| « Back to article | Print this article |

CIL to come out with largest IPO in Oct

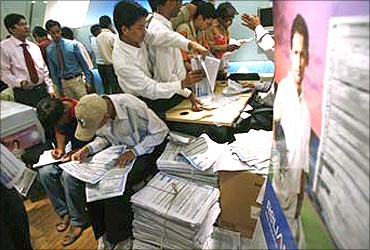

State-run Coal India Ltd is likely to hit the market by the third week of October with India's largest ever public offer to raise up to Rs 15,000 crore (Rs 150 billion). The government is divesting 10 per cent of its stake in Coal India, the world's largest coal miner, through the IPO.

"As of now, it seems that CIL initial public offer will open on October 18 and closes on October 21. The 10 per cent divestment will see the government raising Rs 12,000- 15,000 crore (Rs 120-150 billion)," a person in the know of the development said.

The blue-print of the IPO was finalised last evening at a meeting between Finance Minister Pranab Mukherjee and Coal Minister Sriprakash Jaiswal.

Click NEXT to read further...

CIL to come out with largest IPO in Oct

The meeting was also attended by Additional Secretary Coal Alok Perti and Department of Divestment Secretary Sumit Bose and Coal India Chairman P S Bhattacharyya, the source said.

Coal India, the largest global coal miner, sells the dry fuel 50 per cent cheaper at around $25 a tonne than the prices prevailing in the international market.

Although CIL's IPO was planned in August-September, it was delayed due to opposition to the government's 10 per cent stake sale move from trade unions and political parties.

"The Department of Divestment has finalised the issue date. The company will now file the Draft Red Herring Prospectus of the IPO by the first week of August," the source added.

The government is selling 10 per cent of its stake in CIL divestment.

It currently holds 100 per cent equity in the coal major. CIL had earlier said it will issue over 63 crore shares in the IPO. The Union Cabinet had last month approved to divest 10 per cent of the government's holding in CIL.

The Centre holds 100 per cent equity in the company.

Click NEXT to read further. . .

CIL to come out with largest IPO in Oct

Coal India produced 431.5 million tonnes of coal in the last fiscal.

The country's coal output stood at 531.5 million tonnes in 2009-10. Anil Dhirubhai Ambani Group firm Reliance Power, in January 2008, raised Rs 11,500 crore (Rs 115 billion) through IPO -- the biggest in India till date.

Aiming to raise Rs 40,000 crore (Rs 400 billion) through divestment in this fiscal, so far sell off in Satluj Jal Vidyut Nigam has fetched the exchequer over Rs 1,000 crore (Rs 10 billion).

The government is likely to sell its stake in 10 PSUs, including MMTC, SAIL and Hindustan Copper, this fiscal.

The government in 2009-10 had raised Rs 25,000 crore (Rs 250 billion) through stake sales in Oil India, NMDC, REC and NTPC. NMDC 8.38 per cent stake sale had fetched the government about Rs 10,000 crore (Rs 100 billlion).