| « Back to article | Print this article |

Cities where demand for housing is on the upswing

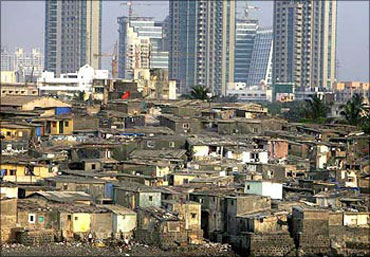

The real estate sector is back in news. Property prices have been on a sharp rise since the last three quarters as there has been an upswing in the economic growth of the country.

This has created improved affordability, lower loan interest rates and better job security helping revive demand for housing.

In the following pages, is an overview of the current scenario in this segment in various parts of the country.

Click NEXT to read on about Mumbai real estate...

Cities where demand for housing is on the upswing

Mumbai

Judgement on FSI: In June this year, the Bombay High Court quashed the rule that allowed 33% additional floor space index (FSI) to builders executing projects in suburban Mumbai in lieu of a fee.

FSI (Floor Space Index) refers to the constructable area on a plot. An FSI of 1 means that the area of construction should be equal to the area of the plot. E.g., a plot of 1,000 sq ft can only have a built-up area of 1,000 sq ft and no more.

The maximum permissible FSI in suburban Mumbai is 2, of which FSI of 1 was allowed by the Act and a developer could avail an additional FSI of 1 if required through transfer of development rights (TDR).

The TDR (transfer of development rights) policy was launched in 1991. Owners -- whose plots were reserved for playgrounds, markets and gardens or meant for road widening -- could surrender their land to the Brihanmumbai Municipal Corporation and get an equivalent space in the suburbs.

In return, they are allowed proportionate TDR rights that can be utilised by themselves or owners, who can also sell the TDR rights.

Earlier in 2008, the government had allowed additional construction rights by hiking the FSI in Mumbai suburbs from 1 to 1.33. This meant that every building in the suburbs was eligible for additional construction rights up to 0.33 FSI without needing to purchase TDR. This, however, was negated by the Bombay high court ruling.

The new judgment has now led to an increase in TDR prices by around 20 per cent, thereby increasing the cost of development for the builders.

The prices in Mumbai have shot up in recent times. As per reports, on an average, the prices of residential projects in Mumbai have risen by around 20 per cent in the last few months. This is mainly because of less supply.

| | Rupees per sq ft | ||||

| Mumbai | | May-09 | Nov-09 | April-10 | % change (Nov09 to Apr 10) |

| Dynamix Balwas Group | Dahisar(E) | 3,168 | 3,798 | 4,680 | 23.2% |

| HDIL Premier Residences | Kurla | 5,751 | 6,151 | 6,351 | 3.3% |

| HDIL Metropolis | Andheri(W) | 7,951 | 10,500 | 12,000 | 14.3% |

| Oberoi Constructions - Oberio Exquisite | Goregaon(E) | - | 9,000 | 10,000 | 11.1% |

| IREL (Indiabulls) | Parel | - | 12,500 | 14,000 | 12.5% |

| IREL (Indiabulls) | Panvel | - | 2,400 | 2,900 | 20.8% |

On account of the economic turmoil, the developers have not invested in new projects. They are looking at selling their existing projects. Some even ventured into developing small launches in the premium segment of the housing market.

While, the units per month sold on average during 1QFY10 were 18% lower than that sold during 4QFY09, the months of unsold inventory stood at 8, which is the lowest level since January 2008. As per analysts, the fall in volume on the sequential basis is mainly due to price hike.

Click NEXT to read on about Delhi ..

Cities where demand for housing is on the upswing

National Capital Region (Delhi)

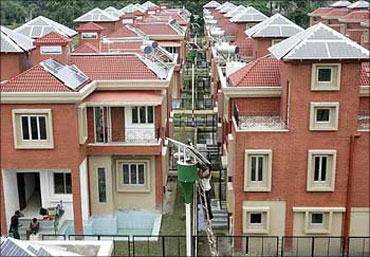

After a slowdown in launches during Calendar Year 2009, the Noida-Greater Noida region during Q1CY10 saw the launch of a number of new projects.

