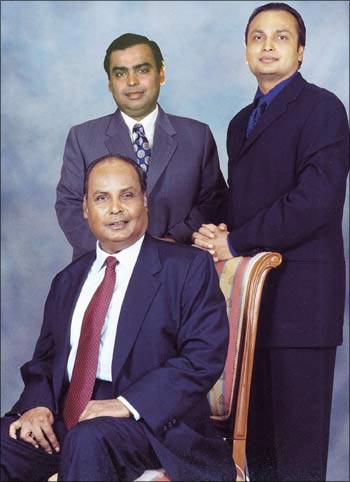

The Ambanis have a formidable business reputation, with skilful media management to match.

There is a constant stream of newspaper column inches given over to writing about their business growth, deals done, and projects in the offing -- to the extent that it becomes difficult to sift reality from hype.

As it happens, the splitting of the business four years ago, and the end of one phase of sibling rivalry six weeks ago, offer an opportunity to take a look at how they have actually done on the key parameters.

In the four years between 2005-06 (the year in which the business split) and 2009-10, Mukesh Ambani's business grew an impressive 116 per cent in sales, but a modest 50 per cent in profits (or 11 cent a year).

Starting from a smaller base, Anil Ambani did much better: sales increased exponentially (more than eight-fold), and profits grew nearly six-fold.

But here's the interesting thing. A couple of weeks after the brothers announced the scrapping of their non-compete arrangements, the market value of Mukesh's companies had grown 180 per cent over March 2006, while that of Anil's companies increased only 67 per cent (not that much better than the 50 per cent increase in the Sensex during the same period).

Click NEXT to read on. . .

In other words, Mukesh's growth pattern was more to the stock market's liking, despite his modest growth in profits, while Anil set a more scorching pace -- at the cost of a debt pile-up that may have made investors nervous.

It so happens that the Anil group's stock prices have seen a sharp pick-up in value in the last few weeks, perhaps because he has been busy selling equity to bring in money and retire some of his mountain of debt.

The picture gets more interesting when you compare these performance numbers with those of other groups (I am grateful to BG Shirsat of the Business Standard Research Bureau for the numbers).

Taken together, the two Ambani businesses saw sales grow 1.5 times, profits double, and market capitalisation increase 1.4 times.

Kumar Mangalam Birla, who has as staid an image as you can get, did better than the Ambanis on all three parameters, with his business roughly trebling in size and profits (more growth in sales, less in profits).

Bharti saw a rough quadrupling and a reverse pattern (doing better on profits than sales), while its market cap grew by about as much as the Reliance companies' did.

Click NEXT to read on. . .

As for Tata, whose turnover was slightly smaller than the Mukesh group's in 2006, it is now 40 per cent bigger even though profits have stagnated (both reflective of the nature of the group's international acquisitions).

The point is that the Ambanis are not in a business league of their own; they have plenty of company. Other leading business houses have done well, often better -- like Sterlite, which saw a doubling of sales, trebling of profits, and a 165 per cent surge in market capitalisation (better than the combined Ambani businesses on profits and market capitalisation, but not on sales).

And the Jindals saw a trebling of sales in these four years, and even faster growth in profits, while market capitalisation increased 1.65 times -- better than the combined Ambani performance on all three parameters.

The interesting point is that none of these other business groups has matched performance with such media buzz.

Indeed, Mukesh's promise to shareholders last month, that he would double Reliance's enterprise value (equity plus debt) in 'less than a decade', is surprisingly modest; doubling in a decade amounts to just 7 per cent annual growth.

Oddly, no one in the media pointed that out.