death rates, the country expects to lower its infant mortality rate to below 30 per 1,000 live births by 2012, although block and village level annual plans have not been prepared for 24 states and Union Territories, the Economic Survey said. India has successfully brought down its crude birth rate (CBR) to 22.8 in every 1,000 people from 29.5 in 1991, this led to decrease in crude death rate (CDR) to 7.4 from 9.8 in 1,000 people in the same period, the pre-budge Survey tabled in Parliament said.

Under the National Rural Health Mission (NRHM), which was launched in 2005, infant mortality rate (IMR) is expected to fall below 30 in every 1,000 live births, it added.

The current IMR stands at 53, substantially lower than the figure of 80 in 1991, it added.

. . .

Indian pharma industry 3rd largest globally

The Indian pharmaceutical industry has become the third largest in world in terms of volume and ranks 14th in terms of value at over Rs 1 lakh crore, the Economic Survey tabled today in Parliament said.

"The Indian pharmaceutical industry has grown from a humble Rs 1,500 crore turnover in 1980 to approximately Rs 1,00,611 crore in 2009-10," the pre-Budget survey said.

The growth of the Indian pharmaceutical industry has been fuelled by exports, which increased 25 per cent in 2008-09.

"Exports of pharmaceuticals have consistently outstripped imports," the survey said.

India exports drug, intermediaries, active pharmaceutical ingredients (APO), finished dosage formulations, bio-pharmaceuticals and clinical services.

The top five destinations for such exports are the USA, Germany, Russia, the UK and China.

. . .

Dubai debt crisis could affect India's foreign trade

The Dubai debt crisis is likely to have "some impact" on India's exports and imports as the gulf region is the country's largest trade partner, the Economic Survey 2009-10 has said.

"There could be some impact on India's exports and imports, keeping in view the significant share of the United Arab Emirates in India's international trade," the survey said.

The financial crisis in Dubai erupted in November last year with the conglomerate Dubai World asking creditors for six months to repay $59 billion debts.

The United Arab Emirates (UAE) accounts for about 10 per cent of India's $490 billion total trade in 2008-09. While imports from the region amounted to $23.79 billion, exports were at $24.47 billion, according to official figures.

Besides, the Survey said, remittances would also be impacted by the Dubai crisis.

. . .

India 10th largest gold-holding country

From a nation that pledged its bullion two decades ago to pay for imports, 2009-10 saw India becoming the world's 10th largest gold-holding country, the Economic Survey noted.

The government's purchase of 200 tonnes of gold from the International Monetary Fund took its total reserves to 557.7 tonnes, or about 6 per cent of total foreign exchange reserves.

In stark contrast, India had to pledge its gold to the Bank of England in 1991 to pay for its imports.

"Post-purchase, India has become the 10th largest official gold-holding country in the world," said the pre-Budget survey, tabled in Parliament.

In November last year, the Reserve Bank concluded the purchase of 200 tonnes of gold from the IMF as part of the country's foreign exchange reserve management operation.

The purchase was an official-sector off-market transaction and executed over two weeks during October.

. . .

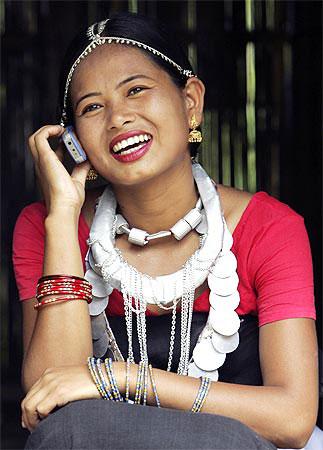

3G spectrum auction to open doors for foreign players in India

The government said the upcoming auction of radiowaves for the third generation mobile services will open the doors for foreign players to make an entry into fast growing Indian telecom market.

The Economic Survey 2009-10 tabled in Parliament said that ". . . This (launch of 3G technology) will provide existing operators a good opportunity as also foreign players to make an entry into the Indian market and bring in new technology and innovation."

There is no cap on the number of service providers in each circle. For the 3G telephony, the government is planning to allow three to four private players in each circle depending upon the spectrum availability.

The auction of 3G and Broadband Wireless Access (BWA) spectrum scheduled to be held on April 9. The government had earlier indicated that interested foreign entities could take part in the auction directly.

The Survey said that the introduction of BWA services will enhance the broadband penetration in the country. The broadband subscriber base stood at 7.98 million by the end of December 2009.

. . .

Retail prices rising 10-times faster than wholesale

In the midst of an ongoing debate among policymakers over price rise, the Economic Survey said the retail prices in the country are rising at a rate ten times faster than that for the wholesale prices.

The survey put at 1.6 per cent the rate of price rise in wholesale market, as measured by wholesale price index (WPI), for the current fiscal 2009-10, against an inflation of 11.4 per cent based on consumer price index (CPI).

The CPI-based inflation has been higher than that based on WPI for four consecutive years now, but the gap has been widening every passing year. In 2004-05, the CPI-based inflation was, in fact, lower than the WPI one and the two were equal in 2005-06, the Survey said.

"The recent period has witnessed significant divergence in WPI and CPI inflation rates, principally on account of the larger weights assigned to the food basket in the CPI and due to the fact that retail prices are sticky downwards," the Survey said.

The divergence between wholesale price inflation and retail inflation is due to higher weightage of food prices in consumer price indices. It reflects faster rise in the prices of food items. Food inflation stood at 17.58 per cent for the week ended February 13.