More than 50,000 apartments are planned to be constructed over CY10-12.

Further, the FSI in Noida was enhanced to 2.5x for group housing projects from 1.5-1.75x earlier, which led to more affordable housing projects.

Noida saw a higher demand during 1QFY10 (4400 units) as compared to 4QFY09 (3000).

In Gurgaon, while on YoY basis, the units/month sold were lower, on the sequential basis, there was a pick-up of 15% to 1900 units sold in March.

The price hike would be capped to about 5% to 15% as there is adequate supply to meet the demand.

| | | Rs per sq ft | | | |

| NCR | | Nov-09 | April-10 | % change (Nov09 to Apr 10) | |

| Ansal API Megapolis-Fairway Apartments | Dadri | 1,800 | 1,890 | 5.0% | |

| 3C Group-Lotus Boulevard | Sector 100 | 3,275 | 3,275 | 0.0% | |

| 3C Group-Lotus Boulevard Espacia | Sector 100 | 3,050 | 3,600 | 18.0% | |

| IREL (Indiabulls) Centrum Park S | Sector 103 | 2,400 | 2,750 | 14.6% | |

| Unitech Sunbreeze | Sector 69 | 2,814 | 2,900 | 3.1% | |

| Orchid Infrastructure Orchid Island | Sector 51 | 3,260 | 4,300 | 31.9% | |

Click NEXT to read on about Bengaluru

Cities where demand for housing is on the upswing

Bengaluru

Bengaluru is the fastest growing major metropolis in India. Residential market has seen some significant action. With a pick-up in economic activity, hiring is back in the IT segment.

The IT/ITES sector accounts for about 50-70% of demand in India's property sector. Bengaluru being the IT hub, is witnessing good demand in residential space. The rise in the IT/ITES sector has resulted in an improvement in sentiment due to rising salaries and increased job security. This has driven the residential sales.

However, buyers are price-conscious and hence the mid-segment is seeing aggressive new launch plans for FY11 which are now being announced after a gap of almost 2-3 years. Property prices have stabilised and have started seeing a rise in mid-segments.

| | | Rs per sq ft | | |

| Bengaluru | | Nov-09 | April-10 | % change (Nov09 to Apr 10) |

| Puravankara Welworth | Doddaballapur | 1,763 | 1,835 | 4.1% |

| Patel Developers | Electronic City | 2,050 | 2,500 | 22.0% |

| Shriram Properties | Attibele | 1890* | 1,950 | 3.2% |

| Hiranandani Upscale | Bannerghatta Road | 3,500 | 3,500 | 0.0% |

| * since jan 2010 | ||||

Click NEXT to read on about Chennai

Cities where demand for housing is on the upswing

Chennai

Many plush property projects are coming up here in the next 2 to 3 years. With the city growing as a major IT hub, demand is picking up on account of the recent hiring by the IT sector.

Monthly sales volumes across major cities such as New Delhi, Mumbai, Bengaluru, Chennai, Kolkata and Hyderabad are around 2-3 times from their troughs.

| | | Rs per sq ft | | |

| Chennai | | Nov-09 | April-10 | % change (Nov09 to Apr 10) |

| Puravankara Cosmo | Pudupakkam | 1820 | 1870 | 2.7% |

| BSCPL Infrastructure | OMR Road | 2570 | 2675 | 4.1% |

| Shriram Properties | GST Road | 1990 | 1990 | 0.0% |

Click NEXT to read on about Kolkata

Cities where demand for housing is on the upswing

Kolkata

Kolkata's real estate market is buzzing with activity. The city is witnessing new construction activity and re-development which are likely to come up within the next 12 to 24 months simultaneously.

The middle class has started migrating to the suburbs in search of affordable housing. The development in the industrial sector coupled with the boom in the information technology led to a significant growth of the real estate in Kolkata.

For example, Tata Housing has increased prices of residential units at Eden Court, the company's first housing project in West Bengal, for the second time in recent times. From Rs 2,750 per square feet since inception, the price has touched Rs 2,900 per square feet.

