| « Back to article | Print this article |

Budget in graphics

Finance Minister Pranab Mukherjee presented his 5th Budget in Parliament on Friday.

The FM provided considerable relief to Income Tax payers by raising the slabs at two levels but hiked the central excise duty on non-petroleum products across the board from 8 to 10 per cent and the basic duty on crude and petroleum products.

The entire Opposition walked out of the Lok Sabha during the presentation of Budget, dubbing it 'highly inflationary' as he partially rolled back the stimulus by hiking the ad velorum component of excise duty on large cars and multi-utility vehicles by two per cent.

Budget in graphics

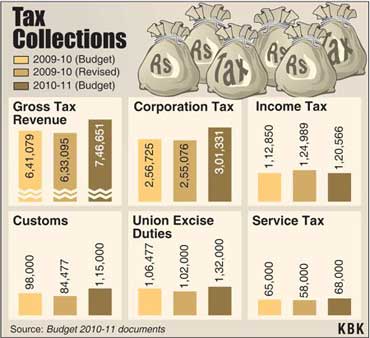

The government's tax revenues took a hit from stimulus measures and slow economic growth in early part of this fiscal with the exchequer falling short of the Budget estimates by around Rs 8,000 crore (Rs 80 billion).

While the government estimated to collect Rs 641,000 crore (Rs 6,410 billion) this fiscal, the revised estimates pegged it at Rs 633,000 crore (Rs 6,330 billion).

Budget in graphics

Prakash Karat, general secretary of Communist party of India-Marxist, termed the Budget 'flawed'.

He said the Budget is anti-poor, "because of the increase in customs and excise duty which will aggravate inflation ending in a rise in prices.

This will burden the poor. One fails to understand the logic behind this Budget. At a time when food prices are so high in the country, such a move will only add to the woes of the people. Food inflation will soar with hike in petrol and diesel prices."

Budget in graphics

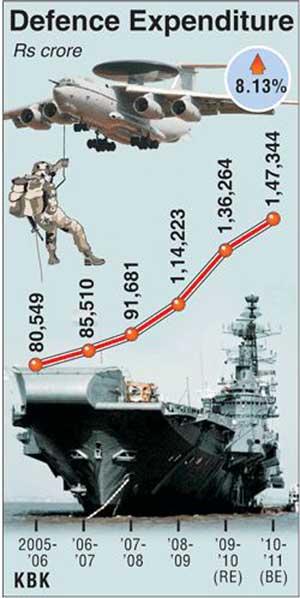

The government on Friday allocated Rs 1,47,344 crore (Rs 1,473.44 billion) towards defence in 2010-11 Budget, a paltry 4 per cent increase from last year's Rs 1,41,703 crore (Rs 1,417.03 billion).

Budget in graphics

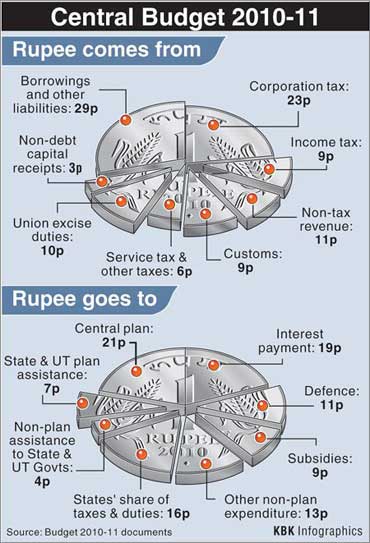

Borrowing at 29 paise will account for the largest share of every rupee that the government will use for financing the Union Budget 2010-11, while will it spend the most - 21 paise - on central plan.