With few ready-to-occupy flats available the price hikes have happened due to imbalance in supply and demand.

Click NEXT to read on about lending by banks

Cities where demand for housing is on the upswing

Lending by banks

Home loan disbursements have picked up as interest rates are under check. The Reserve Bank of India is also taking steps to bring in the revival in the real estate sector.

RBI has already stated that the current customers should be offered an alternative between continuing with their old home loan rates or move to new rates decided by the base rate system. This will help the old home loan borrower to negotiate for lower interest rates now that the base rate has kicked in from July 1, 2010.

However, it is too early to determine the percentage of existing home loan borrowers who might opt of this. As per ICICI Bank, interest liability of existing home loan borrowers will not be impacted unless they voluntarily shift to the new system. The final lending rate will not change drastically.

| Banks | Base Rate (PA) (%) |

| State Bank of India | 7.5 |

| Punjab National Bank | 8 |

| Bank of Baroda | 8 |

| Union Bank | 8 |

| IDBI Bank | 8 |

| Indian Bank | 8 |

| Dhanlaxmi Bank | 7 |

| Federal Bank | 7.75 |

| State Bank of Mysore | 7.75 |

| Corporation Bank | 7.75 |

| ICICI Bank | 7.5 |

| HDFC Bank | 7.25 |

The government is also looking at changes in the prepayment rules to enable a home loan borrower to shift to cheaper lenders if his bank raises interest rates soon after disbursing the loan.

Though still in discussion, as per the government, banks would have to provide a two-month window to their new borrowers to shift to some other bank without prepayment penalty if they have raised interest rates too quickly after disbursement.

| | | Interest Rates for various loan amount | | | | |||

| Bank name | Interest Type | upto 5 lakh | 5-20 lakh | 20-30 lakh | 30-50 lakh | 50-75 lakh | >75 lakh | |

| ICICI Bank | Floating | 8.75 | 8.75 | 8.75 | 9 | 9.5 | 9.5 | |

| ICICI Bank | Fixed | 16 | 16 | 16 | 16 | 16 | 16 | |

| HDFC | Floating | 8.75 | 8.75 | 8.75 | 9 | 9.25 | 9.25 | |

| HDFC | Fixed | 14.25 | 14.25 | 14.25 | 14.25 | 14.25 | 14.25 | |

| SBI - Home Loan | Fixed | 8 | 8 | 8 | 8 | NA | NA | |

| SBI - Home Loan | Floating | 8 | 8 | 8 | 8 | NA | NA | |

| LIC Housing | Floating | 9.75 | 9.75 | 9.75 | 9.75 | 9.75 | 9.75 | |

| IDBI Home Finance | Floating | 8.25 | 8.25 | 8.25 | 8.25 | 8.25 | 8.25 | |

| PNB | Fixed | 10.5 | 10.5 | 10.75 | 10.75 | 10.75 | 10.75 | |

| PNB | Floating | 9.25 | 9.25 | 9.75 | 9.75 | 9.75 | 9.75 | |

| Updated as on 11 June, 2010. | ||||||||

Click NEXT to read on

Cities where demand for housing is on the upswing

On the flip side, the banks have become more cautious with lending. Earlier banks used to finance nearly 80% to 85% of the transacted value.

Now only 70 to 75% of the total property value is financed. Further, the lenders pick the lower value of these two -- the market valuation done by bank or the transacted value.

In the end

With a better economic outlook and lower interest rates the demand for housing is likely to be on the upswing.

Also with the revised paper on DTC, the government has proposed to retain the income tax exemption for up to Rs 150,000 paid as interest on housing loans in a year. This will bring the cheer back to home loan borrowers.

The demand for houses in India is huge as many people do not have their first house. However, the supply is limited on account of zoning rules. Also a lot of politics is involved. Buying a house is a lengthy process.

Further, experts feel residential prices have reached bubble levels. Further hike in prices would lead to lower sales. Also with inflation levels not cooling off, the interest rate hike would be on the cards.

A need for a regulator like the one for the petroleum ministry and for civil aviation is needed. This would benefit the sector in the long run.

Powered by

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2025 www.BankBazaar.com. All rights reserved.